Yesterday, Jim moved the Econbrowser Little Econ Watcher’s countenance to neutral 😐, based primarily on Q3 growth, using the methodology outlined in this post. Remember, there will be two revisions for Q4 growth (before the annual revision, and succeeding revisions). What are some other readings from the Q4 release?

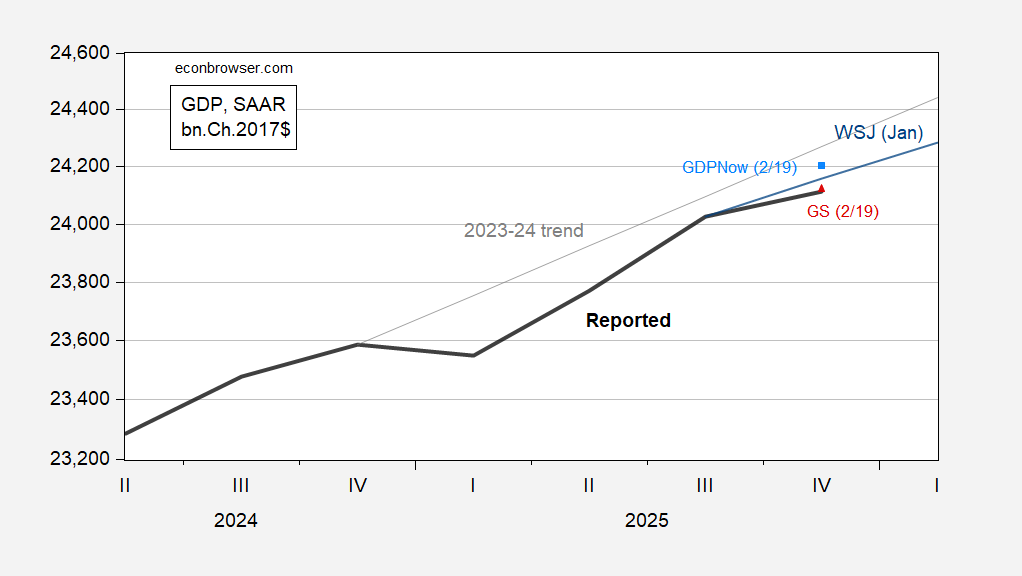

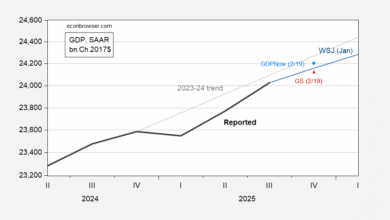

First, GDPNow — as expected — over-nowcasted growth because it couldn’t take into account the government shutdown. On the other hand, the Goldman Sachs tracking estimate, incorporating judgment, was largely on mark.

Figure 1: GDP Q4 advance reported (bold black), GDPNow (sky blue square), Goldman-Sachs (red triangle), WSJ January survey mean (blue), 2023-24 stochastic trend (gray), all in bn.Ch.2017$ SAAR. Source: BEA via FRED, Atlanta Fed (2/19), Goldman Sachs (2/19), WSJ January survey of economists, and author’s calculations.

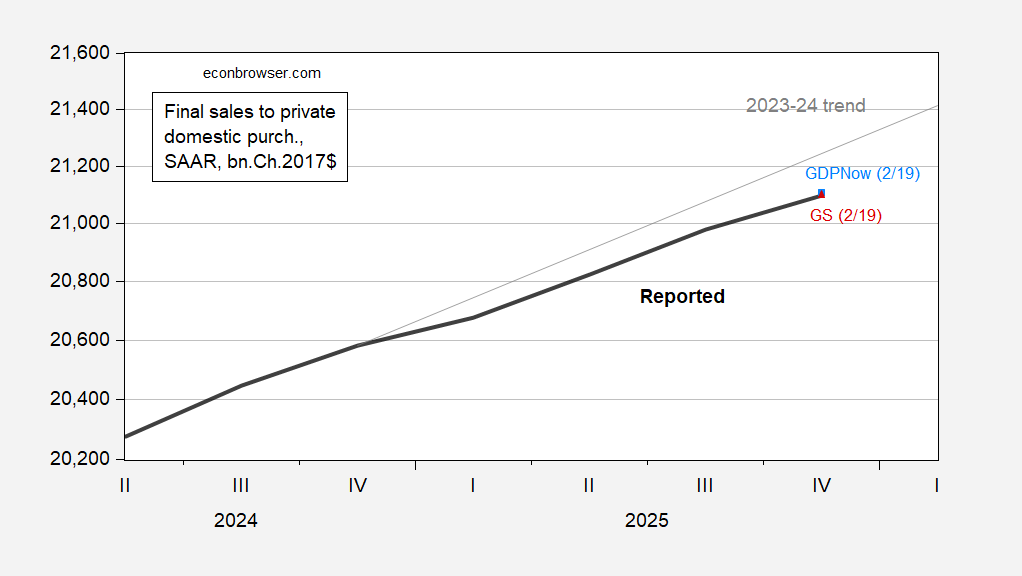

Note that the Little Econ Watcher assessment is based on data through Q3; Q4 evidences a big slowdown (1.4% q/q AR). To the extent this was a “one-off” to be reversed in 2026Q1, one might not want to make an assessment on trajectories solely on GDP. Given the abnormal behavior of external balances (imports, exports) and government spending (record shutdown). I show the trajectory of a proxy for aggregate demand which excludes those two components (technically, final sales to private domestic purchasers, aka “Core GDP”):

