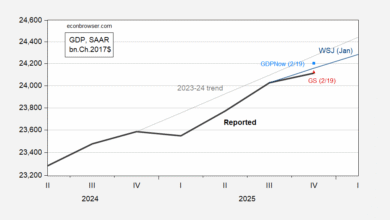

As i was producing some extra slides for my macro course, I generated this graph:

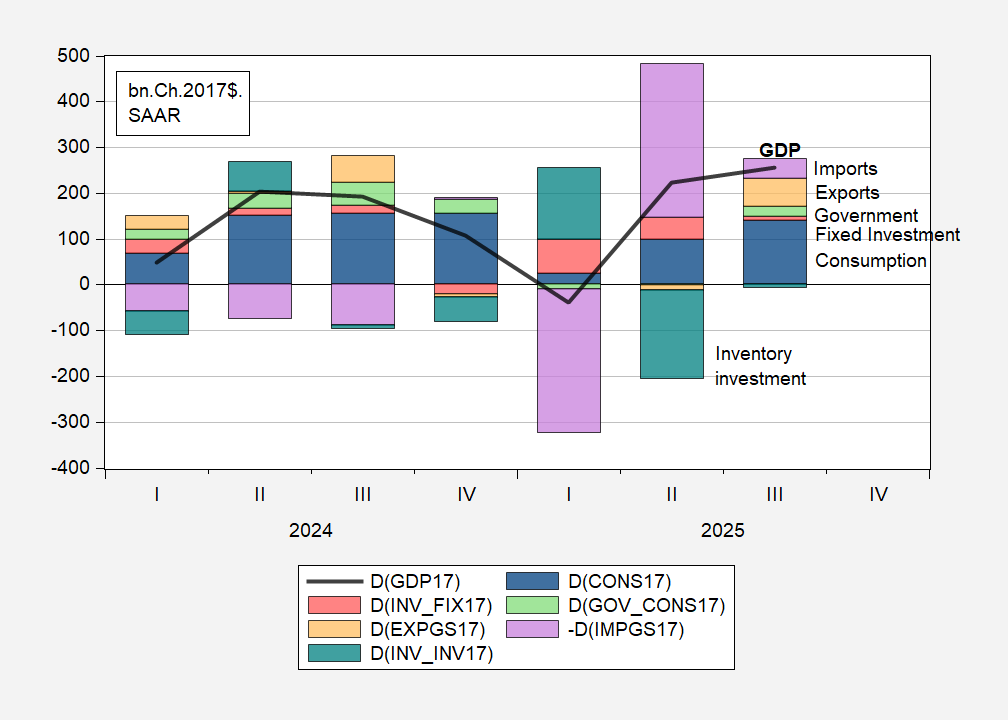

Figure 1: Change in GDP (bold black line), change accounted for by Consumption (dark blue bar), Fixed investment (red bar), Inventory investment (teal bar), government consumption and investment (light green bar), exports of goods and services (orange bar) and imports (lilac bar), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q3 updated release, and author’s calculations.

Note that this is the real dollar contribution instead of percentage point contributions that are typically generated reported in the BEA report, and that Jim plots in his posts on the GDP release. If I did this on a long span of data, I’d be queasy about treating chain-weighted quantity variables this way, but I hope that over this short of a period, the approximation errors are fairly small.

The interesting point is that taking into account the changes in imports and inventory ac/decumulations in Q1 and Q2, these are pretty equal and opposite in value. This allows one to make a kind of guess of what imports of goods and services would’ve been in the absence of tariff-front-running, and hence better visualize the trend in imports.

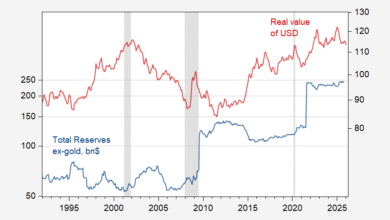

This in turn potentially yields insights into the effects of tariffs, especially in light of the large deterioration in the trade balance in November. I must confess, I was never one to believe that even the enormous and record-breaking tariff rates imposed would alter the trade balance (or more accurately, the current account balance) on the basis of expenditure-switching effects. Moreover, imports might be decreasing because of the depressing effects of policy uncertainty on economic activity.

