This probably seems like a silly question, but it’s actually a hard one to answer quantitatively.

The standard measure is the CPI deflated trade weighted exchange rate, but this uses prices relevant to consumers, not producers. And not cost of production. As discussed in Chinn (2006), unit labor costs (ULC) would be the most appropriate. Unfortunately, neither OECD nor IMF report a ULC deflated exchange rate for China.

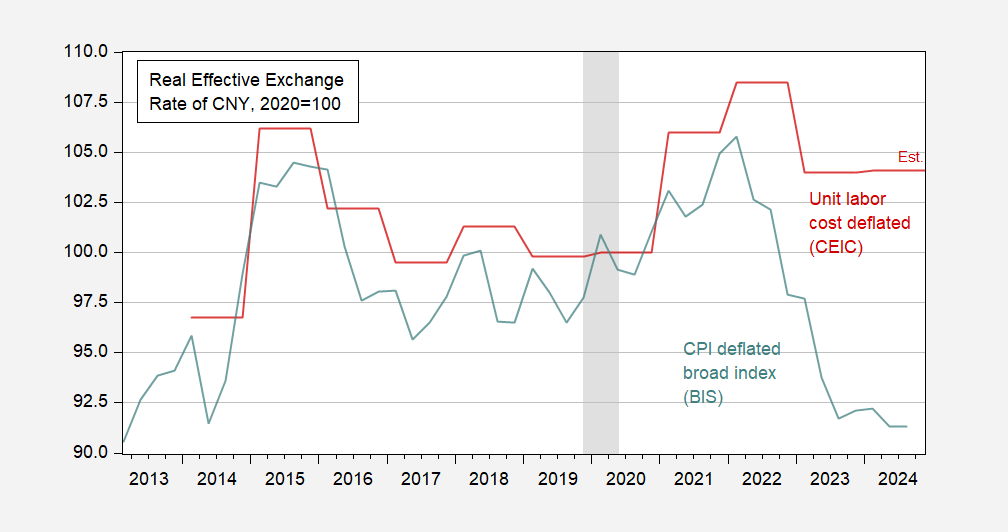

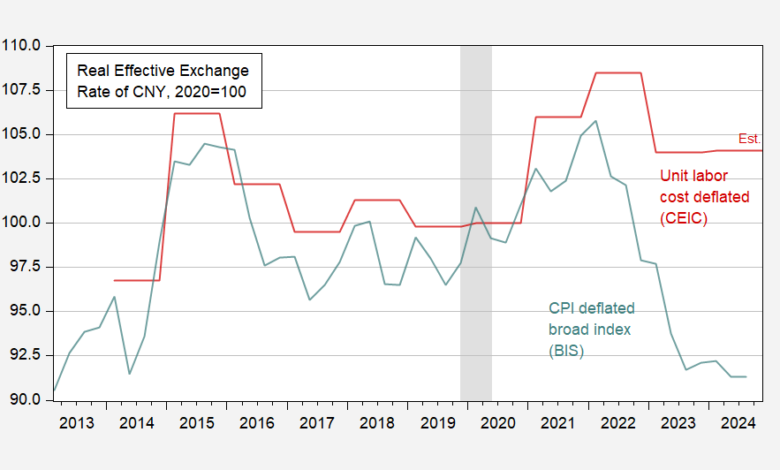

Here’s CEIC’s estimate compared against the BIS CPI deflated rate.

Figure 1: CPI deflated value of Chinese yuan (blue), ULC deflated value of Chinese yuan (red), both 2020=100. Source: BIS via FRED, CEIC.

Note that the ULC deflated series for China is for the entire economy, not the tradables sector, which would be the appropriate one for determining competitiveness. For more discussion of macro competitiveness, see Chinn and Johnston (1996).

Source link