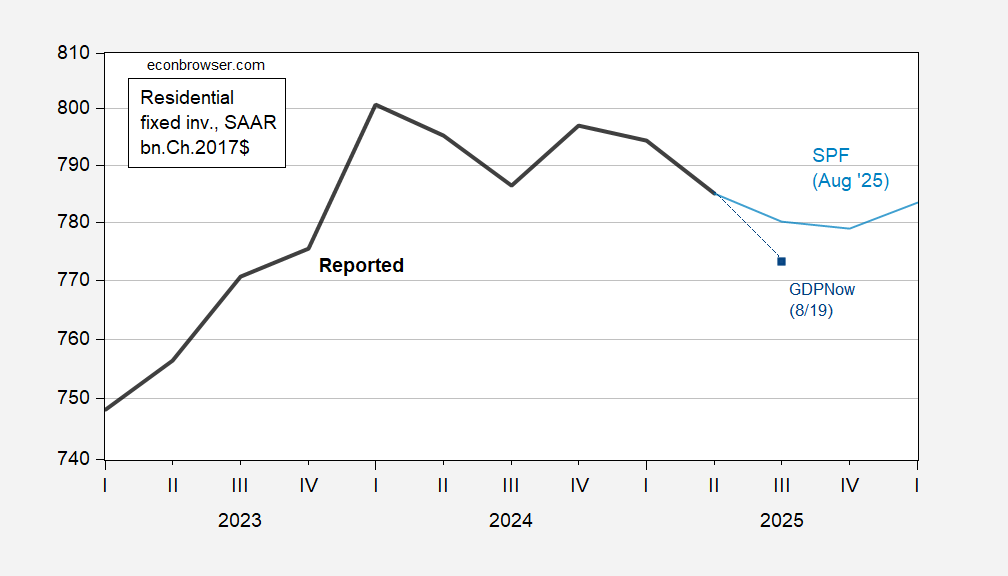

Based on residential investment construction July release (starts 1.428 mn > 1.29 mn Bbg consensus; permits 1.354mn < 1.39mn Bbg consensus):

Figure 1: Residential fixed investment (bold black), Survey of Professional Forecasters August median f’cast (light blue), GDPNow of 8/19 (dark blue square), all in bn.Ch.2017$, SAAR. Source: BEA 2025Q2 advance, Philadelphia Fed, Atlanta Fed, and author’s calculations.

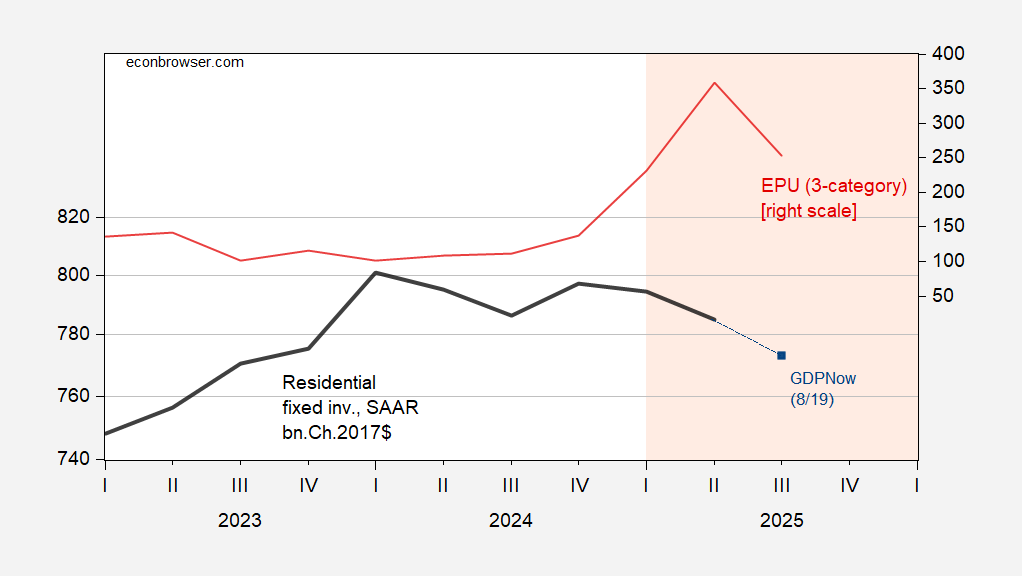

Real 10yr interest rates and nominal mortgage rates are slightly below where they were in January 2025, so I’ll focus on policy uncertainty as a possible determinant of the decline in residential investment.

Figure 2: Residential fixed investment (bold black, left scale), GDPNow of 8/19 (dark blue square, left scale), both in bn.Ch.2017$, SAAR, and EPU (3 category legacy series), (red, right scale). Q3 EPU is for July. Light orange shading denotes Trump 2.0 administration. Source: BEA 2025Q2 advance, Atlanta Fed, policyuncertainty.com, and author’s calculations.

Source link