Justin Ho of Marketplace discussed the implications of the import/export price release Thursday. My view was that pass through into import prices was low in the short run, and even in the long run was not very large, while pass through into the broader price index was unlikely to be large. Not sure I was alone in this view, but here’re my thoughts.

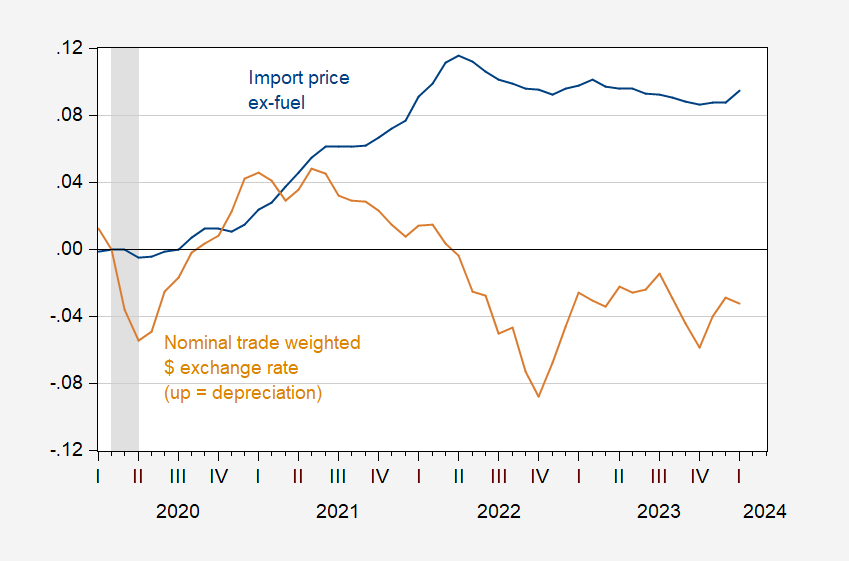

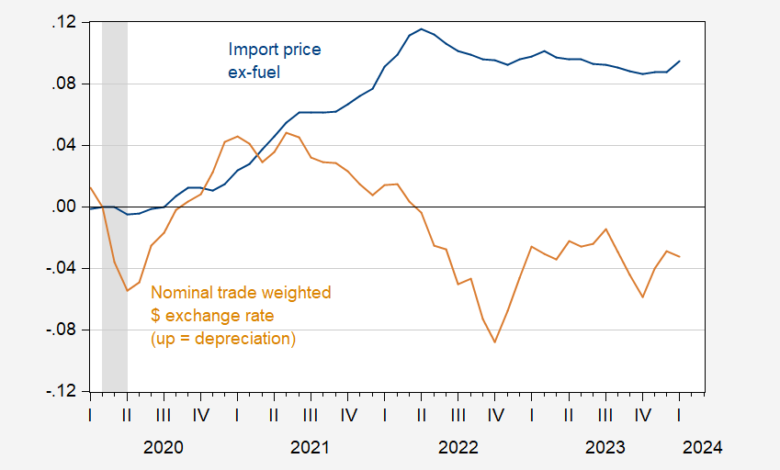

Figure 1: Import price ex-fuel (blue), nominal trade weighted US dollar exchange rate (up is depreciation) (tan), both in logs, 2020M02=0. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Federal Reserve Board via FRED, NBER, and author’s calculations.

The variables are defined so that one anticipates the two variables to comove positively. In fact, there is not much of a correlation apparent in (log) levels. Since both series are nonstationary, it makes sense to estimate in log first differences. Sampling the data as end-of-quarter, and estimating the regression from 2002Q1-2023Q4 (with four lags of exchange rate), one gets the long run pass through coefficient at about 0.3 (ignoring any other factors like domestic slack and measures for exporting country costs). The adjusted R2 is 0.41. Note that, as in previous studies, the estimated pass through is much less than unity, which makes sense given that most imports are invoiced in US dollars.

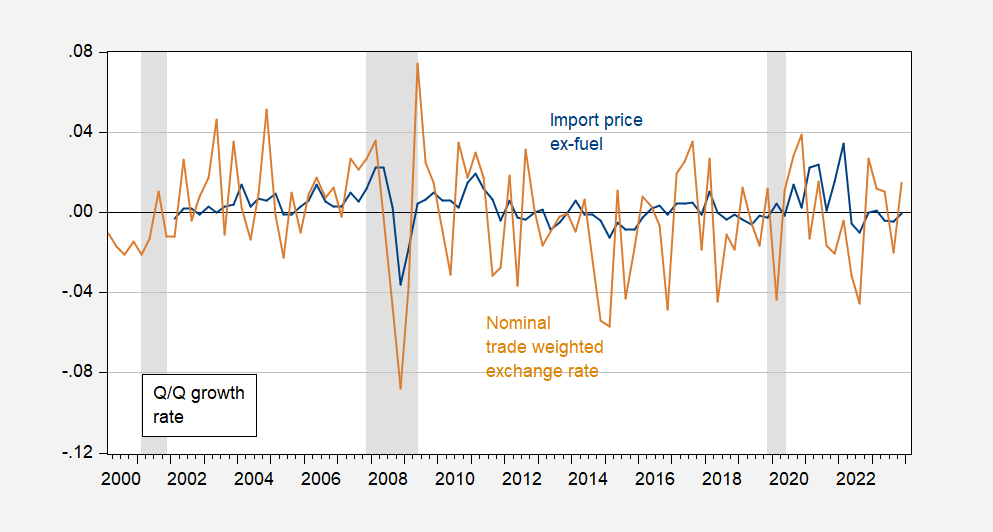

Figure 2: First log difference in Import price ex-fuel (blue), nominal trade weighted US dollar exchange rate (up is depreciation) (tan). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Federal Reserve Board via FRED, NBER, and author’s calculations.

For comparison, Bussiere, della Chiaie and Peltuonen (2014) estimate the long run pass through at about 0.35 for the United States, over the 1990-2011 period. Results from the earlier 2006 Fed survey, discussed here.

What about for broader indices? For the PPI for tradable industries, the estimate is about 0.3 for 2013-20 in Amiti et al. (2022), but 0.7 for 2021, suggesting the pandemic era exhibits different behavior.

What about the impact on the broader indices? Mattschke and Sattiraju (2022) argue dollar appreciation/depreciation have very little impact on PCE inflation. Pointing out that only about 10% of a core consumer basket involves imported goods. (Oil prices denominated dollars, when they rise, are another matter.)

A caveat is in order. In the above literature, the exchange rate is taken as largely exogenous, not completely implausible given the large unpredictable component of nominal exchange rates. That being said, as Forbes, Hjortsoe and Nenova (2018) and Ha, Stocker and Yilmazkuday (2020) notes, the types of shocks (demand, monetary, supply) matter as well. For advanced economies, Ha et al. find the average exchange rate pass through into the CPI to be about 0.10.

Source link