Three weeks ago, Bofit remarks “Concerns emerge over Russia’s slowing growth”:

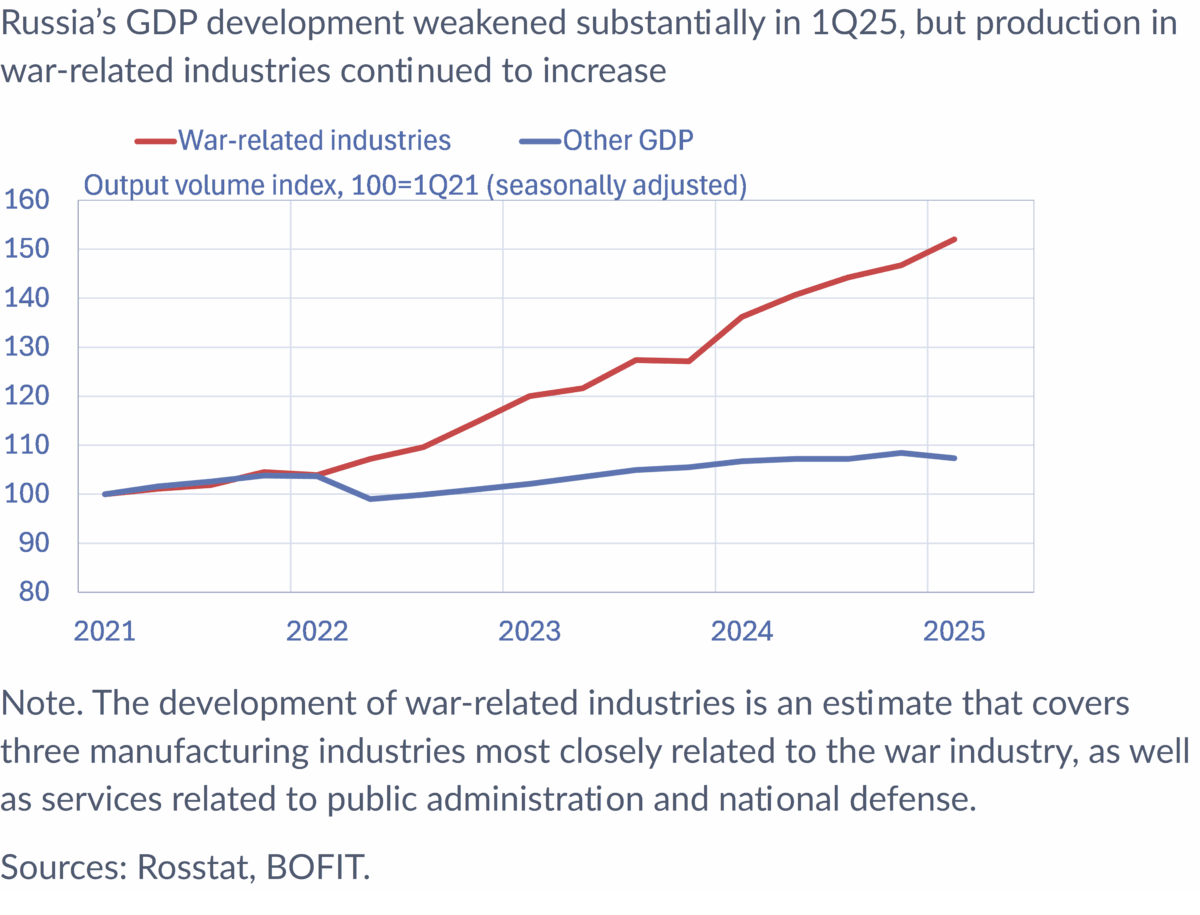

Rosstat this week affirmed its preliminary first-quarter GDP growth estimate of 1.4 % y-o-y, bolstering the view that a substantial slowing of Russia’s economic growth is underway. 1Q25 GDP shrank from the previous quarter by 0.6 % – the first on-quarter decline in GDP since spring 2022 following the invasion of Ukraine. Annual GDP growth was still supported by war-related manufacturing industries and services. In contrast, mining and quarrying production, for example, contracted clearly in January-March, and the volume of wholesale and retail sales also decreased slightly.