Little impact is also to be expected since I view the current account as basically driven by the national saving identity (this is sometimes called the Macroeconomic Balances approach). As it turns out the NIPA current account to GDP ratio is about the same (well, actually about half a percentage points more negative) in 2025 than in 2024.

That being said, I think it’s interesting to see what imports alone are doing.

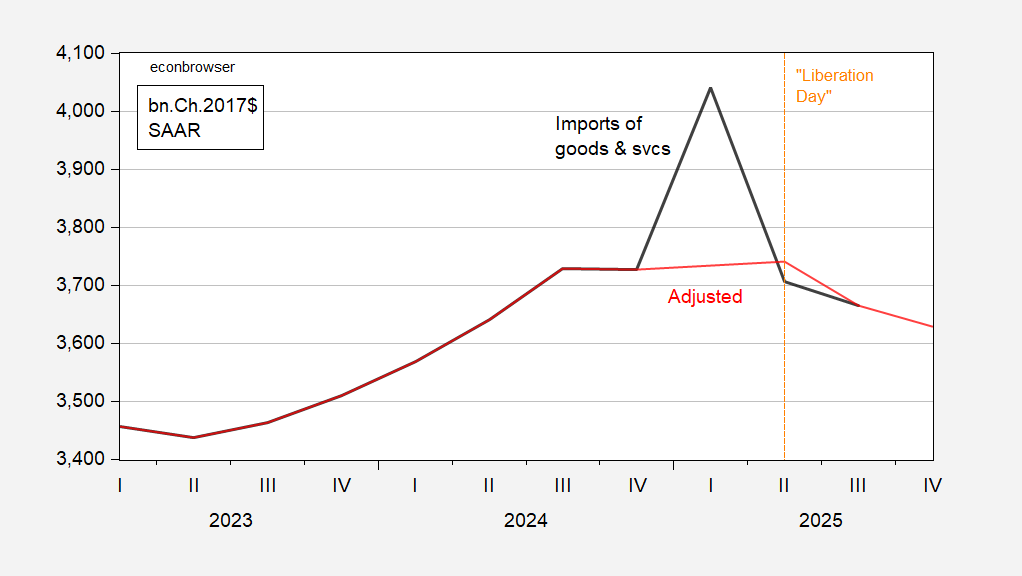

Figure 2: Imports of goods and services (bold black), and counterfactual (red), both in bn.Ch.2017$ SAAR. 2025Q4 final sales is GS estimate of 1/30; 2025Q4 imports is extrapolated using regression of total imports on goods imports 2023Q1-25Q3, where Q4 imports of goods proxied by October and November imports. Source: BEA 2025Q3 updated release, BEA trade release of November, Goldman Sachs, 29 January 2026, and author’s calculations.

