Steven Kopits writes:

On the other hand, interest payments have risen from 9.5% of GDP in 2020 to 13.6% of GDP in 2023. That is a whopping 4% of GDP in just increased interest payments. Further, as the incumbent debt is rolling off and has to be refinanced, interest payments will continue to rise, and fall with considerable delay even when inflation and interest rates return to lower levels.

I do not understand how these numbers were calculated. It must be that “new math” they are teaching in schools these days.

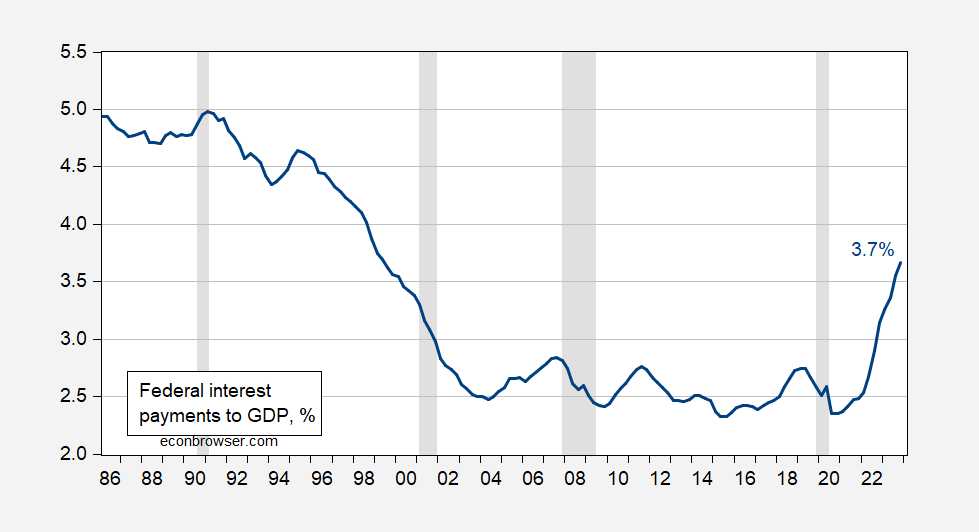

I download FRED series A091RC1Q027SBEA, divide by FRED series GDP, divide the first by the second, multiply by 100 to obtain:

Figure 1: Federal interest payments divided by GDP, in % (blue). NBER defined peak-to-trough recession dates shaded gray. Treasury, BEA via FRED, NBER, and author’s calculations.

I do not see 13.6% in these calculations. If one were to accidentally multiply the Federal interest payments at annual rate by 4 for FY2023, and divide by FY2023 GDP at annual rate, I do then get 13.3%. But this calculation would be nonsensical.

Source link