NFP and private NFP upside surprise +64K v +50K Bloomberg, +69K v +45K Bloomberg. According to official data as well as implied benchmark revision data, NFP is treading water. According to the Powell conjecture that the current BLS series has been overstating employment growth by 60K/month, we are well past NFP peak.

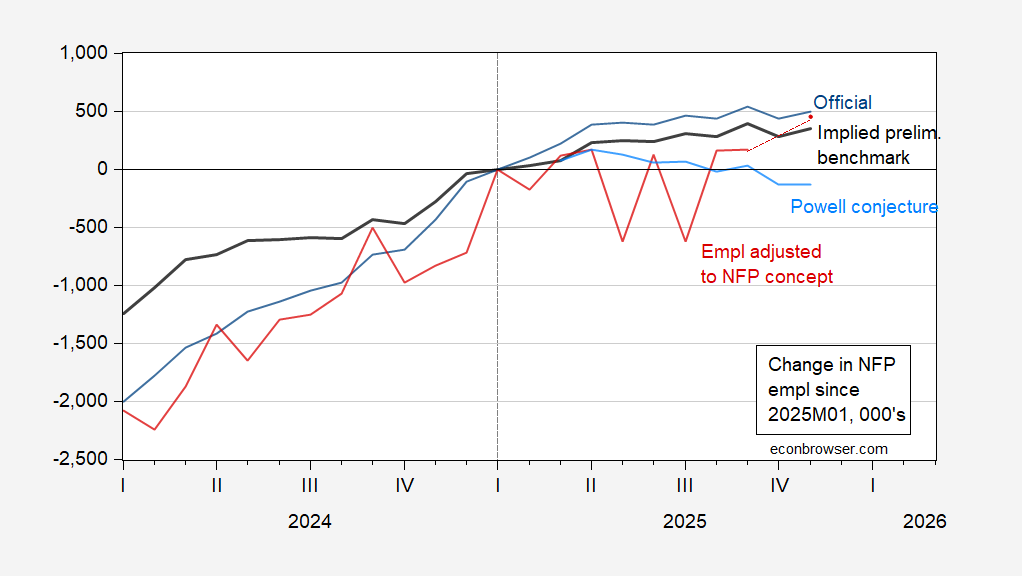

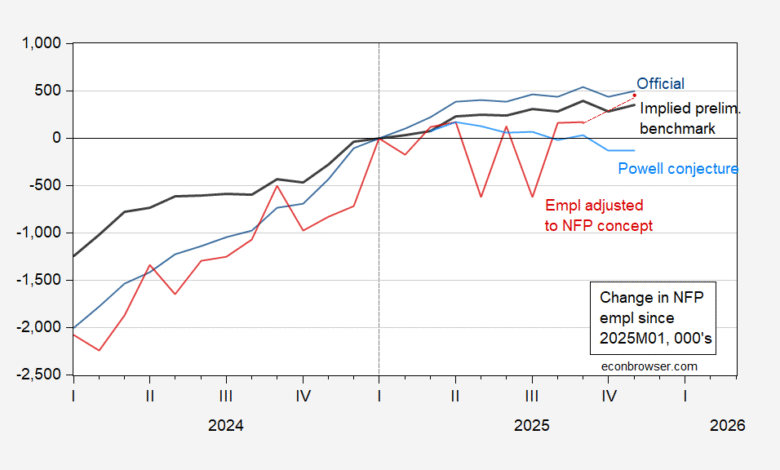

Figure 1: Official CES nonfarm payroll employment (blue), implied benchmark revision (bold black), Powell conjecture based on implied benchmark revision (sky blue), and CPS employment adjusted to NFP concept, smoothed population controls (red), change since January 2025, in 000’s. Source: BLS via FRED, BLS, and author’s calculations.

August and September employment were revised down by 22K and 33K respectively.

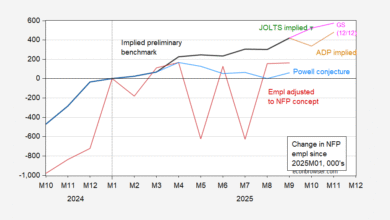

My nowcasts (taking account of the downward revision in August and September) were too high by 22.4K and 98.8K. These nowcasts were calculated using ADP estimates of private NFP. Goldman Sachs overestimated by about 200K each month.

October government employment fell in part because of the Federal Deferred Furlough Program, which should have been resulted in an approximately 150K drop; the actual drop in government (Federal, State, Local) employment was 162K.

It’s interesting to note that the difference between growth in ADP NFP and BLS NFP over the April to September is about 40K, not far from the Powell conjecture of 60K.

One positive piece of news is that the CPS employment series adjusted to the NFP concept rose markedly, potentially marking a break from the downward trend recently observed. That being said, the standard errors associated with the CPS estimates are likely larger than usual, due to the missing data for October.

Source link