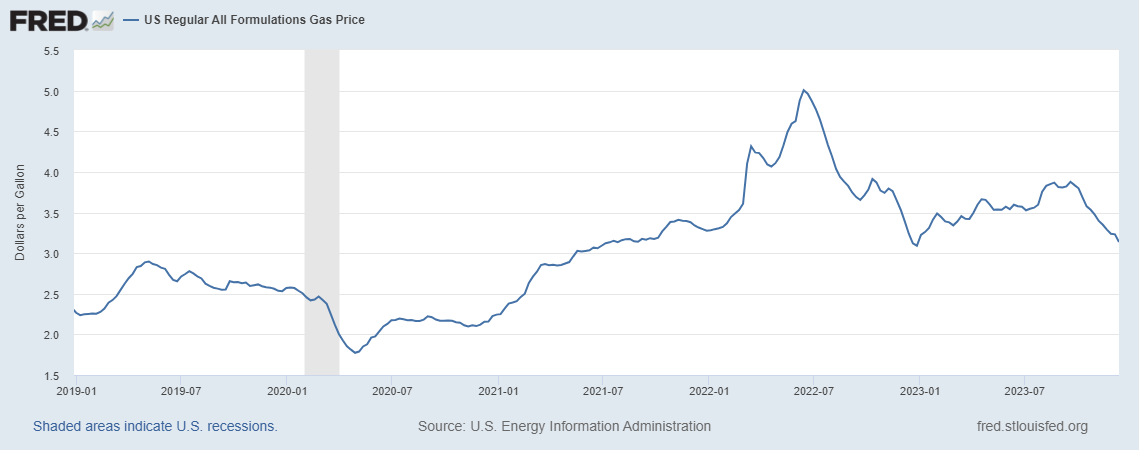

Last week, I was asked about the likely future trajectory. As of the week ending today, prices still falling (from $3.23 to $3.14).

On WPR, I noted that we should enjoy it while we can:

Falling gas prices also help bring down inflation.

“If oil prices are going to stay at the levels that they are, then we can continue to see at least not an upward movement in gasoline prices, and that’s gonna allow us to have inflation continue to fall,” said Menzie Chinn, a professor of economics at the University of Wisconsin-Madison.

But Chinn warns that world events could cause the price of oil to spike quickly.

“For instance, if you saw the conflict in and around Israel expand to a more region-wide conflict which draws in Iran,” he said. “You can imagine that would drive up oil prices, even if outright hostilities didn’t occur, the uncertainty and the risk would drive up prices.”

The weight of gasoline in the CPI (2020) was about 2.6%, which doesn’t sound like a lot, but since gasoline prices are highly volatile, they can be a big contribution to inflation variation, just in a mechanical sense (see this post).

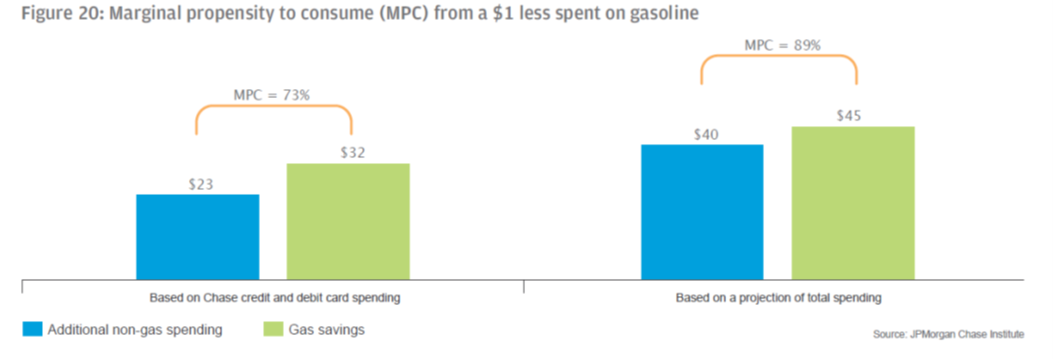

The gasoline price drop, at least the nonseasonal component, is providing a boost to the economy. Back in 2015, JP Morgan Chase estimated each dollar decline in gasoline prices increased spending on other goods and services by 80 cents. So dropping gas prices have helped sustain spending (see Jim Hamilton’s post from back then).

Source: JPMC (2015).

Source link