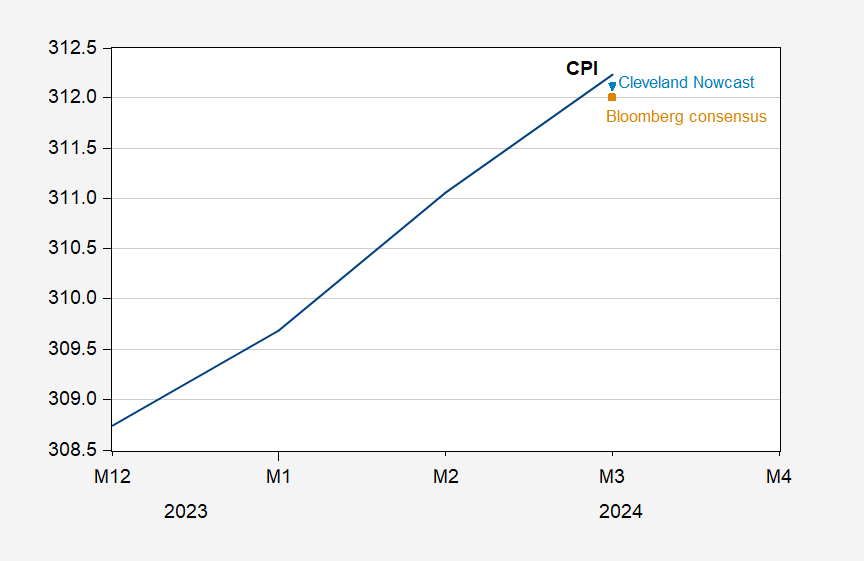

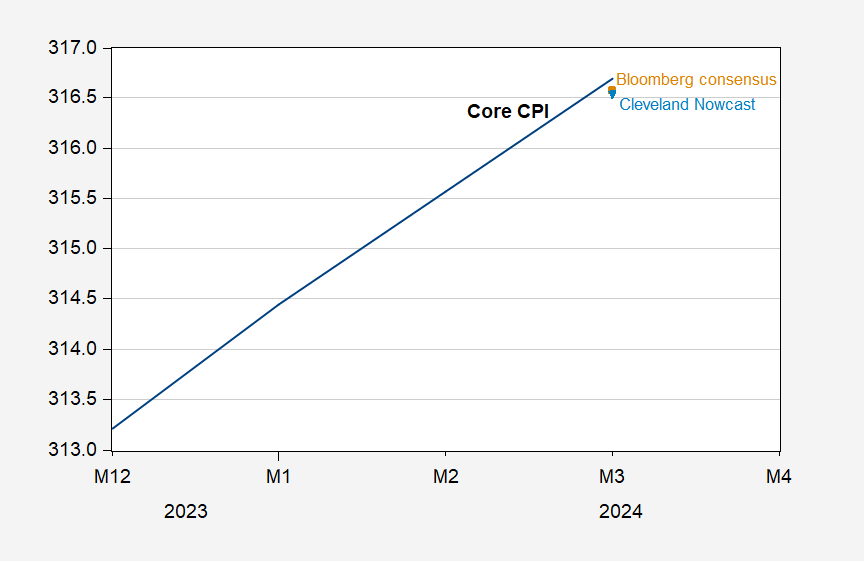

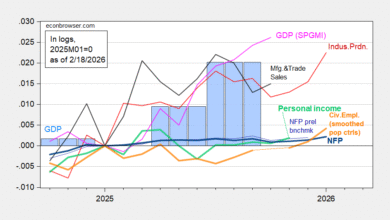

Here’s a graphic depiction of the extent of the surprise, in levels, relative to Bloomberg Consensus and Cleveland Fed nowcasts.

Figure 1: CPI (black), Bloomberg consensus (tan square), Cleveland Fed nowcast (sky blue inverted triangle), all on log scale. Source: BLS via FRED, Bloomberg, Cleveland Fed, and author’s calculations.

Figure 2: Core CPI (black), Bloomberg consensus (tan square), Cleveland Fed nowcast (sky blue inverted triangle), all on log scale. Source: BLS via FRED, Bloomberg, Cleveland Fed, and author’s calculations.

