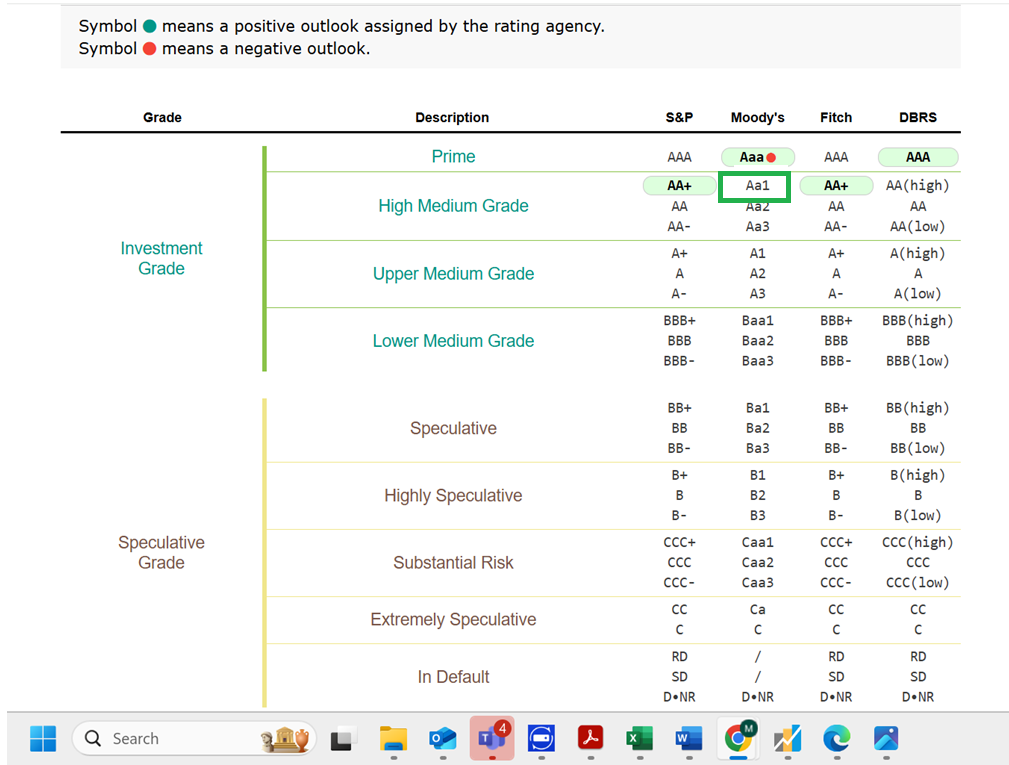

Bessent says Moody’s downgrade is a lagging indicator…

But then the Moody’s statement itself states:

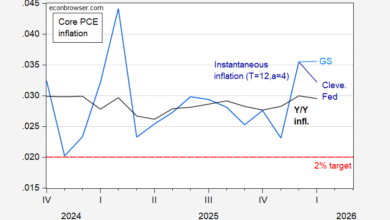

We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration. Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns. [emphasis added]

Note that Fitch dropped its rating in August of 2023.

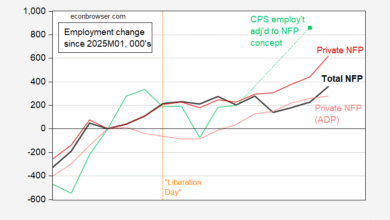

What about market indicators? Here’s 5 year CDS on US Treasurys (from worldgovernmentbonds.com)

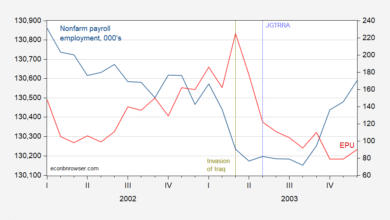

To see the context, consider this 6 month detail:

Thanks, Trump!

Source link