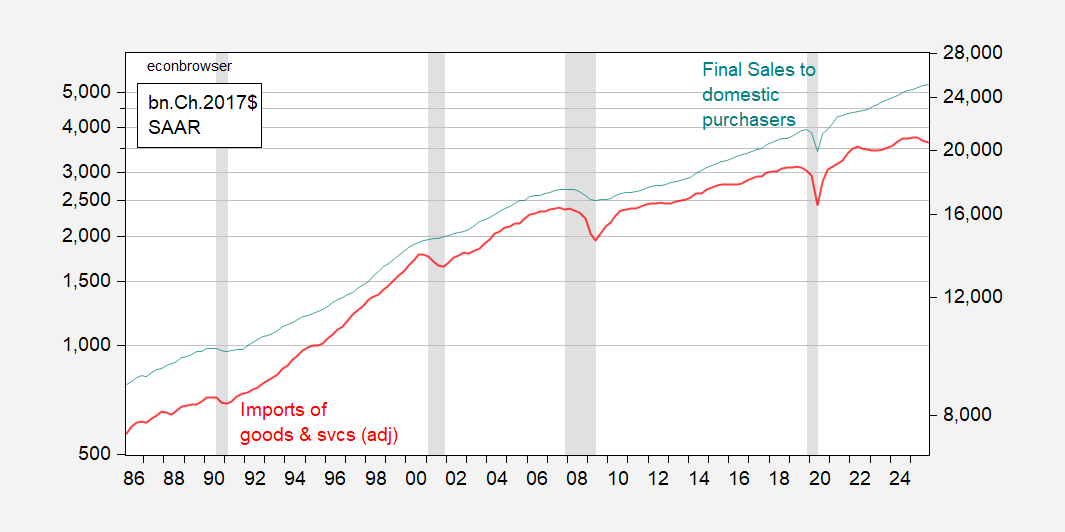

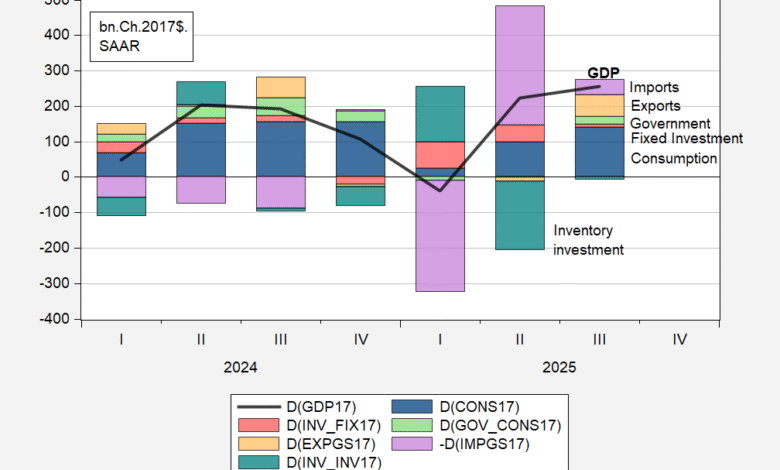

Figure 3: Imports of goods and services, adjusted (red, left log scale), and final sales to domestic purchasers (teal, right log scale), both in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2025Q3 updated releases, BEA November trade release, Goldman Sachs, NBER, and author’s calculations.

It looks like there’s a downward movement in imports, despite the jump in November trade deficit. A quick and dirty estimate over the 2023-2025 period suggests that tariffs account for the majority of the movements.

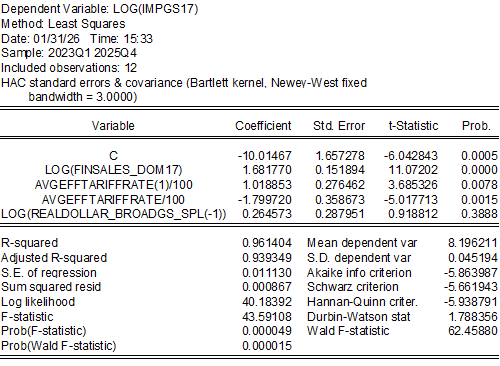

Over the 2023-25 period, imports have a semi-elasticity of 1.8 with respect to the contemporaneous effective tariff rate, while absorption and the value of the dollar have the corrected signs. Note that these estimates are sensitive to sample and specification (as would be expected given the small sample).

The slowing of the economy (as measured by domestic final sales) and the increase in the contemporaneous tariff rate have roughly equal coefficients. To see what is more important empirically, one can examine scaled, or normalized, regression coefficients (dividing by respective standard deviations) indicates that the impact of the former is about 0.93 and 1.35 for the latter.

In sum, tariffs do seem to be reducing imports, even if not necessarily reducing the current account deficit. Trade policy uncertainty doesn’t seem empirically important in the specification tested, but might (likely) have an impact on broader economic activity, and hence depressing imports. Quantifying this effect I leave for a subsequent post.

Source link