Contingency funds are available to fund SNAP disbursements for at least part of November. OMB Director Vought’s unprecedented decision to prohibit use of these funds will have macro implications (I eschew any moral or ethical judgments in this discussion), especially if the government shutdown continues.

In FY2024, SNAP expenditures were about $100 bn. Canning and Mentzer Morrison/ERS (2019) indicate the multiplier for SNAP expenditures are about 1.54. The multiplier is likely state contingent, smaller with rapid growth, larger when growth is slower (which likely pertains to the current labor market state).

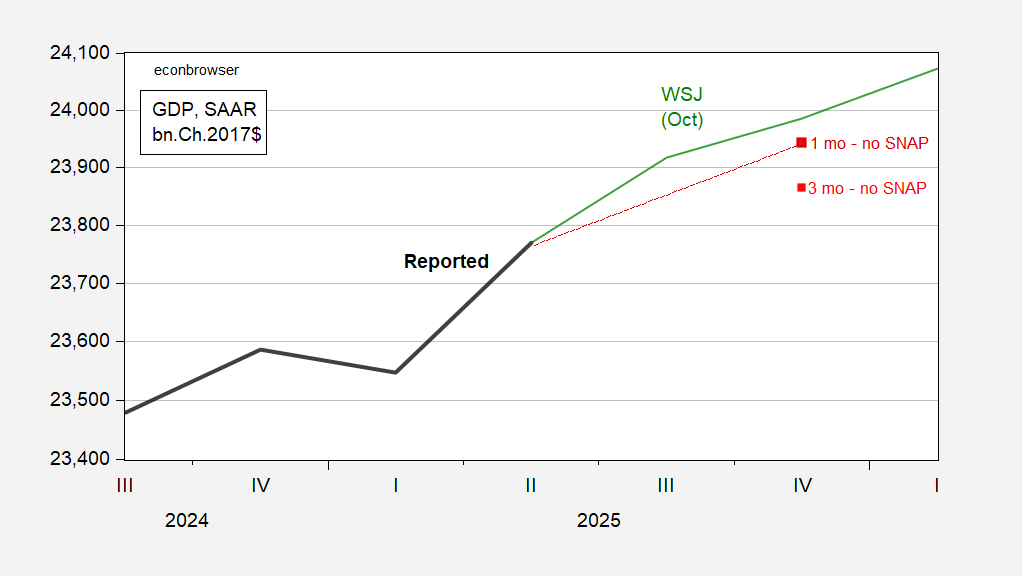

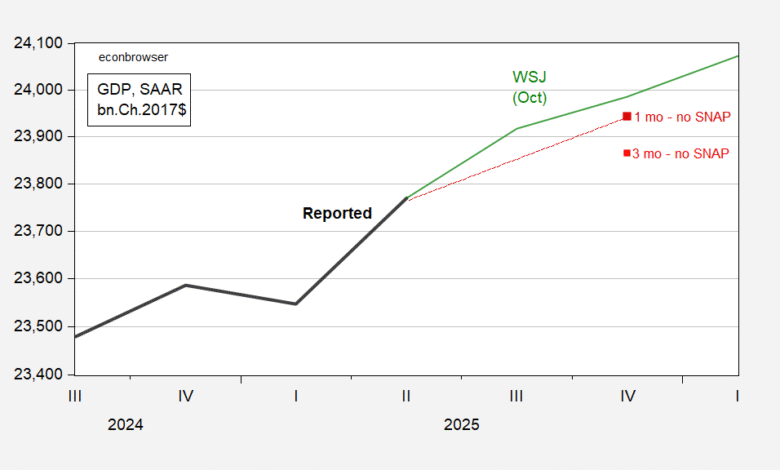

Assuming the unconditional multiplier is 1.54, and SNAP expenditures at about 0.33 percent of GDP, one obtains the following picture:

Figure 1: GDP (bold black), WSJ mean survey forecast (green), 1 month SNAP cessation (large dark red square), 3 month SNAP cessation (small red square), all in bn.Ch.2017$, SAAR. Source: BEA, WSJ, ERS, author’s calculations.

It seems implausible that the SNAP cessation could last three months. On the other hand, the $5 bn or so in the contingency fund is insufficient to fund SNAP for the entire month of November.

In considering the trajectory of the economy, it is important to note that the responses to the WSJ survey were probably conditional on a relatively short Federal government shutdown, so that the negative effects were reversed upon government reopening. Should that not be the case (and/or the law violated such that Federal workers were not paid for the time furloughed), then the economy’s baseline trajectory would be lower than that depicted. (Note that contractors are not provided payments for the period under which the government was shut down.)

Source link