Today, the Confidence Board’s consumer confidence index clocked in at 110.7, vs. Bloomberg consensus of 103.8. The Michigan survey of consumer sentiment and to a lesser extent the Conference Board survey of confidence have diverged from their historical correlation with inflation and unemployment. Interestingly, while the Michigan measure in particular has deviated from the text based measure, they have both now started reverting toward the text based measure.

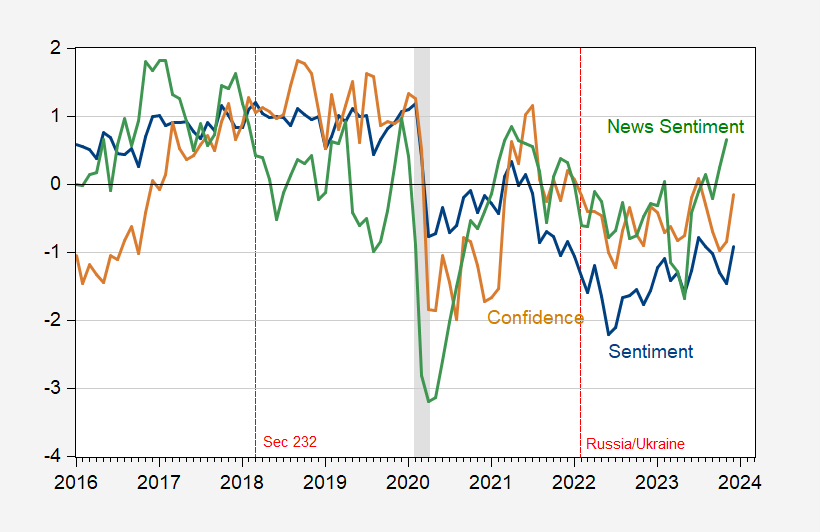

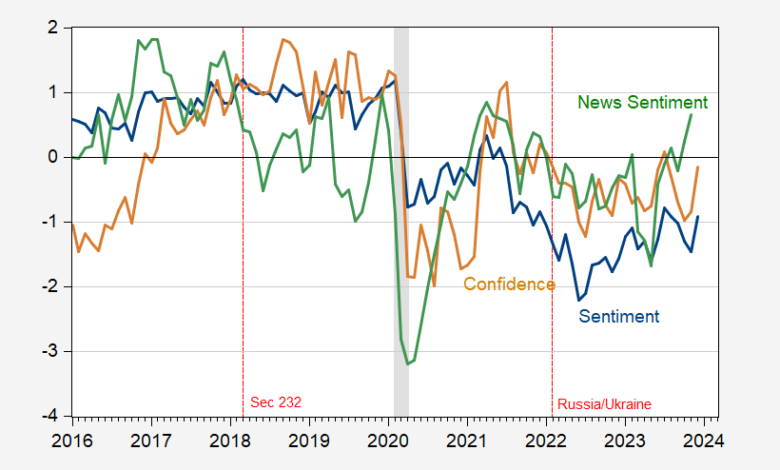

Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Shapiro, Sudhof and Wilson (2020) Daily News Sentiment Index (green), all demeaned and normalized by standard deviation (for the displayed sample period). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, SF Fed, NBER, and author’s calculations.

To the extent that the survey based and news text based series diverge, this gives some support to the Vibes view of the dour mood of the public (subject to the condition that the Daily News Index accurately summarizes the news).