…

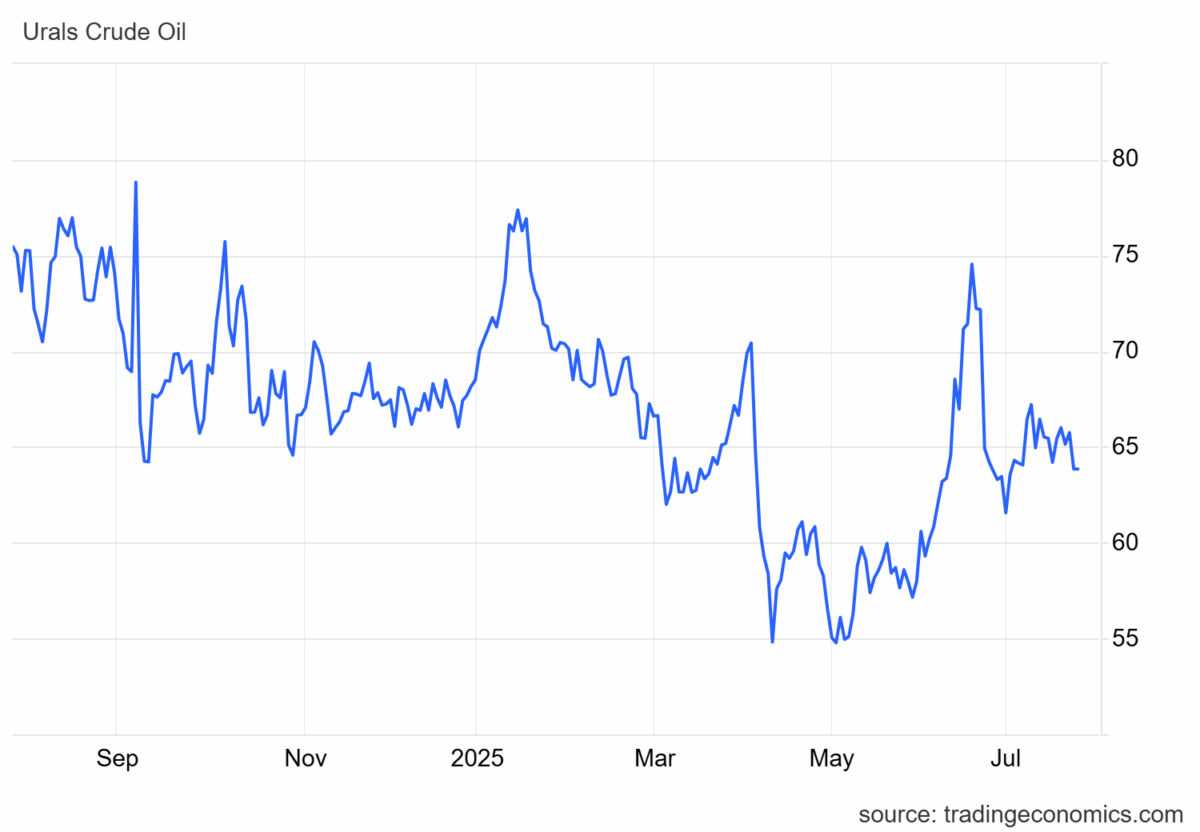

Russia’s GDP forecasts have generally been lowered in recent months due to the worsening economic imbalances and the fall in oil prices. The World Bank’s forecast published in June expects GDP growth of 1.4% this year and 1.2% next year. Consensus Economics’ June report predicts GDP growth of 1.4% this year and 1.3% next year.

