The FT-Booth Macroeconomist Survey was released today. GDP is slated to grow 2.1% in 2024, q4/q4.

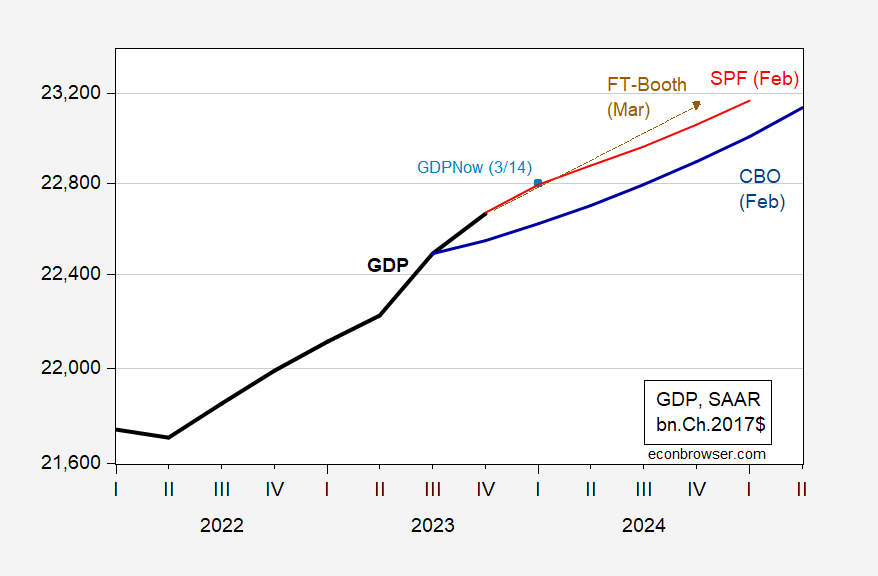

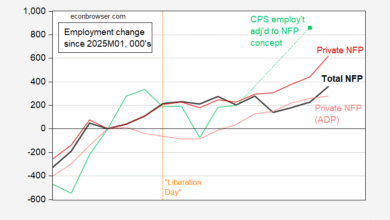

Figure 1: GDP (bold black), CBO projection (blue), Survey of Professional Forecasters (red), FT-Booth median forecast (brown inverted triangle), GDPNow of 3/14 (light blue square), all in bn.Ch.2017$. Source: BEA 2024Q4 2nd release, CBO Budget and Economic Outlook (February), Philadelphia Fed SPF, Booth School, Atlanta Fed (3/14), and author’s calculations.

The median growth rate is 2.1%, with 10% lower/upper bounds at 1.6% and 2.5%. This growth rate is faster than the 1.7% median rate in the February SPF. (I’m apparently more pessimistic than the median, with my point estimate at 1.7%.)

