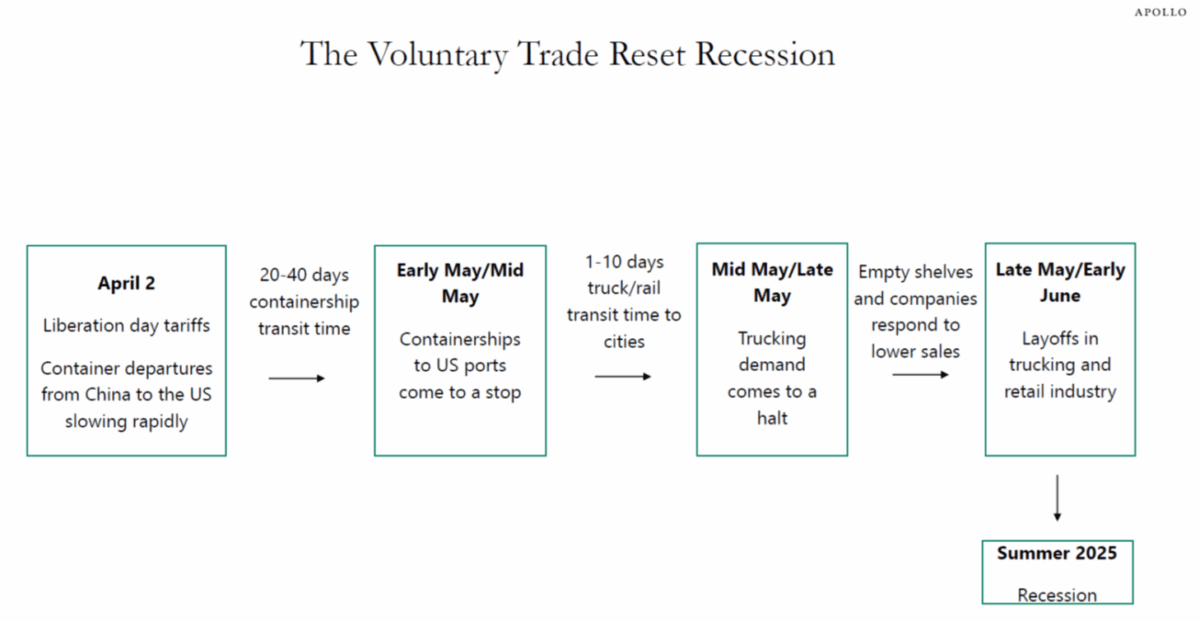

Torsten Slok’s VTRR (Voluntary Trade Reset Recession):

Source: Slok/Apollo.

Torsten appends a 90% probability to recession. This is a conditional forecast (the tariffs stay in place). When the store shelves are empty, that’s when the collapse begins in this scenario.

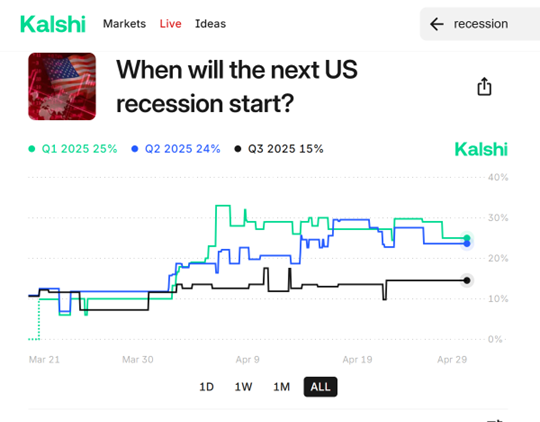

Betting markets place 49% on 2025H1 for a recession start, a bit earlier than Slok’s guess.

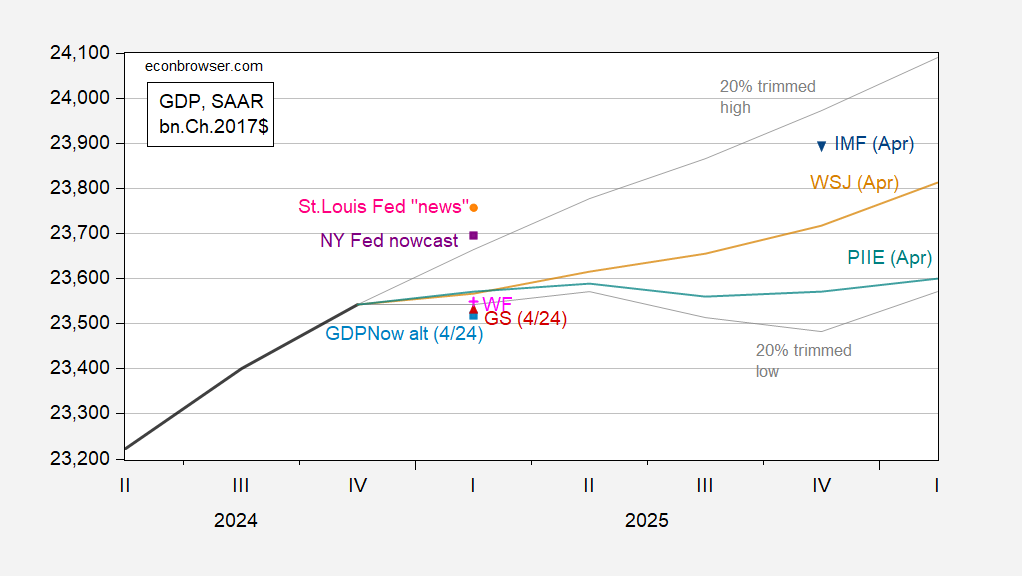

I thought it would be useful to show the range of survey responses on the question of GDP growth, and how they match with two forecasts, and several nowcasts.

Figure 1: GDP (bold black), GDPNow adjusted for gold imports, 4/24 (light blue square), GS, 4/24 (red triangle)), Wells Fargo, 4/25 (pink +), NY Fed, 4/25 (purple square), St. Louis Fed, 4/25 (red circle), IMF April WEO forecast (inverted blue triangle), Dynan/PIIE forecast of April 15th (teal), WSJ April survey mean (tan line), 20% trimmed low/high (gray lines), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Goldman Sachs, Wells Fargo, NY Fed, St. Louis Fed, IMF (April WEO), PIIE, WSJ April survey, and author’s calculations.

The bottom WSJ forecast is Carlton Strong/JP Morgan.

I will say that all these forecasts predate the President’s new executive order requiring all truckers to pass a English literacy test. I would think this would accelerate the onset of shortages.

Source link