What is Cryptocurrency?

Cryptocurrency, also known as “crypto,” is a form of digital currency exemplified by Bitcoin. It offers a decentralized payment system or investment option, utilizing cryptographic techniques for secure transactions without the reliance on central authorities like governments or banks.

Bitcoin, the pioneer in this field, was created to facilitate payments independently of central banks. It uses a secure, decentralized system for transaction verification, eliminating the need for traditional financial institutions.

Ethereum, another major player, employs similar technology for more than just peer-to-peer payments. It’s the currency of choice on the Ethereum network, which supports decentralized applications (DApps) and smart contracts, allowing for financial services without central intermediaries.

The rise of altcoins, or alternative cryptocurrencies to Bitcoin, showcases the diverse applications of blockchain technology, from enhancing payment systems to supporting decentralized finance (DeFi) platforms.

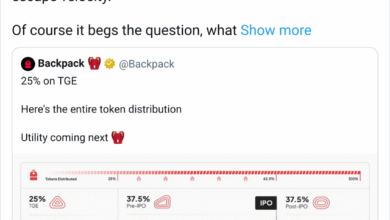

Why Invest in Cryptocurrencies?

Investment in cryptocurrencies is driven by the anticipation of value appreciation. For instance, increased adoption of Bitcoin as a payment method can drive up its demand and price. Similarly, the development of applications on the Ethereum network can boost the demand and value of Ether.

Some view cryptocurrencies like Bitcoin not merely as investments but as the foundation of an improved monetary system, advocating for its use as a standard payment method.

The Enduring Appeal of Bitcoin

Despite its volatile nature, Bitcoin continues to capture attention. Its resilience is evident from its recovery from significant price drops, such as the surge to $69,000 in March 2024 after a previous slump. Factors contributing to its price fluctuations include regulatory changes, market dynamics, and the periodic “halving” events that reduce mining rewards, potentially increasing scarcity.

Cryptocurrency Mechanics

The backbone of cryptocurrencies is blockchain technology, which ensures secure, immutable transaction records and ownership tracking. Cryptocurrencies can serve as a medium of exchange, a store of value, or a utility within specific applications.

Creation and Acquisition of Cryptocurrencies

Cryptocurrencies like Bitcoin are typically generated through mining, a process that validates transactions and rewards participants with new coins. However, direct purchase from exchanges or other users remains the most accessible method for acquiring cryptocurrencies.

Diversity in the Cryptocurrency Market

The cryptocurrency market is vast, with over two million different cryptocurrencies. While some hold significant market value, others may be lesser-known or even valueless. For newcomers, it’s advisable to start with well-established cryptocurrencies.

Cryptocurrency as a Security

The classification of cryptocurrencies as securities is a matter of ongoing debate. Regulatory bodies like the SEC are scrutinizing the sector, with potential implications for how cryptocurrencies are regulated and perceived in the financial market.

Pros and Cons of Cryptocurrency

Cryptocurrencies are lauded for their potential to decentralize financial systems, offer inclusive financial services, and provide secure transactions through blockchain technology. They also offer opportunities for passive income, such as staking.

However, the market is fraught with risks, including high volatility, regulatory uncertainties, and environmental concerns related to energy-intensive mining processes.

Legal and Tax Implications

While cryptocurrencies are legal in the U.S. and many other countries, their legal tender status and tax treatment can vary. Understanding the local regulations and tax obligations is crucial for participants in the cryptocurrency market.

Is Cryptocurrency a Wise Investment?

Investing in cryptocurrencies carries inherent risks. It’s essential for investors to conduct thorough research, understand the market dynamics, and consider the long-term viability of the cryptocurrencies they choose to invest in. Diversification and prudent risk management are key strategies for navigating the volatile cryptocurrency market.

Conclusion

Cryptocurrency represents a significant shift in the financial landscape, offering new opportunities and challenges. While its potential for growth and innovation is undeniable, participants must navigate the complexities of the market with caution and informed decision-making.