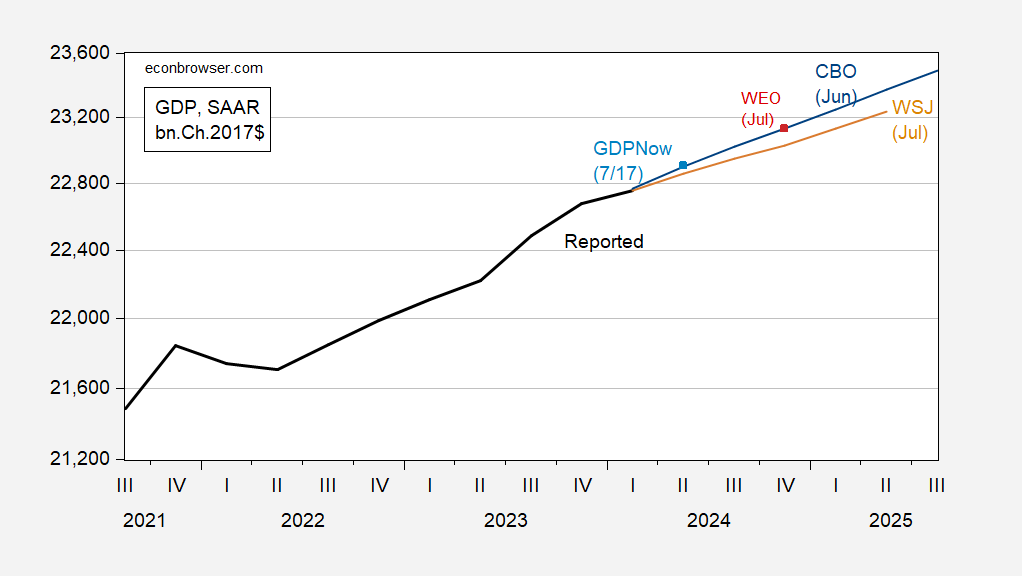

WSJ July forecast relative to CBO, IMF WEO update, and GDPNow as of yesterday:

Figure 1: GDP as reported (bold black), WSJ July survey mean (tan), CBO June projection (blue), IMF WEO July forecast (red square), and GDPNow of 7/17 (light blue square). Source: BEA 2024Q1 3rd release, July WSJ survey, IMF WEO July update, Atlanta Fed, and author’s calculations.

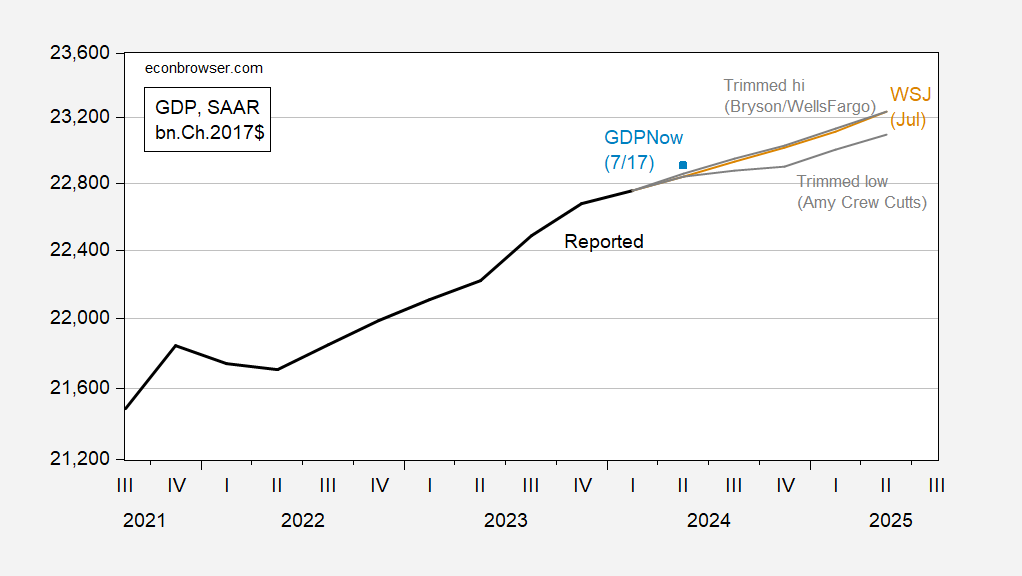

Interestingly, the CBO forecast from June is above the 20% trimmed high (for 2024 q4/q4) for the WSJ survey:

Figure 2: GDP as reported (bold black), WSJ July survey mean (tan), 20% trimmed hi/low range based on 2024 q4/q4 growth (gray lines), and GDPNow of 7/17 (light blue square). Source: BEA 2024Q1 3rd release, July WSJ survey, Atlanta Fed, and author’s calculations.

GDPNow as of 7/17 is registering a 2.7% q/q AR growth rate in Q2, on target for hitting the CBO projection. Interestingly, the IMF and CBO trajectories match pretty well through 2025Q4.

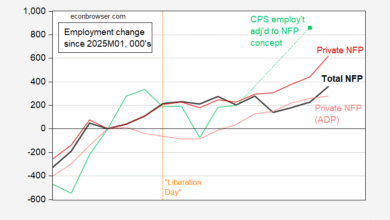

In terms of recession predictions, the estimated probability of a recession in the next 12 months has dropped one percentage point, to 28%. On a related point, only two respondents (out of 68 for GDP growth) forecast two consecutive quarters of negative growth: Nicholas Van Ness (Credit Agricole CIB), and Andrew Hollenhorst/Veronica Clark (Citigroup). In the April survey, 5 respondents were in this group (Van Ness is the one overlap).

Source link