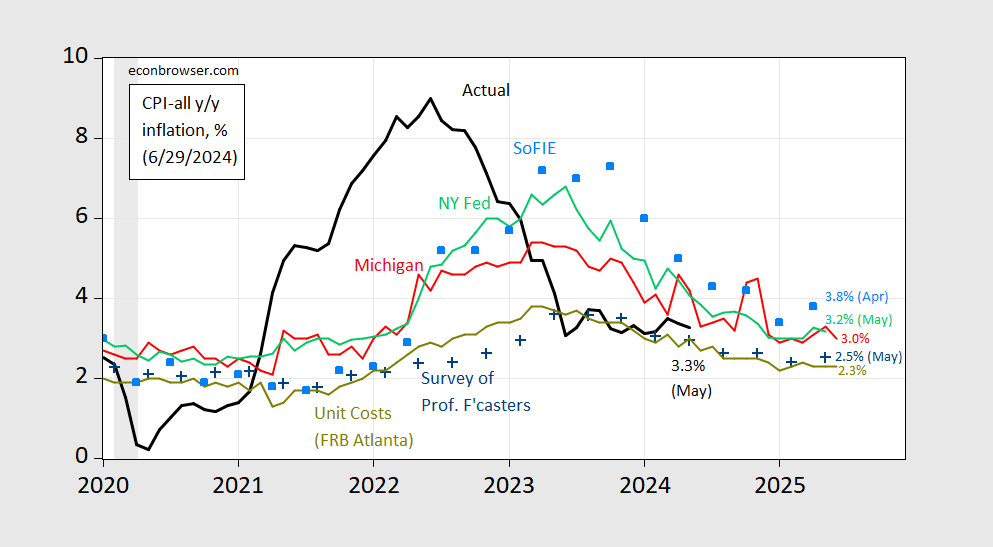

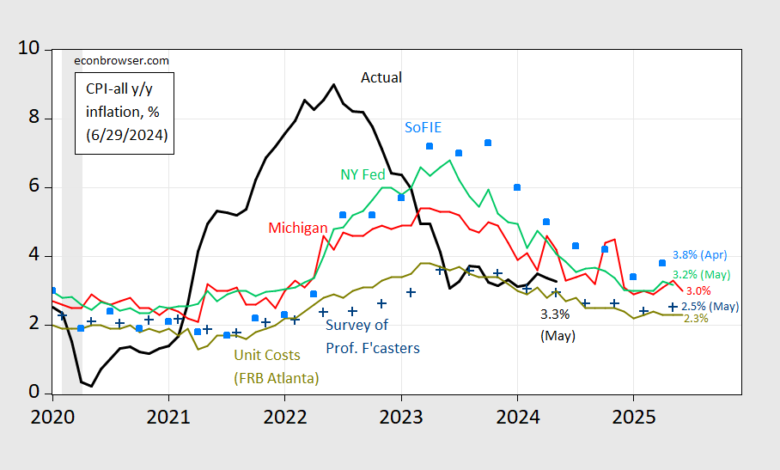

With Michigan final June survey out, we have this picture:

Figure 1: Year-on-year actual CPI inflation (bold black), and expected inflation from University of Michigan (red), NY Fed (light green), Survey of Professional Forecasters (blue +), Coibion-Gorodnichenko SoFIE mean (sky blue squares), and unit cost growth rate (chartreuse), all in %. Source: BLS, U.Michigan via FRED, Philadelphia Fed, Atlanta Fed, Cleveland Fed, and author’s calculations.

With CPI inflation running about 0.45 ppts faster than PCE inflation over the 1986-2024 period, we are close to the 2% PCE inflation target, at least insofar as the SPF is concerned, perhaps half a ppt from the Michigan survey (which historically has been upwardly biased in terms of forecast errors). Note that unit cost expectations (Atlanta Fed) do not suggest imminent cost push pressures.

Source link