A flurry of investment bank newsletters (Wells Fargo, GS) impels me to look at what happened to the aggregate trade balance in the wake of Trump’s tariff hikes:

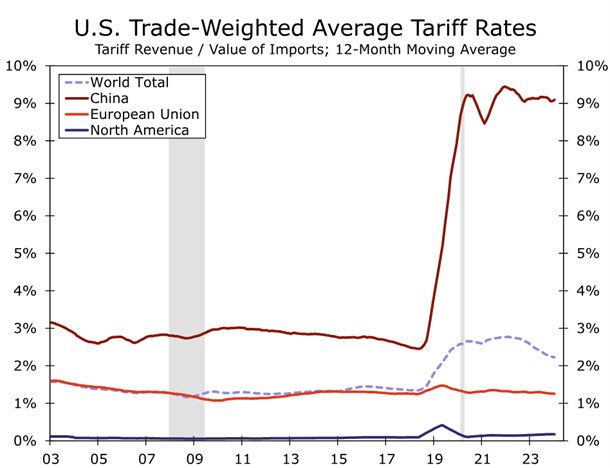

Source: Wells Fargo.

The US trade-weighted tariff rate against world imports roughly doubled to nearly 3%. What happened to aggregate net exports and the current account, expressed as a share of GDP?

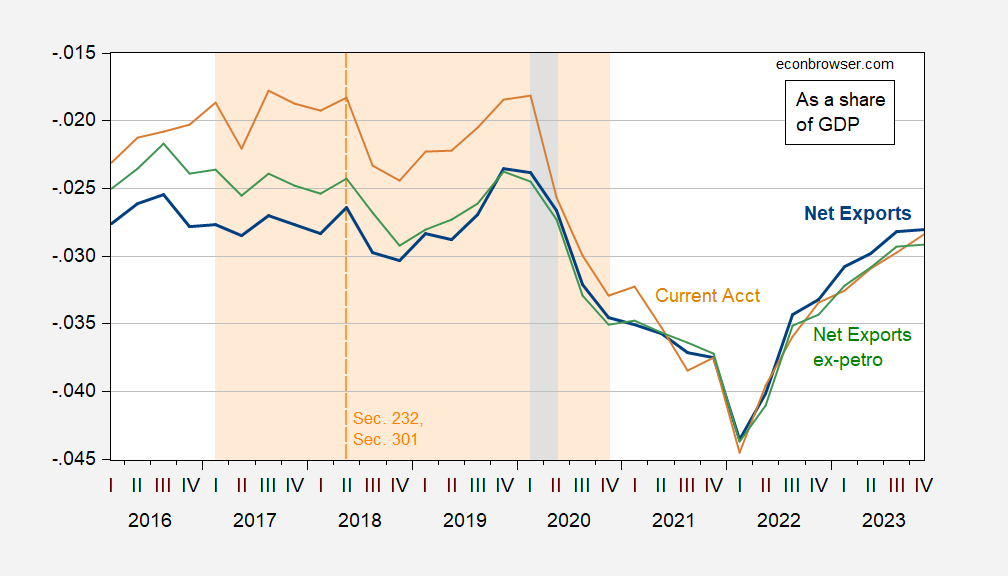

Figure 1: Net exports to GDP (bold blue), net exports ex-petroleum (green), and current account (tan), all as share of GDP. Trump administration shaded orange, dashed line at start of Section 232 and Section 301 actions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

At the beginning of the Trump Administration, the net exports to GDP ratio was -2.8%; by the end (2020Q4), it was -3.5%. What about excluding petroleum imports and exports? Then the deterioration was even worse — going from -2.4% to -3.5%.

What if we start from the real start of the trade war, 2018Q2. Then the net exports ratio declines from -2.6% to -3.5% by administration’s end.

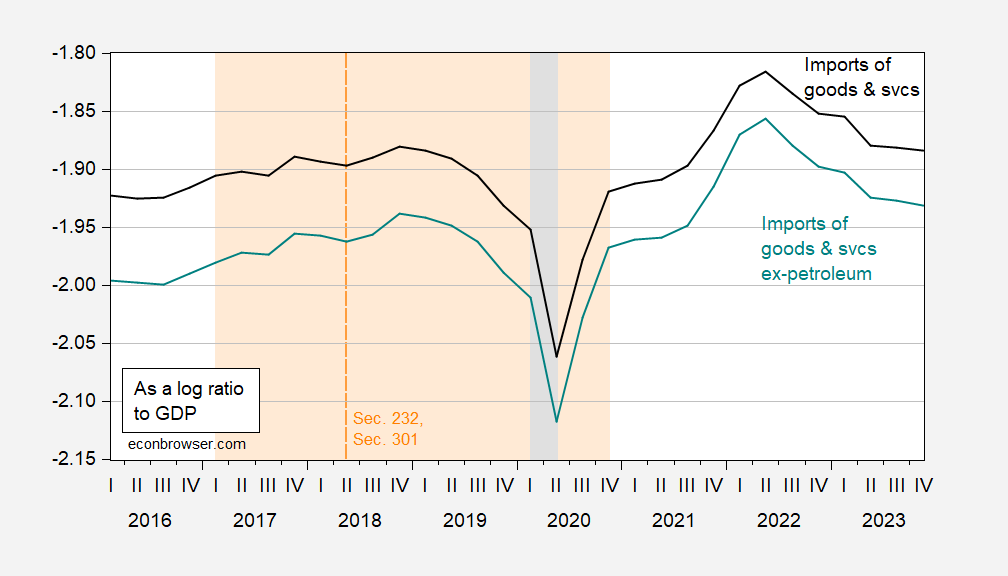

What about imports — rather than the trade balance? Here, the change in imports is hard to see.