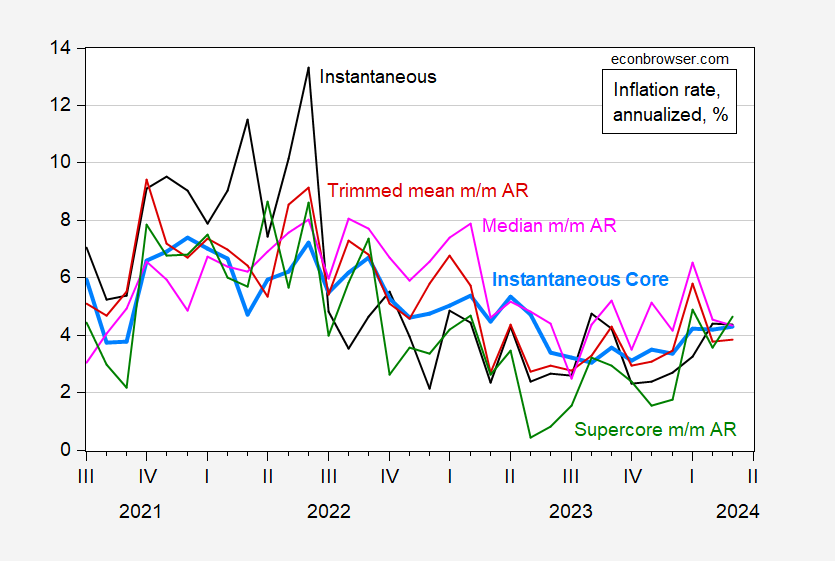

Here’s what “trend” inflation measures look like, in particular instantaneous inflation (T=12, a=4) per Eeckhout (2023).

Figure 3: Instantaneous CPI inflation (bold black), instantaneous core CPI inflation (sky blue), trimmed mean inflation m/m annualized (red), median inflation m/m annualized (pink), and CPI supercore m/m annualized (green). Instantaneous inflation calculated per Eeckhout (2023), for T=12, a=4. Source: BLS, Dallas Fed via FRED, BLS, and author’s calculations.

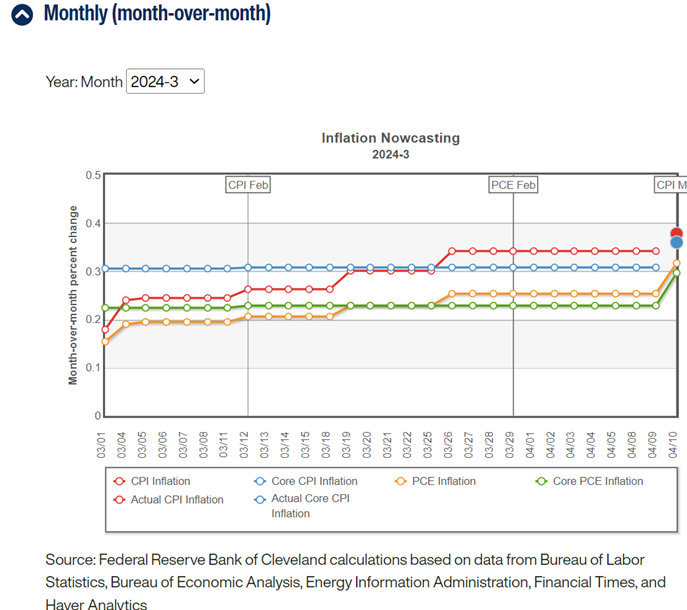

Recall, the Fed doesn’t target the CPI explicitly, but the PCE deflator (headline, according to text, but in practice it seems everybody uses core). But clearly information from the CPI is relevant to the PCE deflator. The Cleveland Fed nowcast utility shows how the PCE deflator nowcasts are affected.

Source: Cleveland Fed, accessed 4/10/2024.

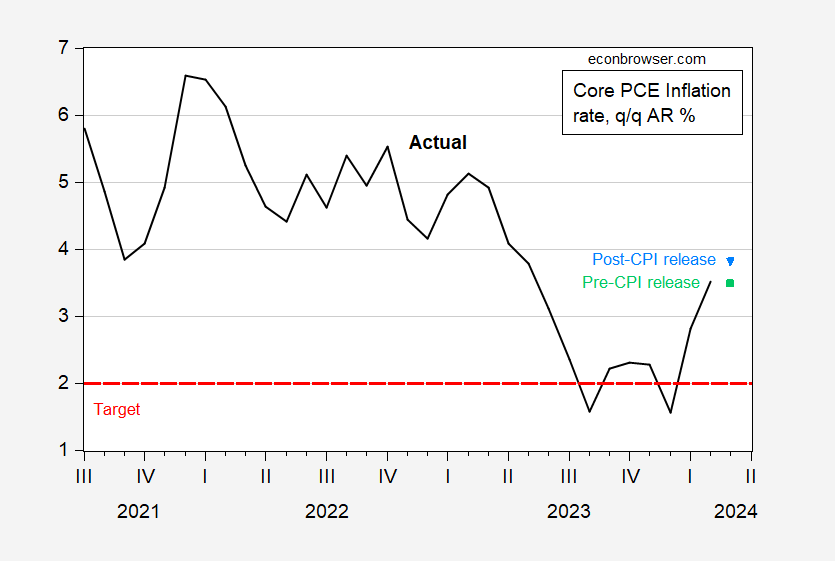

While y/y core PCE inflation would be decreasing with the pre- and post-CPI release nowcasts, the q/q core PCE inflation would now be rising instead of stabilizing.

Figure 4: Core PCE quarter-on-quarter annualized inflation (bold black), and nowcast as of 3/10 (sky blue inverted triangle), and as of 3/9 (light green square), all in %. Source: BEA, Cleveland Fed, and author’s calculations.

Modal forecast from the CME for the June 12th meeting was for a drop by 25 bps (56%); post-CPI release, it’s a no-change (81%). The expected value was 5.23% pre-release, and 5.33% post-release.

CEA’s take, here.