Bloomberg points out eggs were big in the PPI, accounting for 80% of the y/y rise (egg prices spiking due to avian flu). I wondered what eggs accounted for in the food at home component of the CPI.

Didn’t have the CPI subcomponent for eggs handy, so I took the BLS not-seasonally-adjusted price of a dozen large grade A eggs, seasonally adjusted using moving (geometric) average and decomposed the CPI-food at home cumulative increase since January 2024.

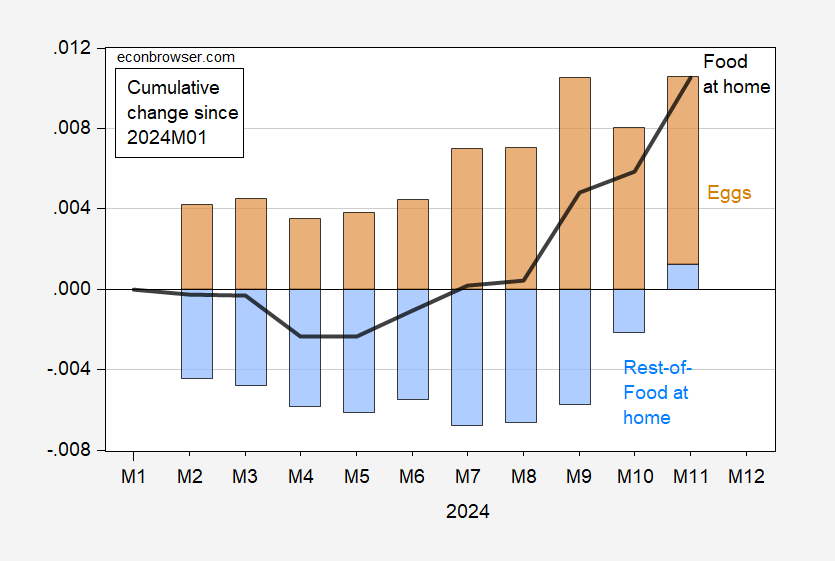

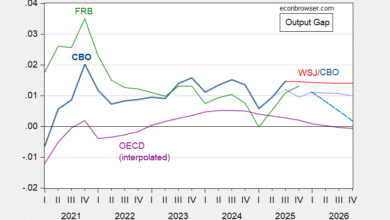

Figure 1: CPI-food at home (s.a.), contribution from eggs (brown bar), contribution from rest-of-food-at-home (blue bar), calculated using log differences. Source: BLS via FRED, and author’s calculations.

This indicates food-at-home (aka “groceries”) would be pretty close to flat in 2024 were it not for eggs.

Calculations:

- 2023 weight for eggs in CPI: 0.178%

- 2023 CPI-food at home weight in CPI: 8.072%

- Implied 2023 weight of eggs in CPI-food at home: 2.205%

For comparison, weight of eggs in PPI (final demand): 0.07%

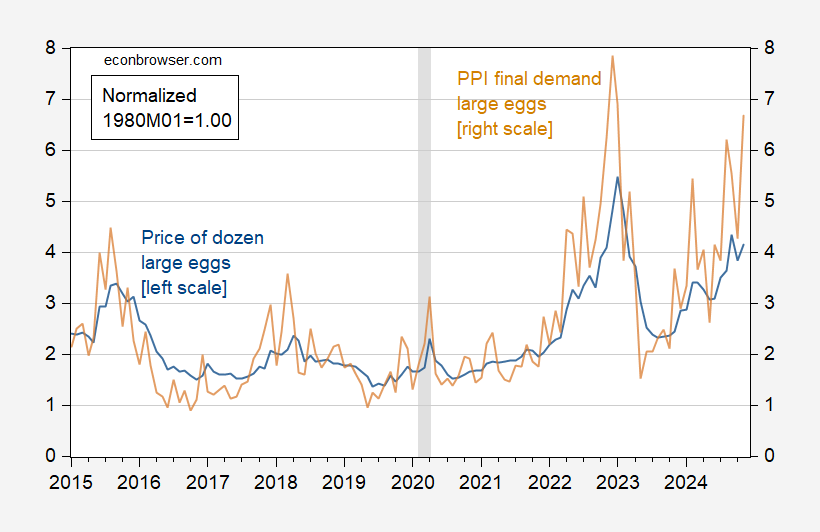

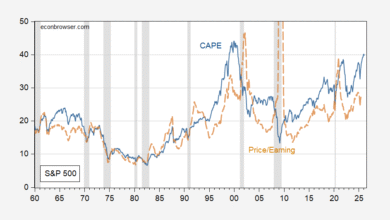

Here’re consumer prices for a dozen eggs vs. PPI (final demand) for large eggs.

Figure 2: Dozen large eggs (blue, left log scale), and PPI (final demand) large eggs (tan, right log scale), both normalized to 1980M01=1. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, BLS, NBER, and author’s calculations.

Source link