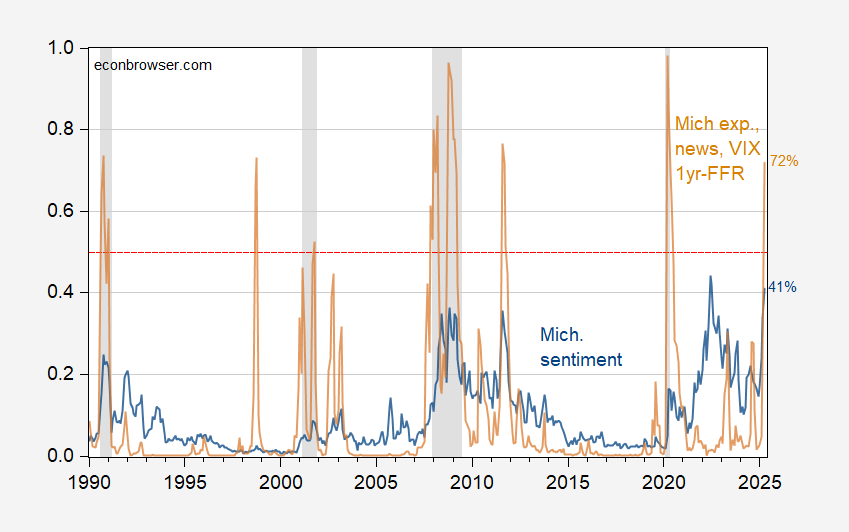

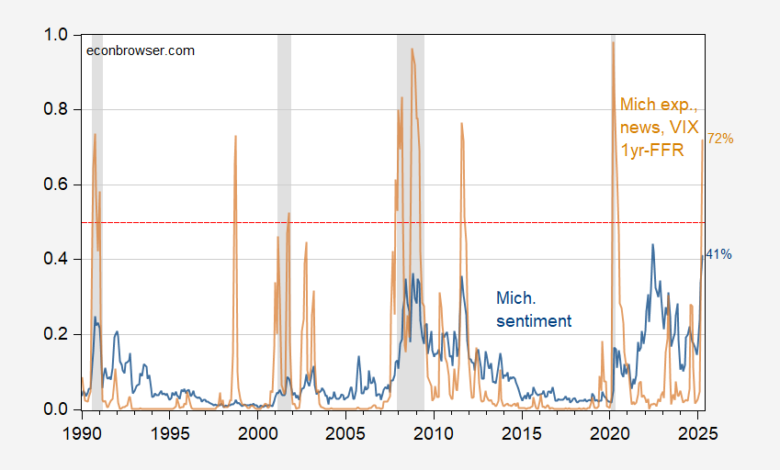

Updating this post, probability of recession in April is 72%.

Figure 1: Estimated recession probability from probit regression on (final) Michigan Sentiment (blue), and on (final) Michigan expectations, News Sentiment, 1yr-FFR spread, VIX (tan). April data is for news through 4/20, interest rates and VIX through 4/24. NBER defined peak-to-trough recession dates shaded gray. Source: NBER and author’s calculations.

Notice there are two false positives in this sample period – 1998, and 2011. (I tried dropping the VIX, which leads to 45% probability in April, but has two false positives, in 1998 and 2023.)

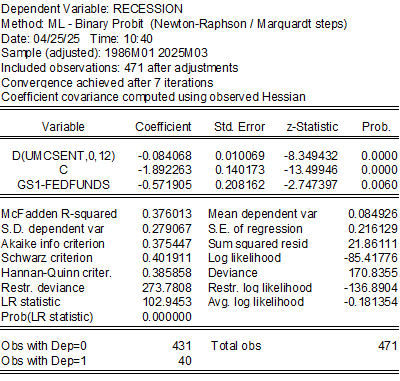

The prediction is based on this regression, assuming no recession starting by March 2025:

