Actually, no — but perhaps a fast food nation in recession. In arguing that output is mismeasured, so much so we’ve been in recession for the past four years, Peter St. Onge (Heritage) and Jeffrey Tucker (Brownstone Institute) write:

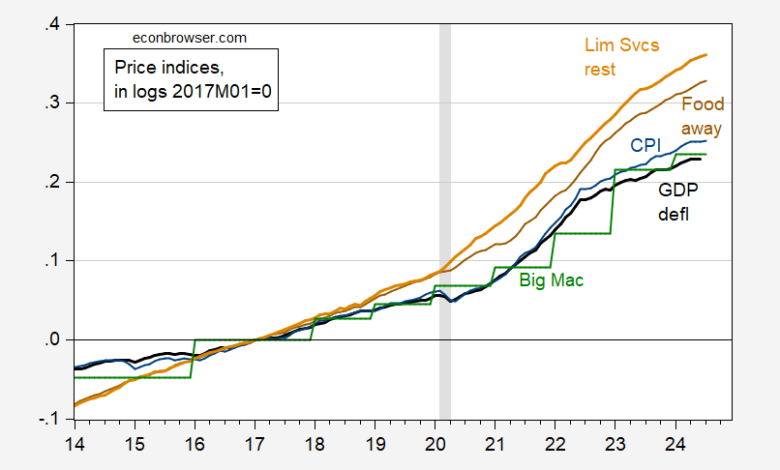

Various studies have shown that since 2019 fast food prices — a gold standard in financial markets for measuring true inflation — have outpaced official CPI by between 25% and 50%.

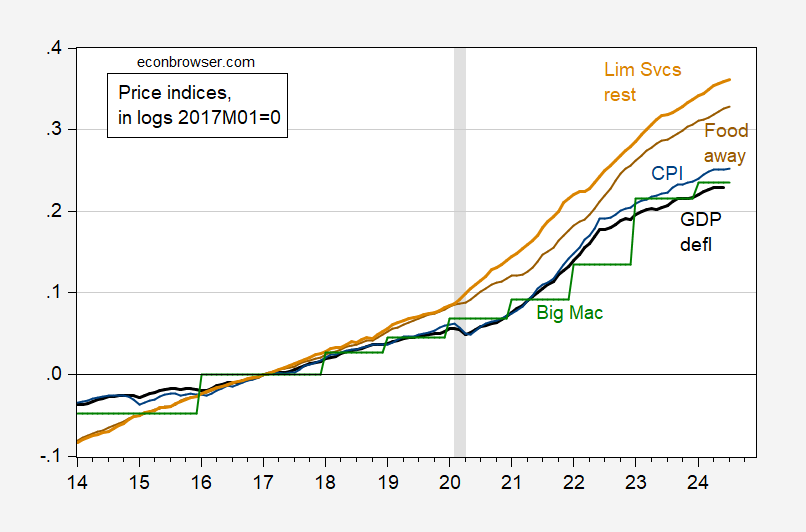

The “various studies” cited are as far as I can tell a set of newspaper articles. What if we measure GDP using fast food prices? Here’s the evolution of the fast food (“limited service restaurants”) component of the CPI, as compared to the GDP deflator, the CPI, and the food away from home component of the CPI:

Figure 1: GDP deflator (black), CPI (blue), food away from home CPI (brown), food away from home – limited service restaurants CPI (tan), Big Mac price (green), all in logs 2017M01=0. Big Mac prices based on price as close to year mid-point as possible. NBER defined peak-to-trough recession dates shaded gray. Source: SPGMI (Macroeconomic Advisers/IHS-Markit) 8/1 release, BLS via FRED, BLS, Economist, NBER, and author’s calculations.

Some discussion of fast food store prices here). My preferred measure is the Big MacTM, which is used in many studies of purchasing power parity (including one published in Economic Journal).

It’s true that using the limited services restaurant price index, prices have risen faster than the CPI (although the same is not true for Big MacTMs!).

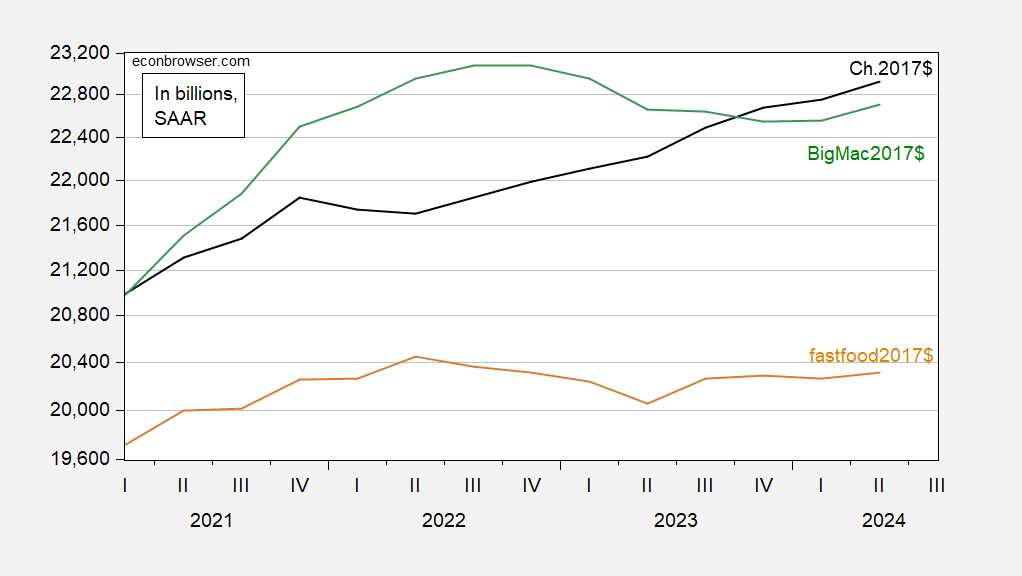

I plot the different measures of GDP over the same period plotted by St.Onge and Antoni.

Figure 2: GDP in bn.Ch.2017$ (black), in bn.BigMac2017$ (green), in bn. bundles of restaurant food 2017$ (tan), all SAAR. Big MacTM prices interpolated (cubic) from annual July observations. Source: BEA 2024Q2 2nd release, BLS, Economist, and author’s calculations.

Using Big MacTM prices, real GDP has been falling since end-2022, albeit from a higher level than GDP measured in Ch.2017$. Using the food-away-from-home limited services component of the CPI, we have a picture slightly more in line with the St. Onge-Tucker thesis.

So…if all we consumed, invested in, paid soldiers and civil servants, and exported was burgers, sandwiches, fried chicken and tacos, then indeed we might have been in a recession for the past four years. (Fast food has a 2.5% weight in the CPI-U, so assuming consumption is 70% of GDP, then fast food consumption accounts for about 1.8% of GDP.)

Source link