CES based employment indicators (NFP, private NFP, hourly wages, hours) essentially at consensus. Here’s the roundup of key NBER indicators (of which employment and personal income ex-transfers are central).

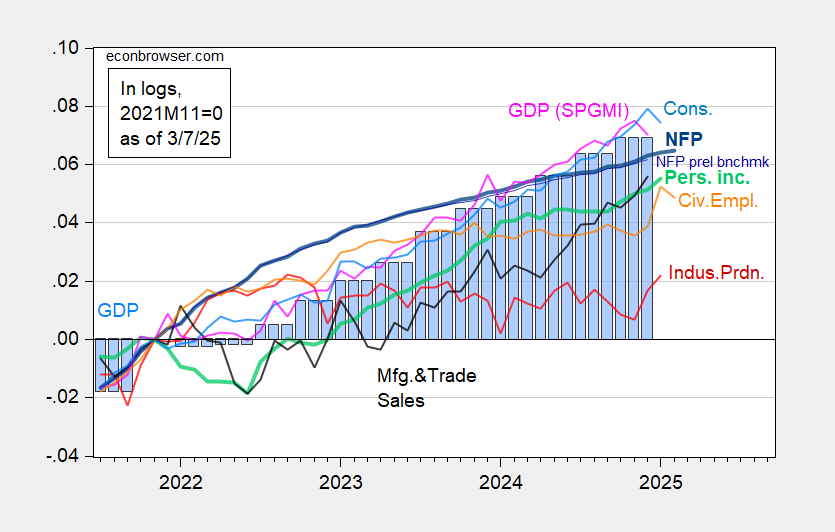

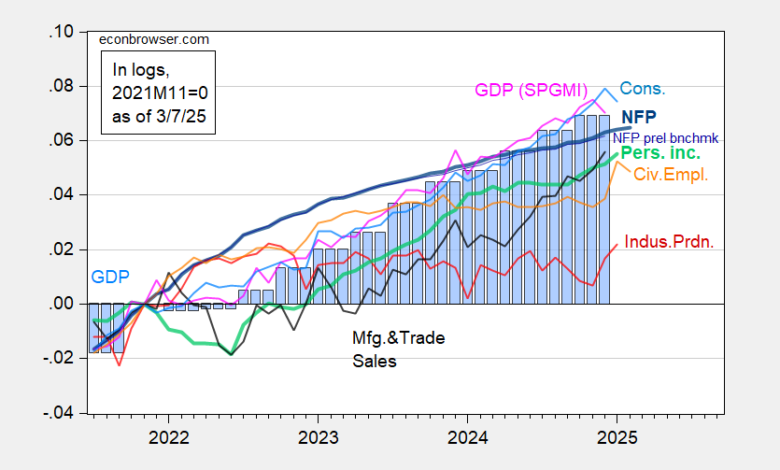

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

Recall, the February employment figures relate to roughly the second week of the month, which predates most of the DOGE-imposed government firings, and the cuts in private sector employment associated with contract terminations.

Based on Wednesday’s ADP numbers, I projected +125K private NFP, vs actual +140K (Bloomberg consensus of +142).

Note the official civilian employment series evidences a sharp jump in January; that’s almost entirely due to incorporation of new population controls. BLS has produced several research series which smoothly incorporate population controls. I plot below the overall civilian employment and adjusted-to-NFP concept series. Both evidence upward movement.

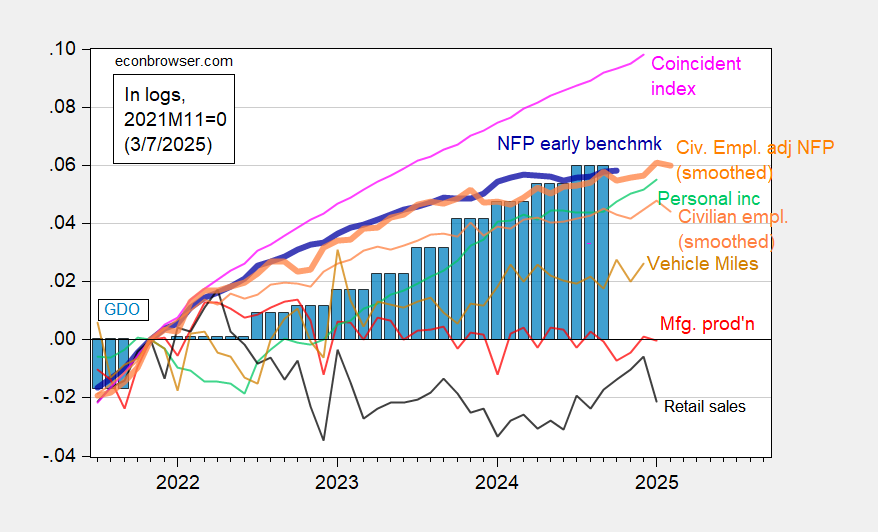

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 2nd release, and author’s calculations.

GS notes that unusually cold weather might have weighed on retails sales, which came in -0.9% m/m vs. Bloomberg consensus -0.2% (unusually cold weather also drove up industrial production via utilities output).

Despite the downward movement in the CPS based employment (research) series, I’m still dubious on recession call, given upward movement in employment (see discussion here of research series and the CES/CPS gap), and the high variability in the CPS based employment series.

NY Fed Q1 nowcast is at +2.7% q/q AR, down from +2.9% last Friday; GDPNow reported (2/6) is at -2.4% (my guess, adjusting for gold imports is +0.6%). Goldman Sachs tracking remains at +1.6%. St. Louis Fed news based nowcast is at 2.5%.

Source link