Figure 2: Imports to GDP (black), imports ex-petroleum (teal), both in logs of Ch.2017$. Trump administration shaded orange, dashed line at start of Section 232 and Section 301 actions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Imports do decline starting in 2019, but I’d attribute that more to the strengthening dollar than tariffs. In any case, by the end of the Trump administration, imports ex-petroleum is about the same as share of real GDP as at the start of the tariff war.

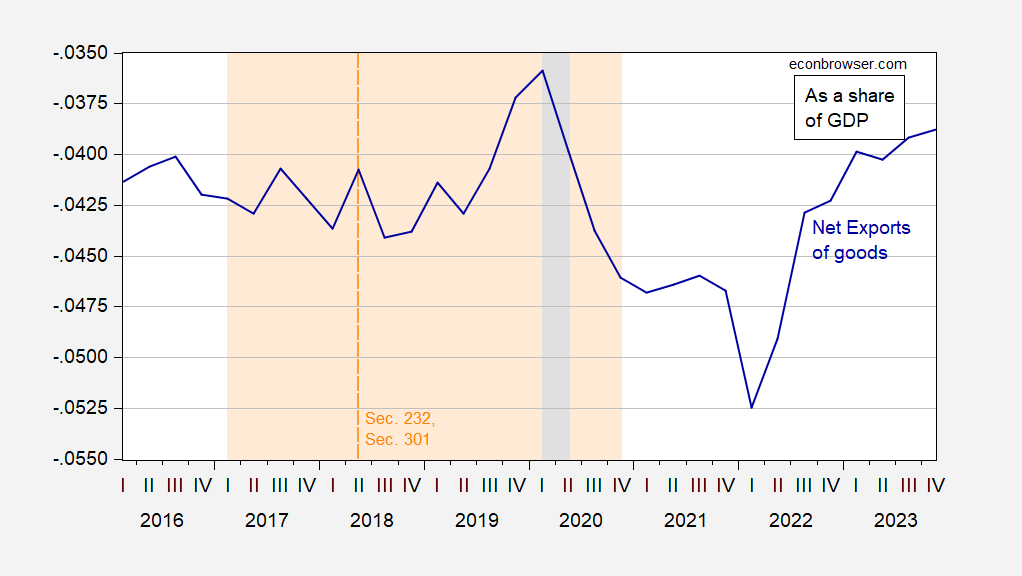

Since Mr. Trump doesn’t believe that trade balance calculations shouldn’t include services, I include the evolution of the goods (only) trade balance.

Figure 3: Net exports of goods to GDP (dark blue), as share of GDP. Trump administration shaded orange, dashed line at start of Section 232 and Section 301 actions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

That too declines.

So what about Mr. Trump’s statement:

“For many, many years, the United States has suffered through massive trade deficits. That’s why we have $20 trillion in debt. So we’ll be changing that.” June 30, 2017

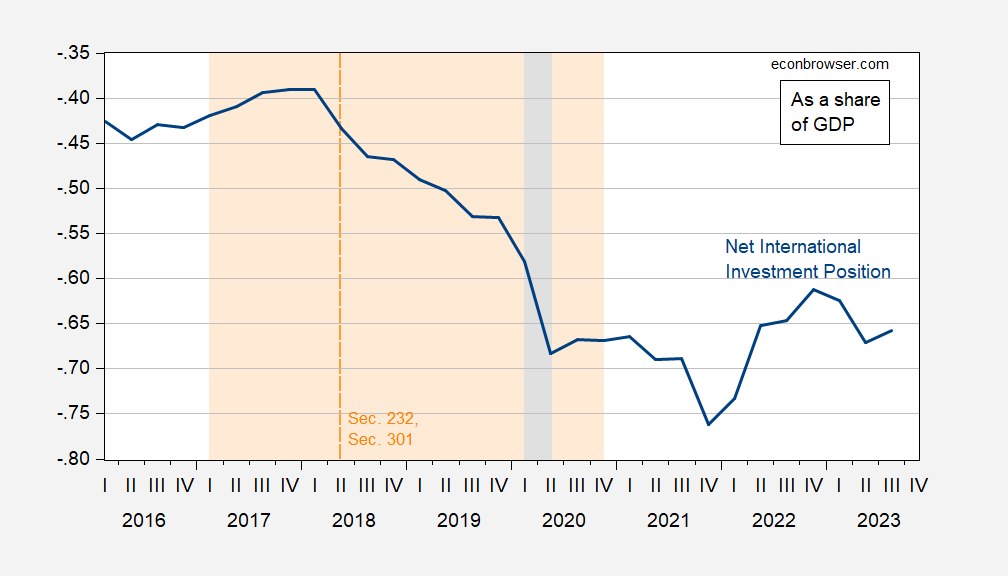

Here’s the NIIP to GDP ratio.

Figure 4: Net international investment position (ex-derivatives) as share of GDP. Trump administration shaded orange, dashed line at start of Section 232 and Section 301 actions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Well, not quite “mission accomplished”. At the start of the tariff war, the NIIP was -43% of GDP; at the end of the Trump administration, the NIIP was -67%. While changes in the NIIP are heavily influenced by changes in the exchange rate, it’s also true that the cumulated current account (an alternative measure of NIIP not subject to such large exchange rate related valuation changes) went from -50.3% to -53.0% over this same period.

Source link