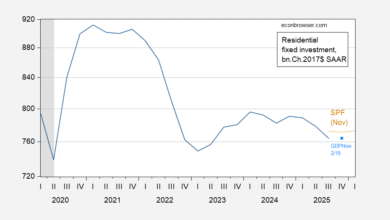

Figure 2: Final sales to private domestic purchasers Q4 advance reported (bold black), GDPNow nowcast (sky blue square), Goldman-Sachs (red triangle), ad 2023-24 stochastic trend (gray), all in bn.Ch.2017$ SAAR. Source: BEA via FRED, Atlanta Fed (2/19), Goldman Sachs (2/19), and author’s calculations.

Visually, advance reported q/q AR sales growth of 2.4% seems to have largely have hit the mark, in accord with the view that it’s easier to predict these domestic components. However, growth was below GDPNow’s 2.6% nowcast (but roughly at GS’s). Recession in 2025Q4 seems highly unlikely given what we’ve seen thus far. Nowcasts for 2026Q1 range from 2.7% (NY Fed) to 3.1 (Atlanta Fed).

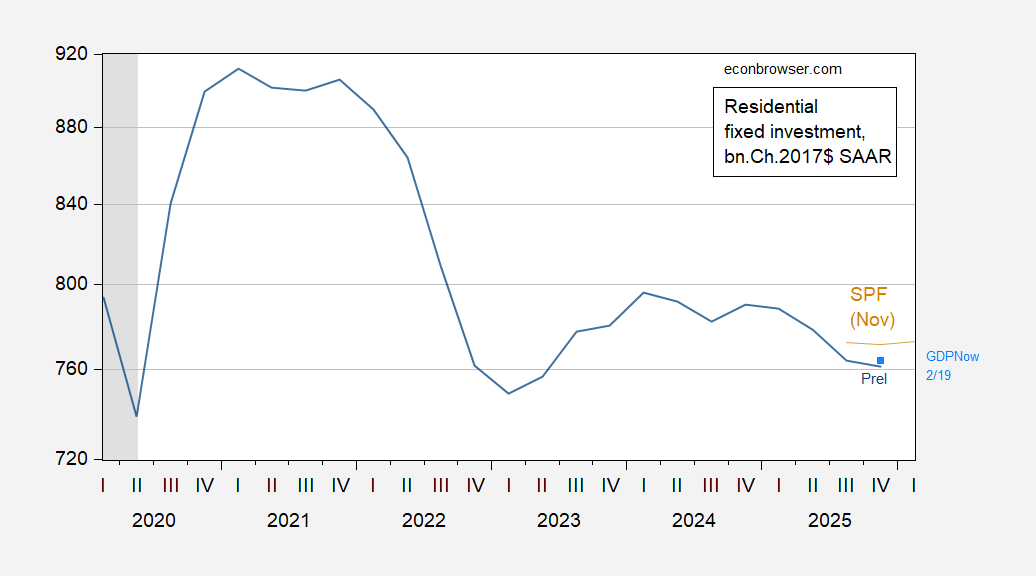

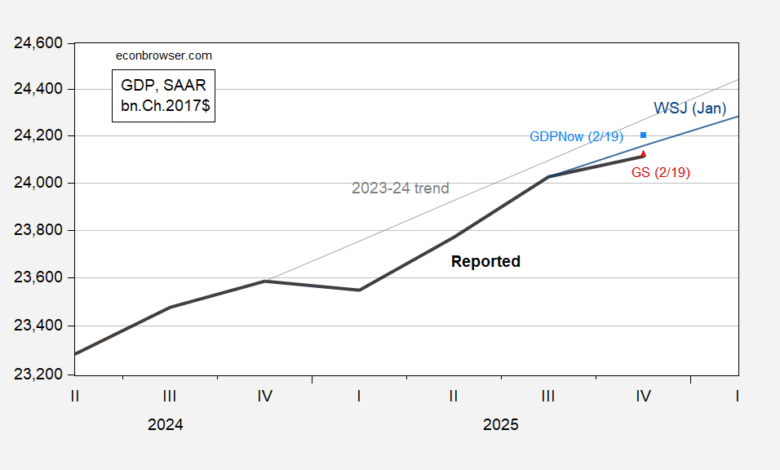

Finally, what about residential investment, discussed in this post? Well, advance numbers undershot GDPNow’s nowcast (and are well below November 2025 Survey of Professional Forecasters forecasts).

Figure 3: Residential Fixed Investment Q4 advance reported (bold black), GDPNow nowcast (sky blue square), November Survey of Professional Forecasters forecast, all in bn.Ch.2017$ SAAR. Source: BEA via FRED, Atlanta Fed (2/19), Goldman Sachs (2/19), and author’s calculations.

Source link