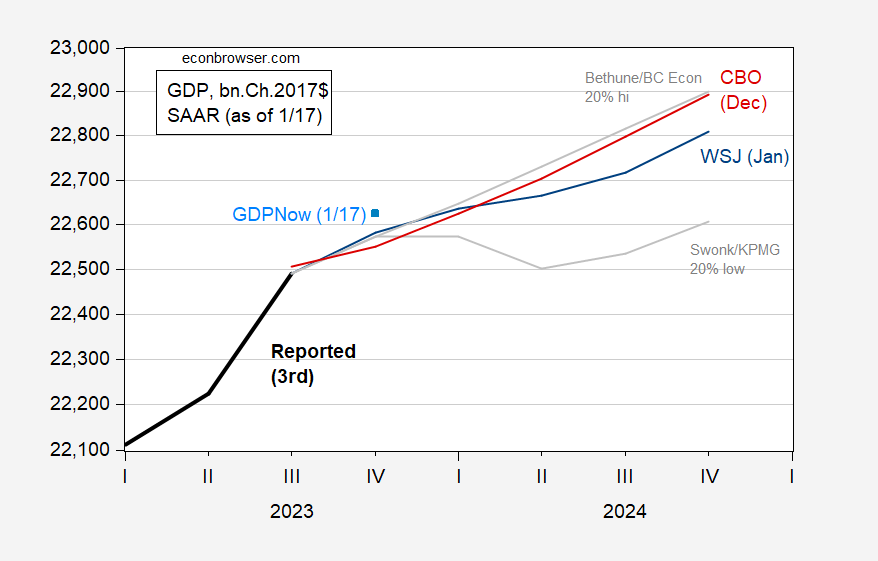

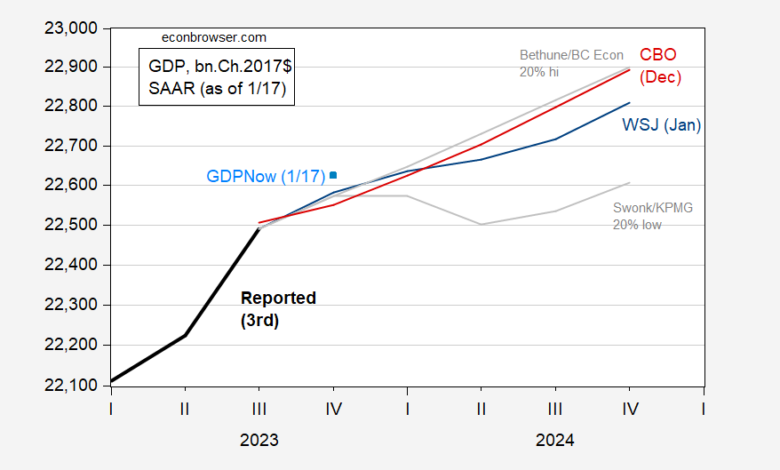

The mean forecast trajectory keeps on rising as actual GDP outcomes keep on surprising on the upside (Q4 mean growth rose from 0.9% to 1.7% q/q AR since October), but forecasts are pretty dispersed, as shown in Figure 1.

Figure 1: GDP (black), Mean forecast GDP from January 2024 WSJ survey (blue), 20% trimmed high (for 2023 q4/q4) of Bethune/Boston College Economics. (gray), trimmed low of Swonk/KPMB (gray), CBO projection from December (red), GDPNow nowcast of 1/17 (light blue square), all in bn.Ch.2017$ SAAR. Source: BEA, WSJ surveys (various), CBO, and author’s calculations.

Neither mean nor median responses indicate a two quarter slowdown. Nonetheless, the 20% band low entry (for q4/q4 2024) from Diane Swonk (KPMG) indicates a 0% growth in Q1, and -1.30% q/q AR in Q2. About 22% of respondents predict two or more consecutive quarters of negative growth.

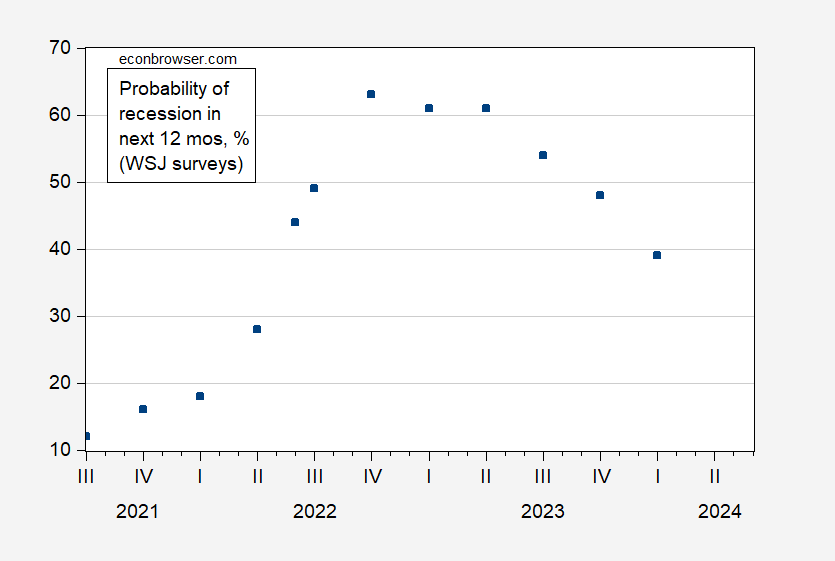

Recession probability declines again.

Figure 2: Probability of recession in the next twelve months. Source: WSJ survey, various issues.

Source link