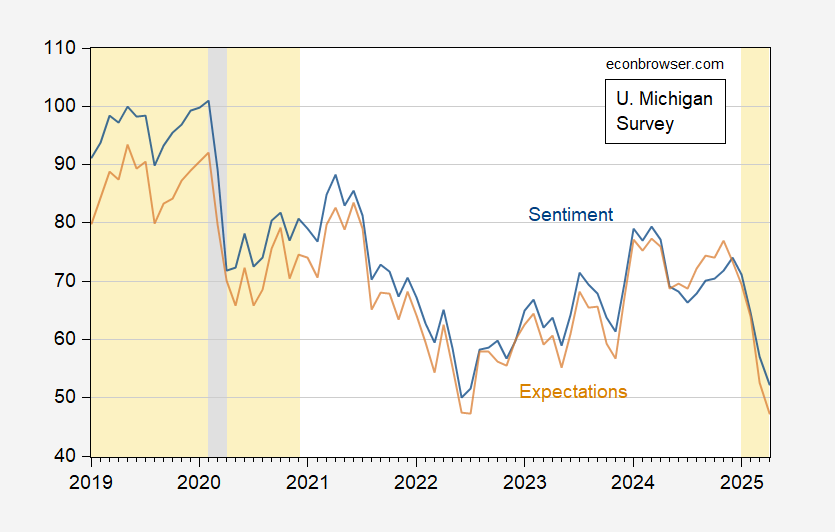

To highlight the extent of the drop in sentiment and expectations, here is a picture of the two series over the last six years.

Figure 2: University of Michigan Survey of Consumers Sentiment Index (blue), and Expectations (tan). NBER defined peak-to-trough recession dates shaded gray. Trump administrations shaded light orange. Source: University of Michigan, NBER.

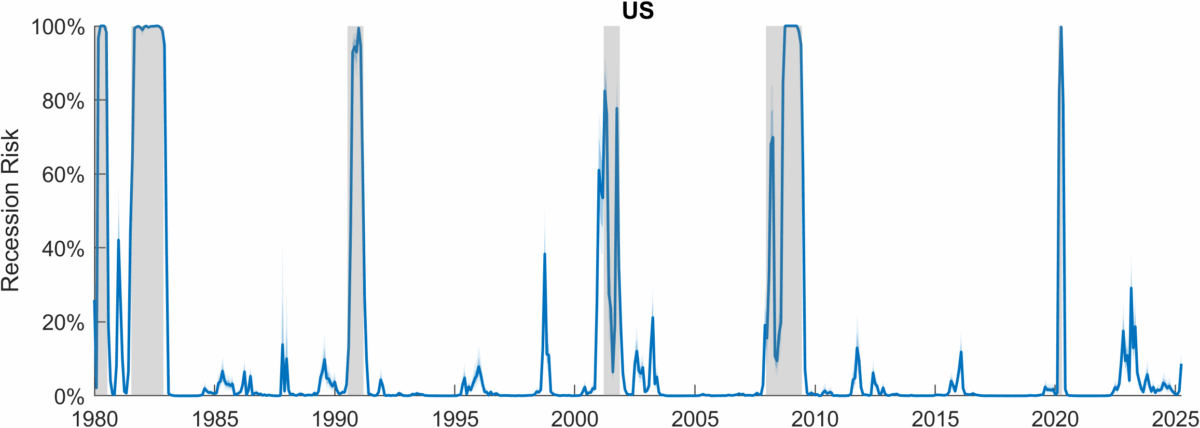

After posting my first estimates based on preliminary data, Francesco Furno brought my attention to his work with Dominico Giannone Nowcasting Recession Risk.

We propose a simple yet robust framework to nowcast recession risk at a monthly frequency in both the United States and the Euro Area. Our nowcast leverages both macroeconomic and financial conditions, and is available the first business day after the reference month closes. In particular, we argue that financial conditions are not only useful to predict future downturns–as emphasized by the existing literature–but they are also useful to distinguish between expansions and downturns as they unfold. We then connect our recession risk nowcast with growth-at-risk by drawing on the literature on distributional regressions and quantile regressions. Finally, we benchmark our nowcast with the Survey of Professional Forecasters (SPF) and show that, while both have a similar ability to identify downturns, the former is more accurate in correctly identifying periods of expansion.

For the US, the key variables are the PMI for manufacturing and the ECB’s Composite Indicator of Systemic Stress (CISS). Dr. Furno was kind enough to provide some up to date recession probability estimates.

Source: Furno, personal communication.

