A reader takes issue with my post showing y/y and instantaneous core PCE deflator versus 2% target, noting (correctly) that as of 2020, the Fed’s new monetary strategy incorporates Flexible Average Inflation Targetting (FAIT). While I might have missed it, I don’t recall how one should operationalize FAIT in terms of graphs and rates of reversion to trend lines. The reader gives no guidance, merely a criticism, so I will update what I’ve posted before.

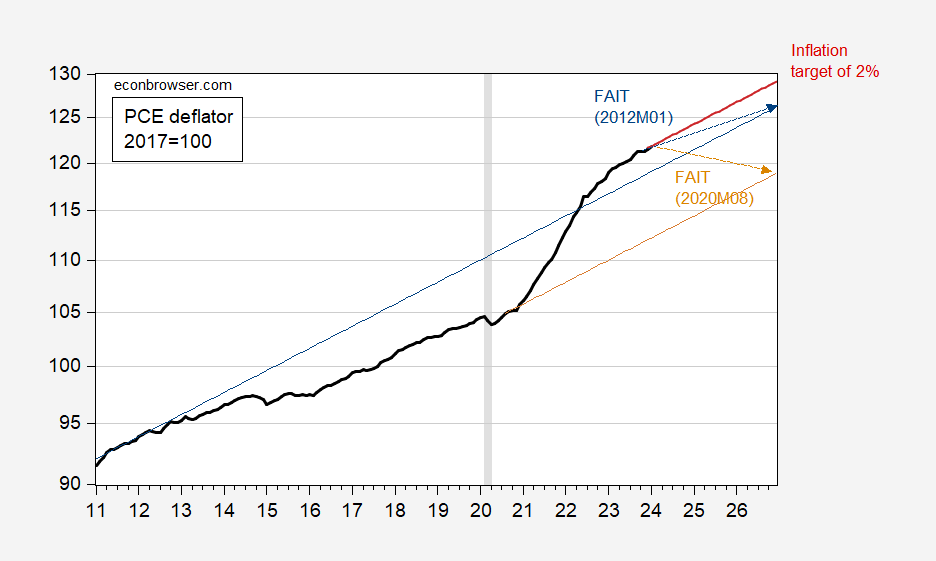

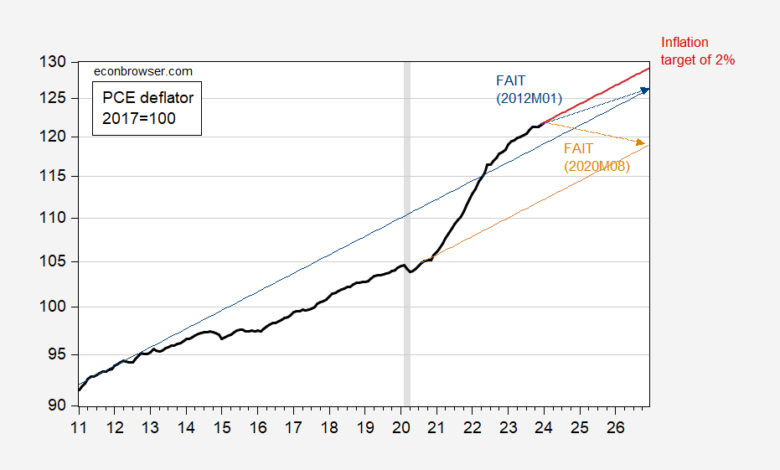

Figure 1 shows the actual PCE deflator (note that officially, the Fed is paying attention to the PCE deflator, not specifically the core PCE deflator).

Figure 1: PCE deflator (black), FAIT trend as of 2020M08 (tan), and as of 2012M01 (blue), and inflation target as of January 2024 (red line). Arrows denote what path of price deflator should be if reversion to be accomplished by December 2026. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Note that in order to hit FAIT trend by end-2026, starting from when the new monetary strategy was published, the Fed would need to engineer deflation (of about 0.8% on an annual basis). To hit FAIT trend starting from 2012M01 (when Jeffry Frieden and I argued for conditional inflation now), inflation would have to run a bit less than 1.5% for the next three years. I have not seen anybody put forward these types of numbers. Of course, the amount of required deflation or disinflation, respectively, would alter if the target date was pushed further back, so 2040 or so.

Hence, I must confess to be somewhat puzzled by the reader’s criticism of plotting ex post PCE inflation against the 2% trend, as most FOMC members seem to be talking about inflation targeting as we used to know it, rather than FAIT.

Source link