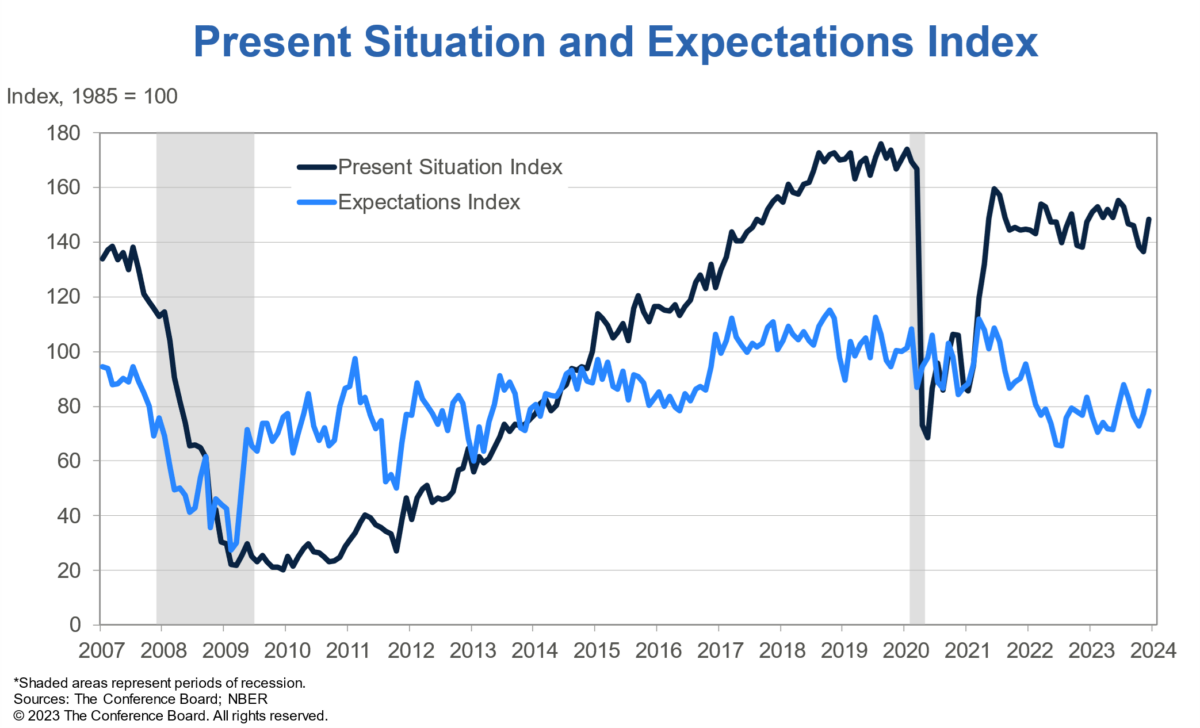

The jump in the Confidence Board measure was due to increases in both the present situation and expectations components.

Source: Confidence Board, accessed 12/20/2023.

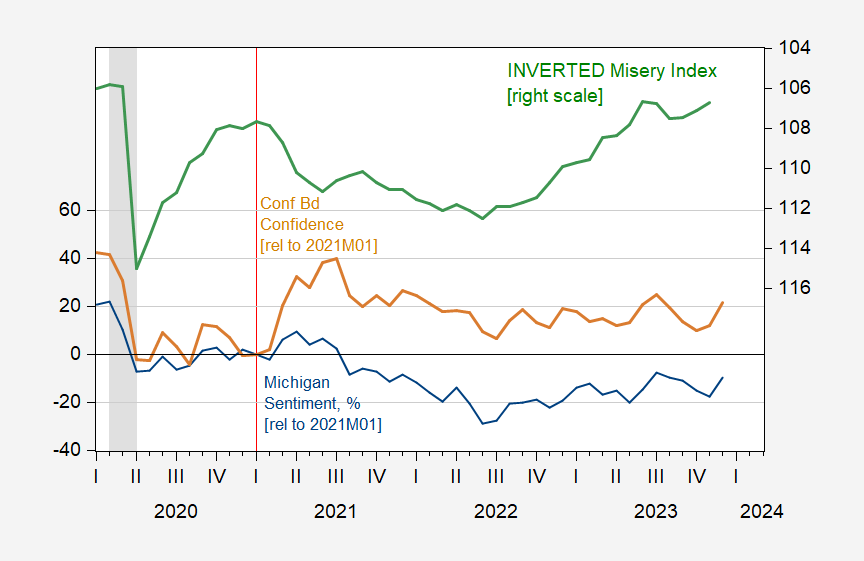

On the trend divergence between (inverted) misery index and sentiment and confidence indices, see Figure 2 below.

Figure 2: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), both demeaned and normalized by standard deviation (for the displayed sample period).and inverted Misery Index (green, right scale). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, NBER, and author’s calculations.

Source link