Part 1,434,237. (Previously [1] [2] [3][4][5] [6] [7] [8] [9] [10] [11] [12] [13] ) Remember EJ Antoni, declaring a recession occurring in 2022H1?

In terms of how we define it or what marks a recession, the basic understanding is that when the economy shrinks for two consecutive quarters, so three months, and then another three months, that’s a recession. The reason that the White House has been making a lot of hay of, oh, that’s not official definition, blah, blah, blah. Okay. I suppose there is no technical official definition, but I’ve taught plenty of economics courses. That was what we used in every single class. That’s what you’ll see in most, if not all economics textbooks. That’s been the understanding for the last 100 years. So the idea that this is somehow new or not true, I dismiss that out of hand.

Well, what was two consecutive quarters of negative GDP growth has been wiped away by the annual revision.

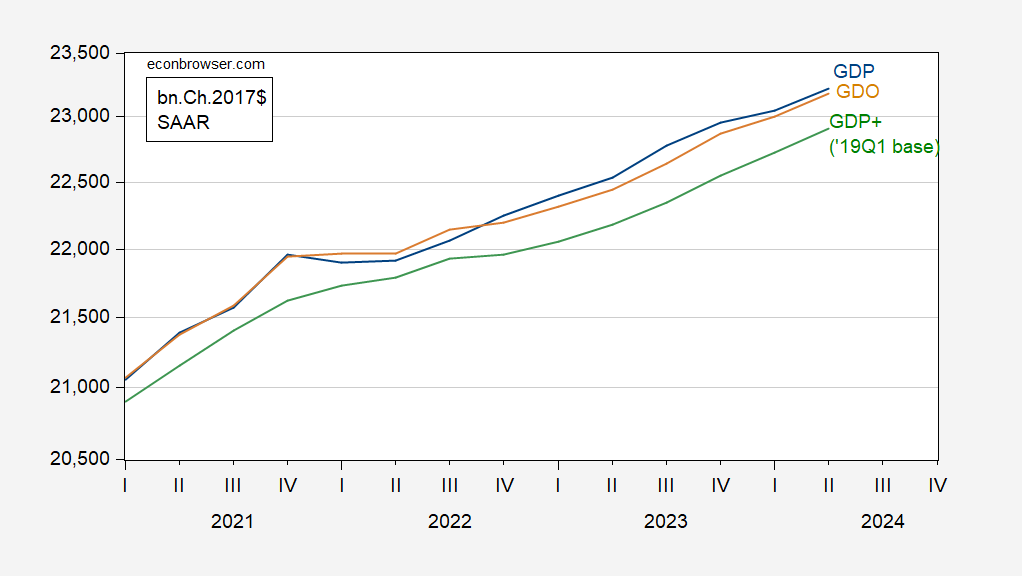

Figure 1: GDP (bold black), GDO (tan), and GDP+ (sky blue), all in bn.Ch.2017$ SAAR. GDP, GDO based on 2024Q2 3rd release/annual update. Source: BEA, 2024Q2 3rd release/annual update, Philadelphia Fed, author’s calculations.

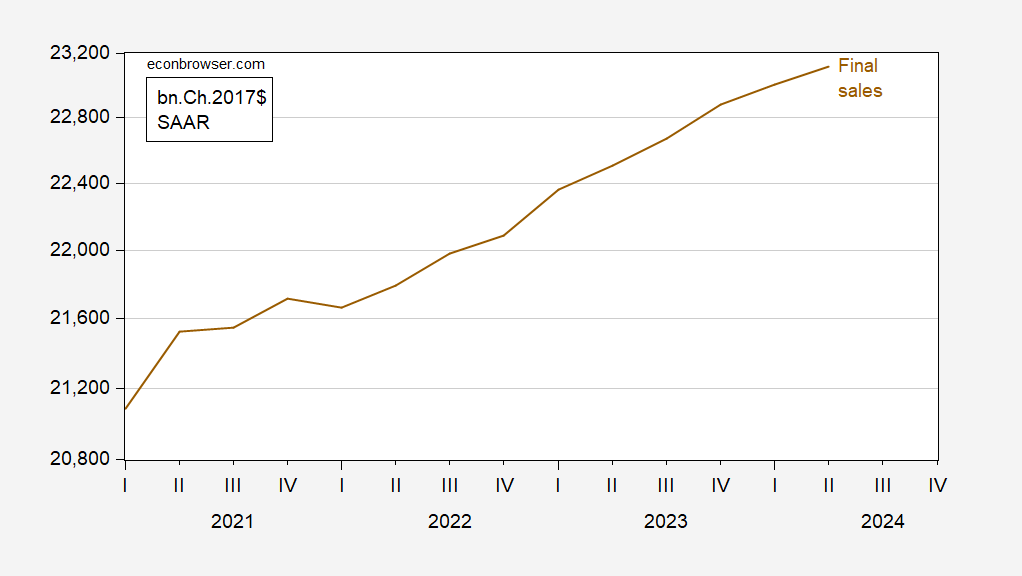

According to GDP, there was one quarter of negative growth in 2022Q1; using GDO or GDP+, there were no quarters of negative growth. In addition, the measure of aggregate demand (I use final sales) only shows one quarter of negative growth as well.

Figure 2: Final sales (brown), all in bn.Ch.2017$ SAAR. Source: BEA, 2024Q2 3rd release/annual update.

Source link