Notice that, using the 50% threshold, there are no false positives using their model estimated using logit. Further, their model suggests less than 10% probability of a recession in March. Using their two indicators, and applying an Eviews default logit regression in a static specification, I obtain 14% probability of recession, far below a 50% threshold (the replication code was provided by I didn’t have Matlab on my laptop).

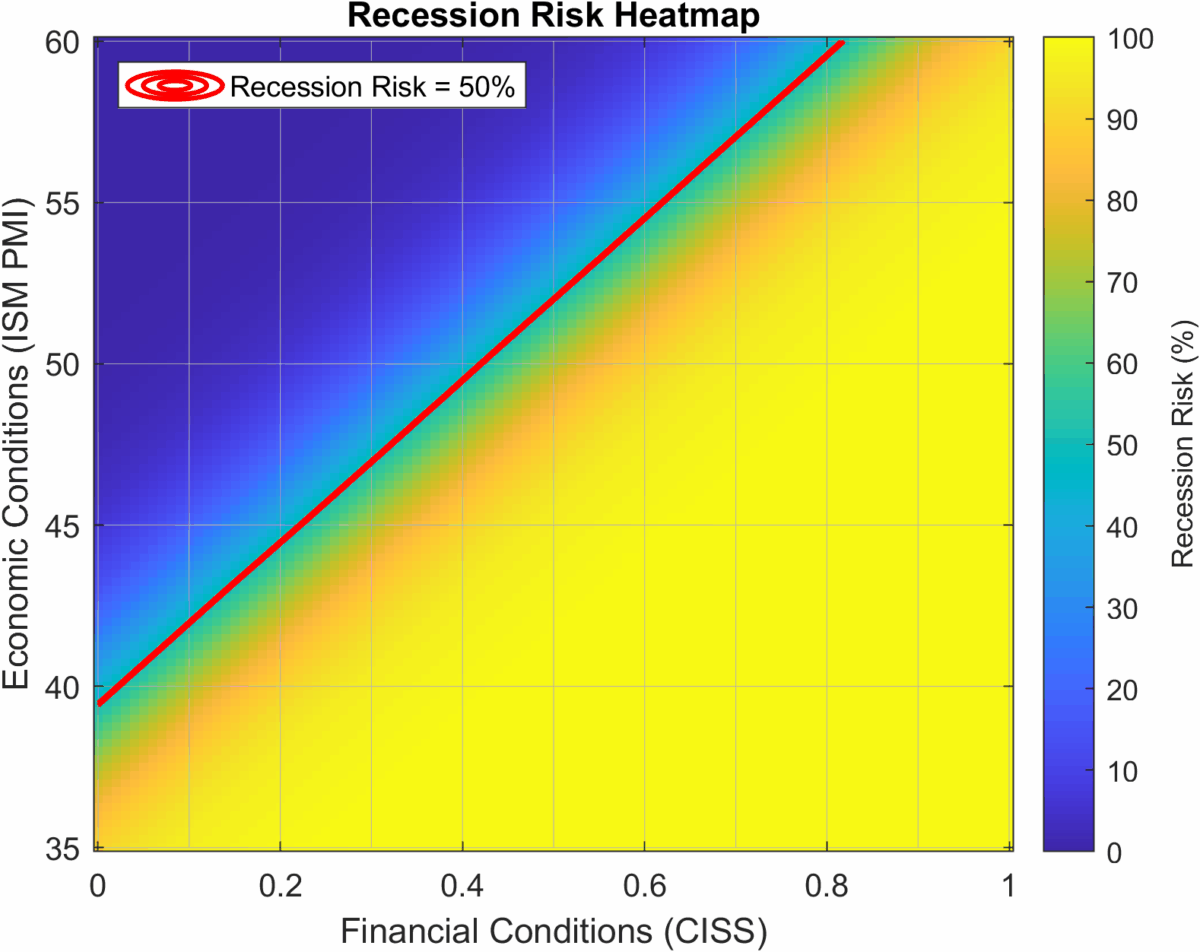

When April’s numbers come out for PMI (on May 1st), one can use this heatmap to judge whether the recession likelihood is high or not.

Source: Furno, personal communication.

So… sentiment for April says maybe, PMI and CISS for March says no…

Source link