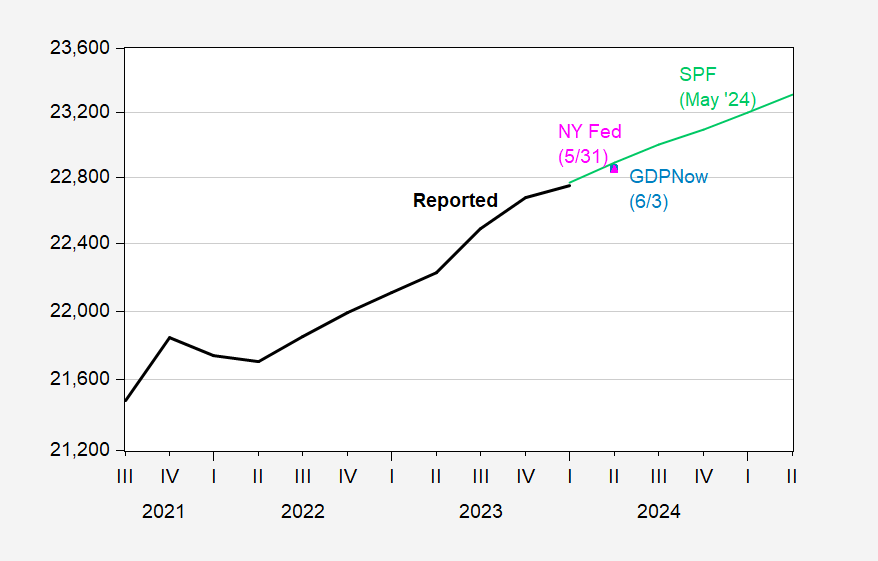

Atlanta and NY Fed lower growth rates for Q2

Figure 1: GDP as reported (bold black), GDPNow (light blue square) , NY Fed (pink triangle), Survey of Professional Forecasters May median (light green line), all in bn.Ch.2017$, SAAR. Source: BEA (2024Q1 2nd release), Atlanta Fed, NY Fed, Philadelphia Fed, and author’s calculations.

For a first, the implied level using GDPNow is below the May SPF, a result of downward revision in Q1 GDP and slower nowcasted growth.

The downward movement in nowcasts is pronounced. Consider GDPNow.

Source: Atlanta Fed, accessed 3 June 2024.

The downside surprise on construction and ISM manufacturing was the big mover — from 2.7% to 1.8% q/q SAAR in GDPNow. Goldman Sachs tracking only dropped 0.1 ppts by comparison.

That being said, no recession is apparent in Q2 nowcasts yet. Nor in monthly indicators for April (see here).

Source link