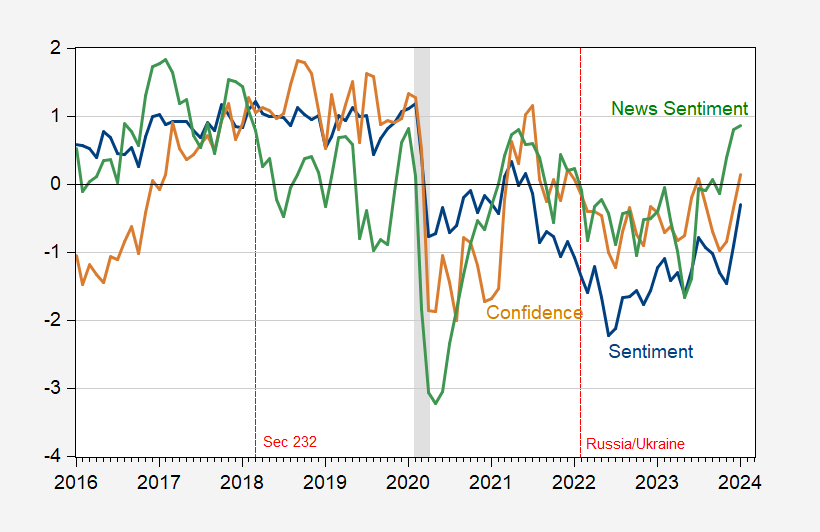

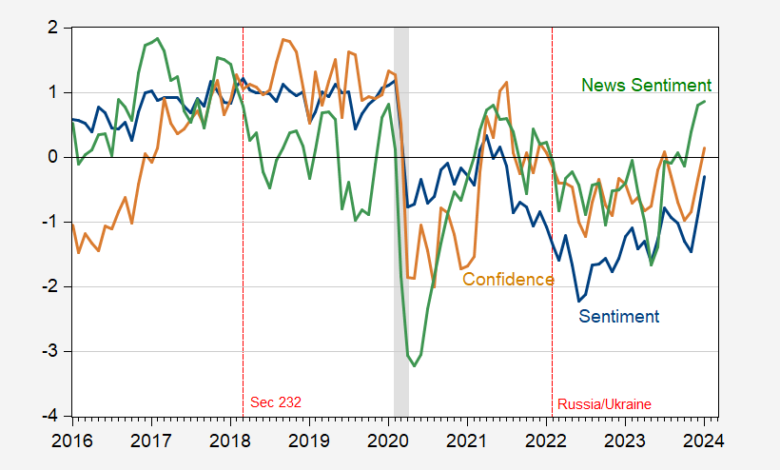

The Conference Board’s confidence index is up, following U.Michigan’s survey of sentiment.

Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Shapiro, Sudhof and Wilson (2020) Daily News Sentiment Index (green), all demeaned and normalized by standard deviation (for the displayed sample period). Michigan December observation is preliminary. The News Index observation for December is through 1/7/2024. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, SF Fed, NBER, and author’s calculations.

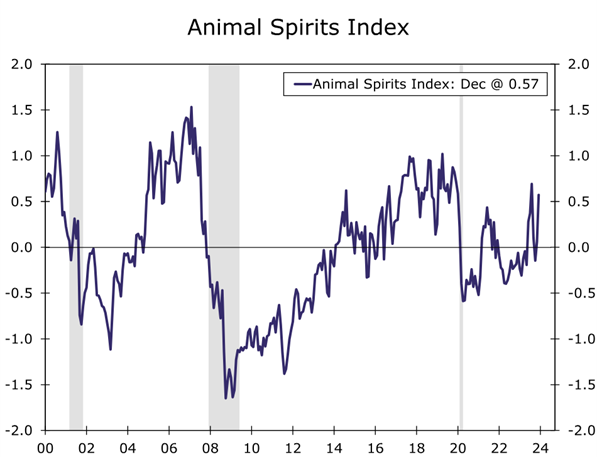

Wells Fargo has constructed a “Animal Spirits Index”, which is the first principal component of five variables: (1) the S&P 500 index, (2) the Conference Board’s consumer confidence index, (3) the yield spread, (4) the VIX index and (5) the economic policy uncertainty index.

Source: Wells Fargo, January 30, 2024.

Like the confidence and sentiment indices, the ASI has trended upwards in recent months, and in December stood at levels obtaining on the eve of the pandemic.

Source link