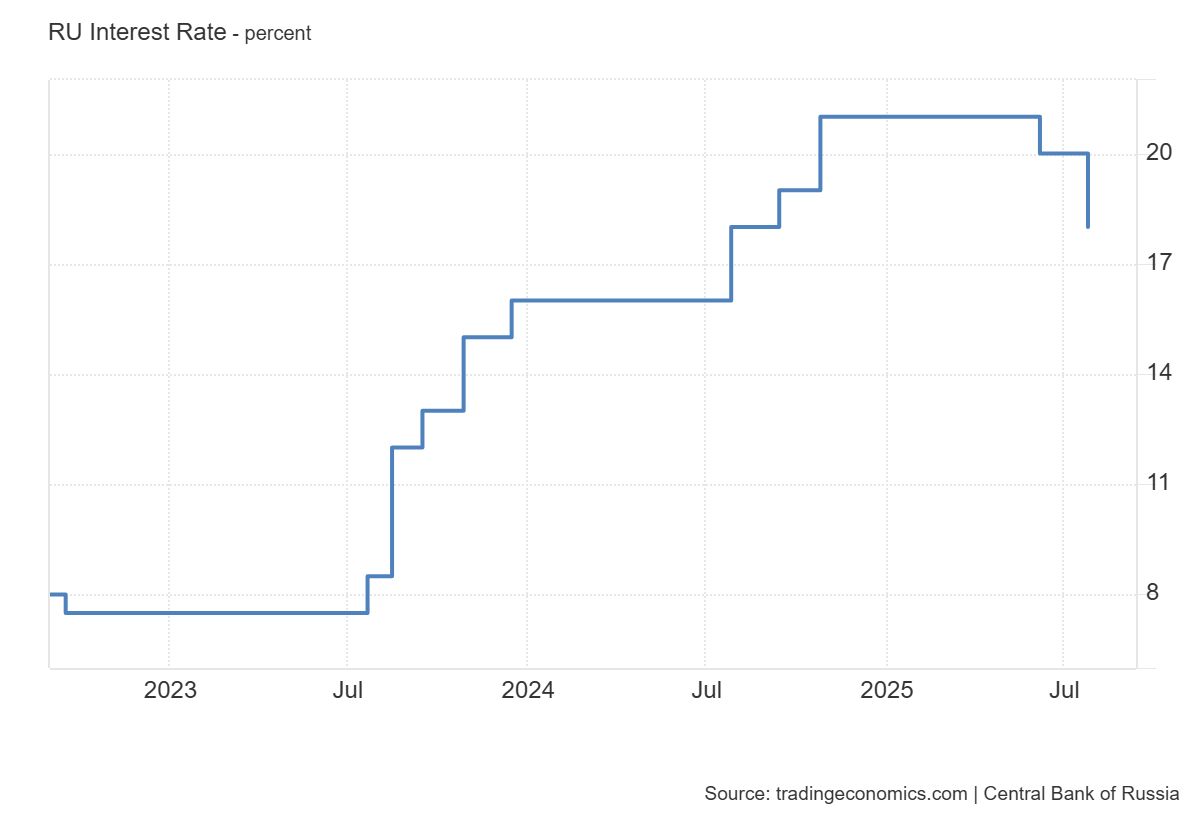

And so in some sense not surprising that the Central Bank of Russia drops the interest rate, today:

It’s not clear to me that this will do anything much except accelerate inflation; that’s because of the reasoning in the Bofit piece as well as Hilgenstock and Ribakova (PIIE):

By the end of 2024 and in early 2025, signs of economic deceleration had become evident. Even the military-industrial sector began to stagnate. The economy had butted up against its supply-side constraints and the Bank of Russia was focused on reining in inflation. In the first quarter of 2025, annual growth slowed to an estimated 1.4 percent year-on-year (from 4.5 percent in the last quarter of 2024). This actually means a 0.6 percent contraction of activity compared to the previous quarter—the first quarterly contraction since the second quarter of 2022 (figure 1).

Monetary policy can’t do much if the supply side is constrained. Maybe there’ll be a respite in commodity (oil) prices.

It could be that Trump relaxes sanctions. However, even Brent prices remain low so it’s not clear that this would save the Russian economy.

One implication: Now is not a time to relent in terms of pressuring the Russian economy. Moscow’s ability to continue to wage war is being more and more constrained, even as resources continue to be directed to that endeavor.

Source link