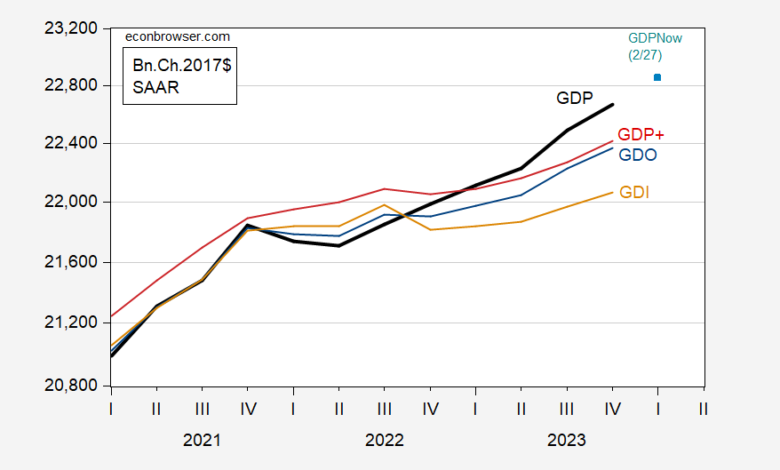

With the second release for GDP, we have the following picture of aggregate output:

Figure 1: GDP (black), GDPNow nowcast of 2/27 for GDP (light blue square), GDP+ scaled to 2019Q4 (red), GDO (blue), GDI (tan), all in bn.Ch.2017$ SAAR. 2023Q4 GDI, GDO based on assuming 2023Q4 enterprise surplus is the same as 2023Q3. Source: BEA, Philadelphia Fed, Atlanta Fed, and author’s calculations.

The expenditure side measure of “Y” (as I would tell my macro students) continues to be estimated above the income measure. Note that we really don’t know GDI and GDO for 2023Q4, as enterprise surplus is unknown. I have guesstimated GDI and GDO assuming enterprise surplus is constant in nominal terms going from Q3 to Q4. Under this assumption, GDI continues to grow in Q4.

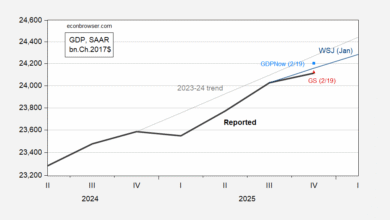

What about final sales, a better measure of aggregate demand? This continues to grow as well.

Figure 2: Final sales (blue, left scale), GDPNow nowcast of 2/27 for final sales (light blue square, left scale), final sales to domestic private (tan, right scale), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, and author’s calculations.

In Q4, final sales to private domestic purchasers (which some observers take as a better measure of momentum) is 2.8% q/q AR, compared to GDP growth of 3.2%. Hence, momentum in aggregate demand seems strong. For Q1, GDPNow indicates the same growth rates for Q1…

As an aside, note there is no two consecutive decline in GDP+ in 2022H1, and only one quarter decline in GDI. Neither measure of final sales indicate a two-consecutive quarter decline.

Source link