Today we present a guest post written by Lindsay Jacobs, Assistant Professor at the Robert M. La Follette School of Public Affairs, at the University of Wisconsin, Madison.

Social Security retirement benefits are a significant source of income for older U.S. households. While the program is a prominent feature of modern life, it faces well-known funding challenges: Its ‘pay-as-you-go’ financing model, increasing life expectancy, and a diminishing ratio of workers to retirees together point to likely future shortfalls. There are a number of policy changes that could address the issue, including increasing the age at which one can claim “full” Social Security retirement benefits. Indeed, there have already been changes to claiming ages, with the Full Retirement Age (FRA) increasing gradually from 65 to 67.

In my ongoing research [paper], I’m exploring how people in different occupations have responded to these increases in the FRA in the past—and how they might continue to do so in the future.

Although it’s not a part of the design of Social Security benefit structure, later-life work, disability, and Social Security claiming patterns vary widely across the population, particularly for people in different occupations. All else equal, people in less physically demanding, white-collar jobs can and do work longer, and an increase to the FRA is relatively tougher for people in blue-collar work to absorb.

Key findings on jobs and the timing of Social Security claiming.

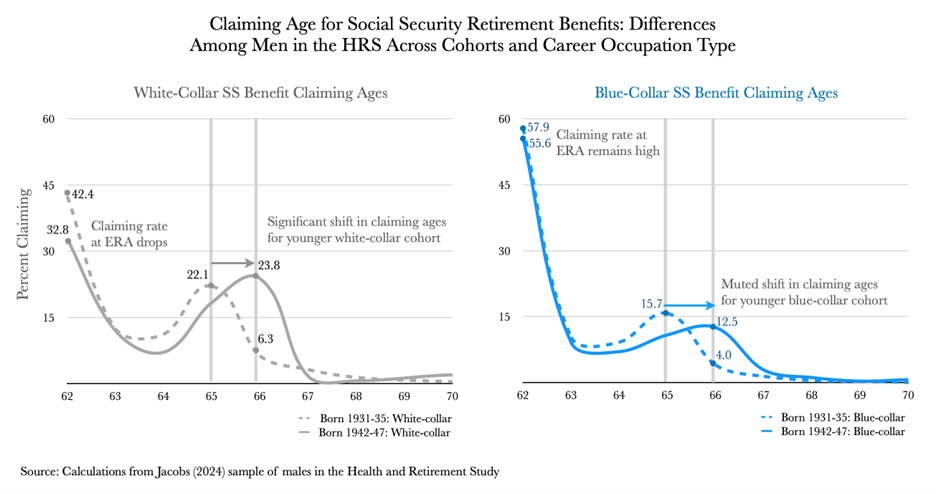

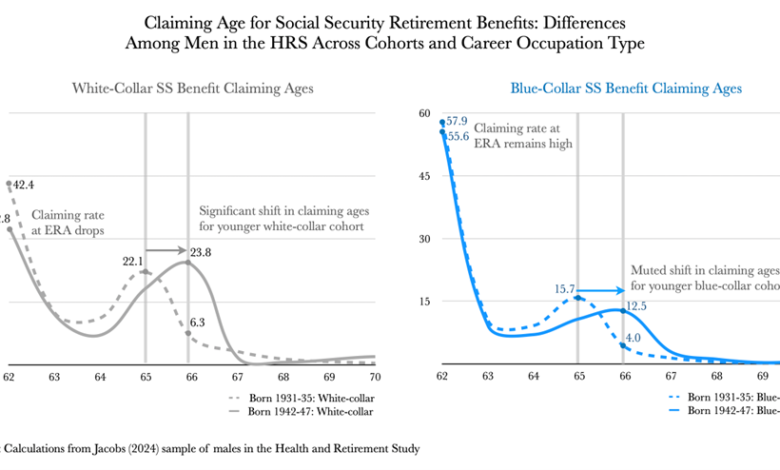

The figure here shows two interesting facts about claiming ages for cohorts of men in the Health and Retirement Study (HRS) born between 1931 and 1947. The first is that those whose careers involved jobs in more white-collar work (left) are far less likely to claim reduced Social Security benefits at the earliest age possible, 62, compared to those with blue-collar work histories (right). The second is the difference in how those in later cohorts responded to facing a higher FRA and reduced early benefits. The solid lines are claiming ages for cohorts facing an FRA of about 66, while the dashed lines are for older cohorts who faced an FRA of 65. The younger white-collar workers tend to adjust by even fewer claiming reduced benefits at age 62 and delaying claiming to the new FRA of 66. In contrast, blue-collar workers’ early claiming rates at 62 remain largely unchanged despite facing a larger reduction in benefits.

To understand how claiming ages might shift with potential future increases beyond the current Early Retirement Age (ERA) of 62 and FRA of 67, I estimate a model of behavior that matches facts from the HRS data and measure responses to hypothetical changes in policy by occupation.

Generally, I find that increasing the ERA by two years has a far greater impact on blue-collar workers, while raising the FRA matters more for white-collar workers. This shows up in a number of measures. The primary change is in claiming age behavior, where now about 70 percent of blue-collar workers claim benefits right at the ERA of 64. The new policy also results in more years worked, modest increases in savings prior to retirement, and—rather importantly—an increase in the share of people applying for Social Security Disability Insurance (SSDI).

Why does this matter?

None of this is to suggest that the ERA or FRA should or shouldn’t increase, or that the design of or any reforms to Social Security retirement benefits should explicitly take occupation history into account. However, understanding responses and the mechanisms that generate them is important for a couple of reasons.

One motivation for thinking about the relationship between occupations and Social Security is to more precisely predict the distributional responses to policies that estimates of average responses would miss—including how we might expect to see spillovers into adjacent programs like SSDI.

But the other motivation is in thinking about political feasibility. Last year, French pension reforms brought the retirement age from 62 to 64—and somewhat abruptly for those already in their 50s at that. This inspired intense protest, and the experience underscores the importance of considering heterogeneous effects: The average loss in wellbeing for all workers would overlook the more intense loss among one half of workers, and would underestimate the political (un)popularity of such policy changes.

A copy of the paper can be found here: https://lindsayjacobs.github.io/papers/VariedResponses-Policy.pdf.

This post written by Lindsay Jacobs.

Source link