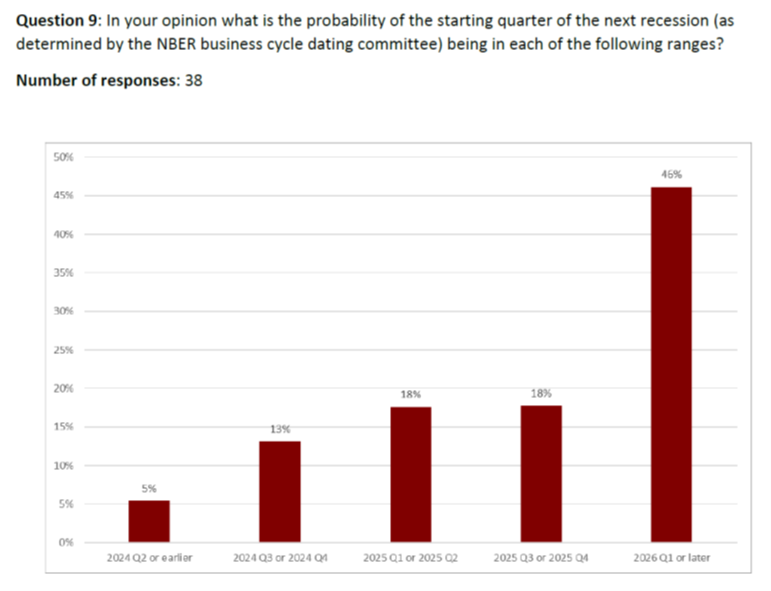

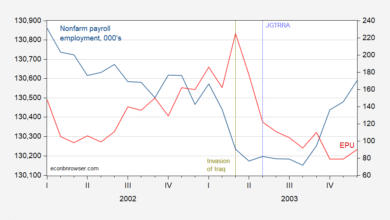

What about recession? The modal response is now pushed to 2026 or later.

Source: Booth School.

The recession start date has yet again been deferred, with modal response moved to 2026 or beyond. In the December survey, 42% indicated a start in 2025Q3 or beyond.

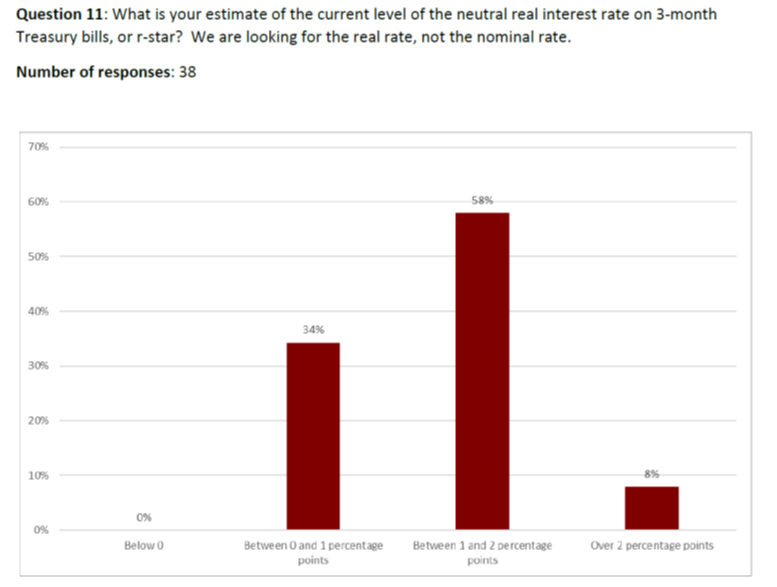

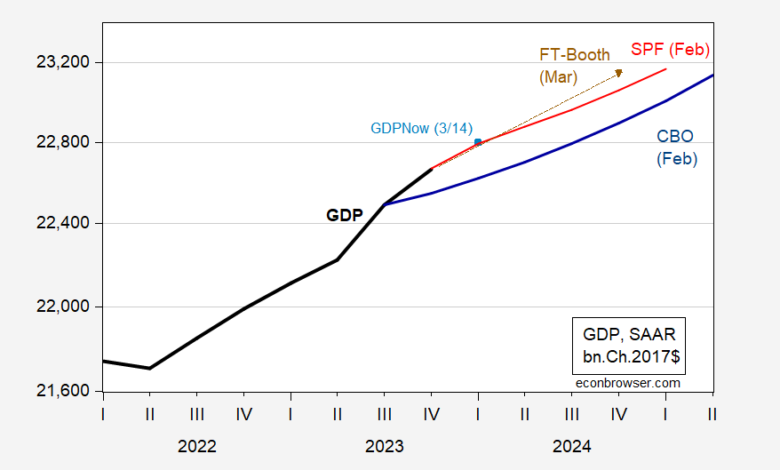

Finally, the respondents weighted in on r*:

Source: Booth School.

The modal response is for r* to between 1%-2%, which is consistent with the estimates shown in this post, and this post. Only 3 people (out of 38) believed r* > 2% (which only the Lubik-Matthes estimate matches).

“Fed will have to keep rates high for longer than markets anticipate, say economists,” in FT highlights other aspects of the survey.

Source link