(Or, ” I have in my hand fifty-seven cases of individuals…”) At 3:44 into this video, this Ms. DiMartino Booth makes this assertion, claiming this is the reason we haven’t seen a recession in the data pre-election.

She further argues that left-leaning government statisticians artificially put employment numbers up (so that the preliminary benchmark revision and then eventual benchmark revision would be downward). This is a testable hypothesis: it suggests that revisions would be downward when Democrats are seeking to hold presidential power again, and upward when Democrats are seeking to take the White House. Does the data on preliminary benchmarks conform to his hypothesis? Short answer: No.

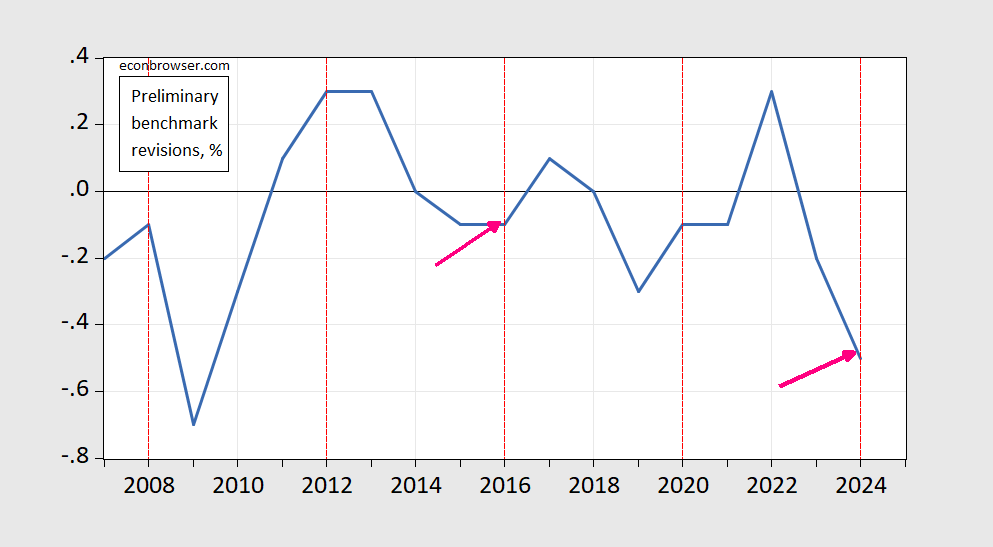

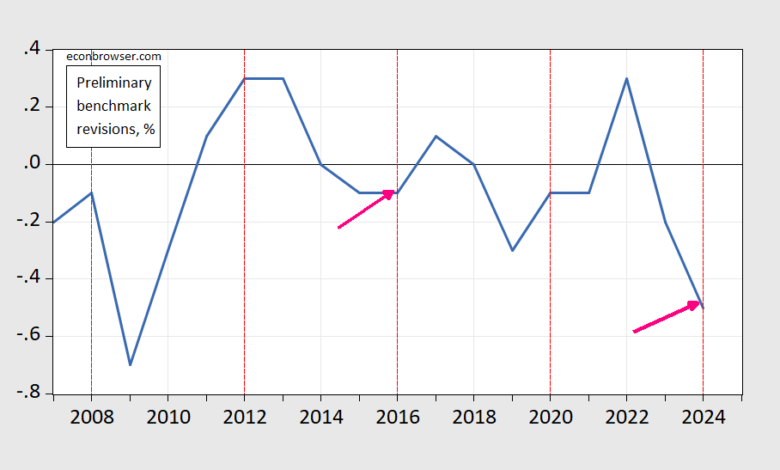

Here is a graph of preliminary benchmark revisions since 2007.

Figure 1: Preliminary benchmark revisions to nonfarm payroll employment, in ppts (blue). Pink arrows indicate observations consistent with hypothesis that government statisticians at BLS bias CES NFP numbers in favor Democrats. Source: BLS, and individual year BLS preliminary benchmark revision releases.

Notice that of the last five elections, only two conform to the DiMartino Booth hypothesis. If the Deep (Statistical) State were so pervasive, I would’ve expected a better batting average (and, wouldn’t it have been better to have the preliminary benchmark be close to reported, only to have the benchmark (i.e., final) show the “correct” number.

See also my assessment of similar charges made by EJ Antoni.

Personally, I can’t remember the last time the labor theory of value came up in a discussion of Fisher ideal price indices…

For completeness’s sake, note that Ms. DiMartino Booth think job destruction in the private sector started in “early 2024”, although in a August 2024 interview, she indicated a recession start to be backdated to October 2023.

Source link