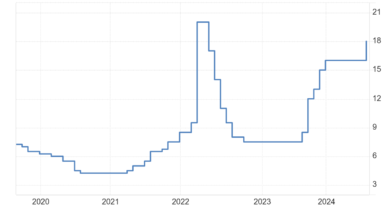

The efficient markets hypothesis indicates that new information should induce a revision to the present discounted value of future dividends, and hence a change in the market value. Apparently news came today.

Source: Investing.com, 1:50 CT, 4/1/2024.

Of course, the efficient markets hypothesis would’ve also suggested that the price of this stock was way out of proportion to fundamentals (as perceived by rational agents). However, fads (as defined by Summers) can be very long-lasting, and difficult to detect using the standard random walk criterion.

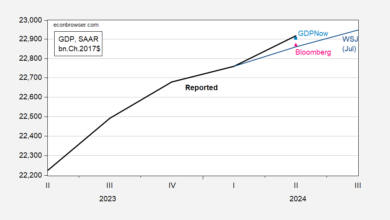

Addendum:

Since the consolidated group only started trading last Tuesday, maybe better to show what’s happened over the past week.

Source: Investing.com, 2:15 CT, 4/1/2024.

Source link