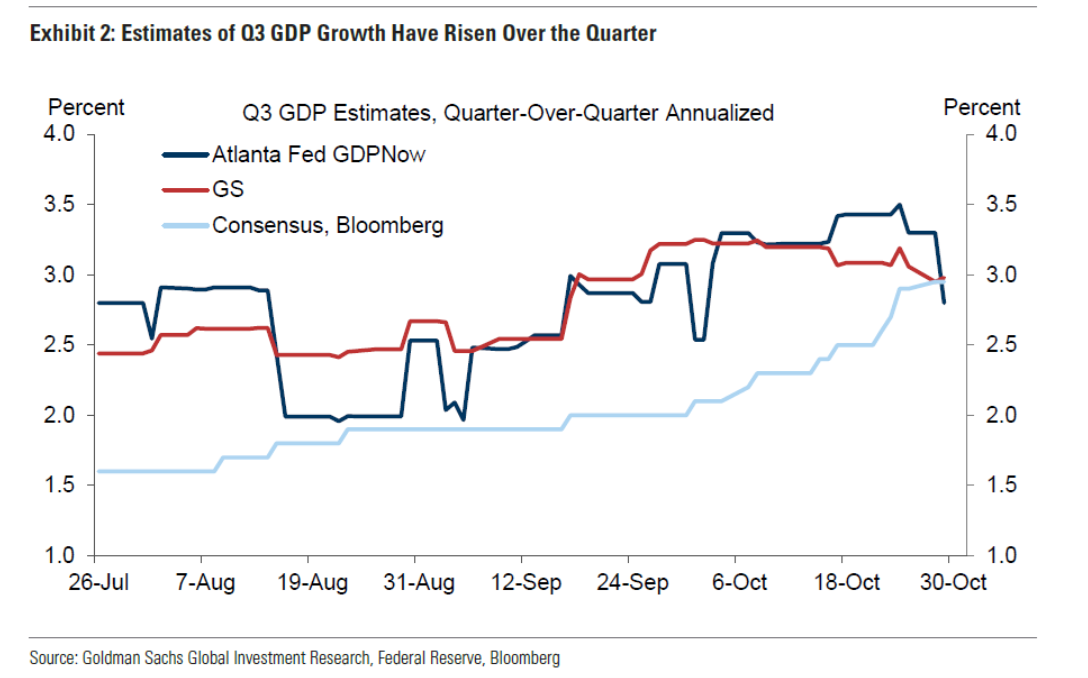

Never just look the headline number. The “why’s” matter. GDPNow down from 3.3% q/q AR to 2.8%, while GS tracking at 3.0%

.

Source: Rindels, Walker, “US Daily: Q3 GDP Preview,” Goldman Sachs Global Investor Research, October 29, 2024, Exhibit 2.

2.8% or 3% is less than earlier nowcasts, but still way above recession levels (think EJ Antoni, who thought the recession might’ve started in July or August).

If one looks at the GDPNow forecast evolution (as of 29 October 2024), one sees that a big reason for the decline in nowcast is bigger imports. How does one interpret this?

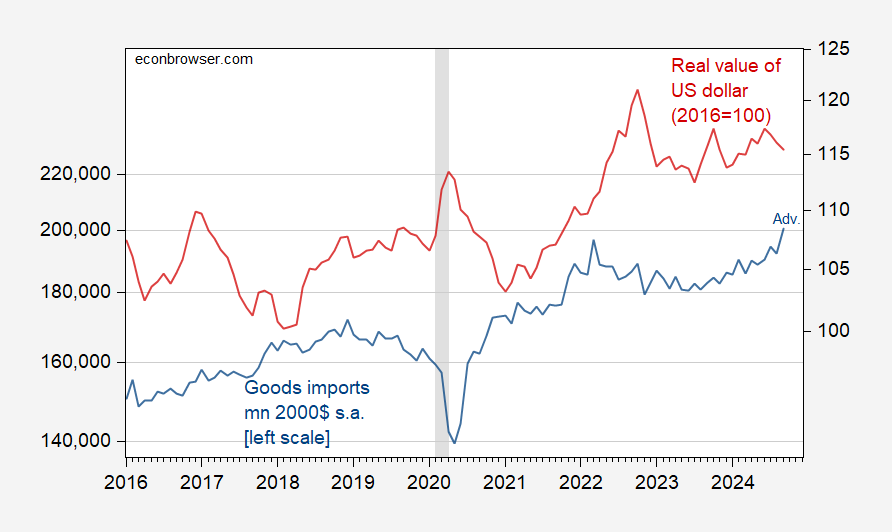

Interpretation highlights the difference between accounting and economics. A higher growth rate of imports (not due to exchange rate appreciation) presumably means faster growth is expected now and in the future (more imports for consumption and investment where both are forward looking variables). However, a push up in the nowcasted level of imports holding constant nowcasts of the other components of GDP (GDP ≡ C+I+G+X-IM) means that the nowcast of GDP is lowered (h/t my old colleague at CEA Steve Braun for teaching me this).

Here, imports surprised on the upside. From the advance economic indicators release today:

Figure 1: Real goods imports, in mn. 2020$ (blue, left log scale), and real value of the US dollar (red, right log scale). Deflation of imports using BLS price of imports of commodities. NBER defined peak-to-trough recession dates shaded gray. Source: Census and Federal Reserve via FRED, NBER, and author’s calculations.

So, this quarter’s numbers are down, while the implied growth rate (ceteris paribus) is up for next quarter.

Source link