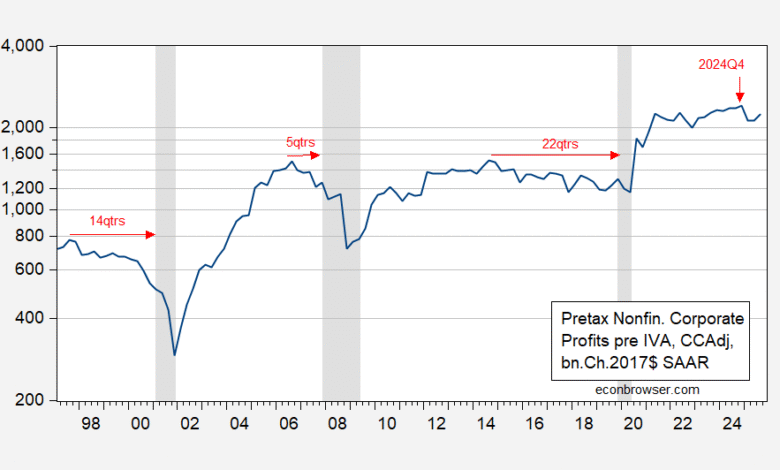

Unsurprisingly, the former leads the latter, but the lag is (highly) variable.

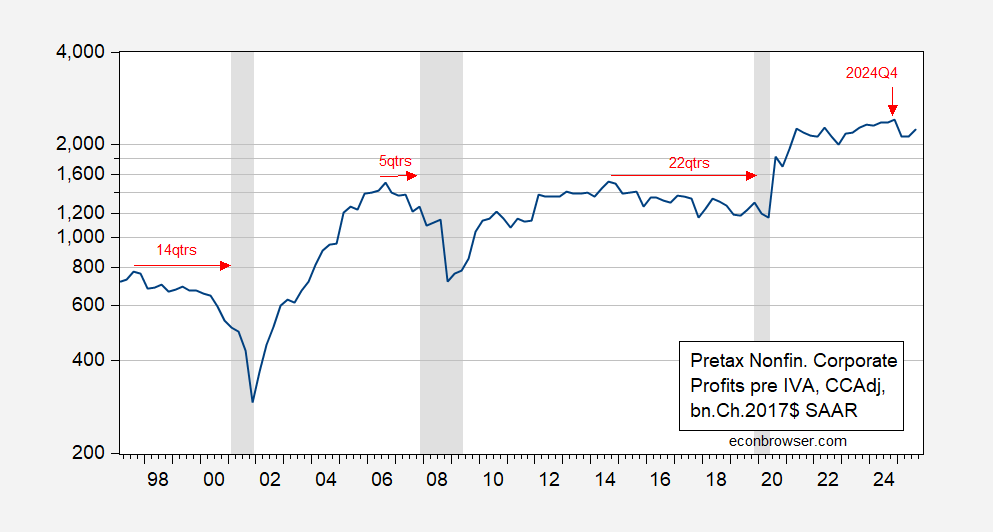

Figure 1: Real pretax corporate profits for nonfinancial firms, bn.Ch.2017$ SAAR (blue). Deflated by personal consumption expenditure deflator. Red arrows denote time from peak profit to NBER peak. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Hence, while nonfinancial corporate profits have (apparently) peaked, it’s not clear this signals an imminent recession. And indeed, considering there might not have been a recession were it not for the Covid-19 pandemic, the lag length seems so variable so that corporate profit peaks are of little use.

Source link