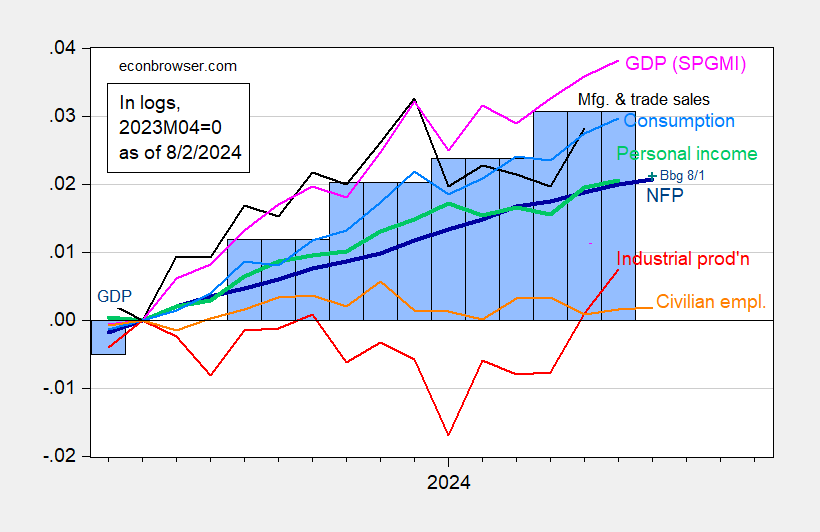

NBER BCDC key indicators, alternative indicators, weekly indicators:

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

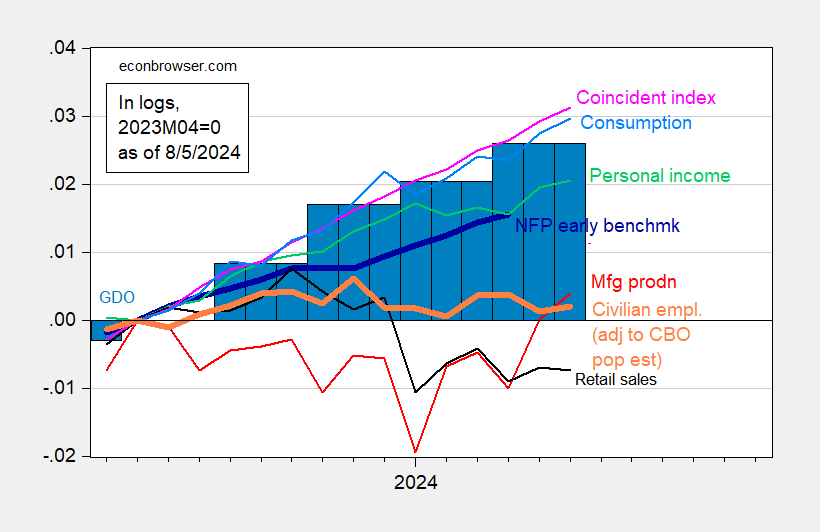

Figure 2: Nonfarm Payroll early benchmark (blue), civilian employment adjusted to CBO estimated immigration (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), retail sales in 1999M12$ (black), consumption in Ch.2017$ (light blue), and coincident index (pink), GDO (blue bars), all log normalized to 2023M04=0. 2024Q2 GDO uses estimated GDI. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, Philadelphia Fed, and author’s calculations.

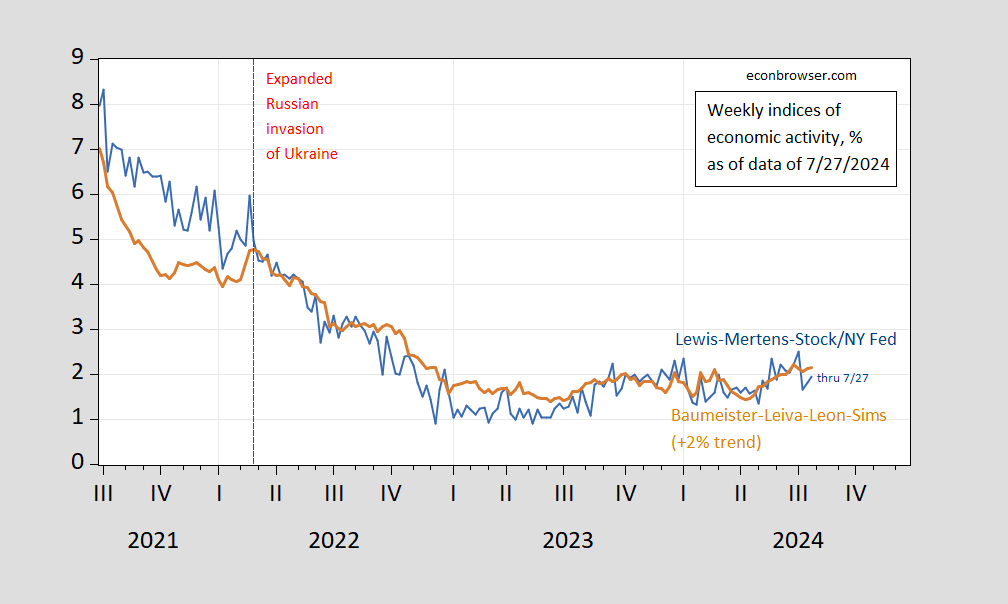

Figure 3: WEI (blue), WECI plus 2% (tan), in %. Source: NY Fed via FRED, Baumeister et al.

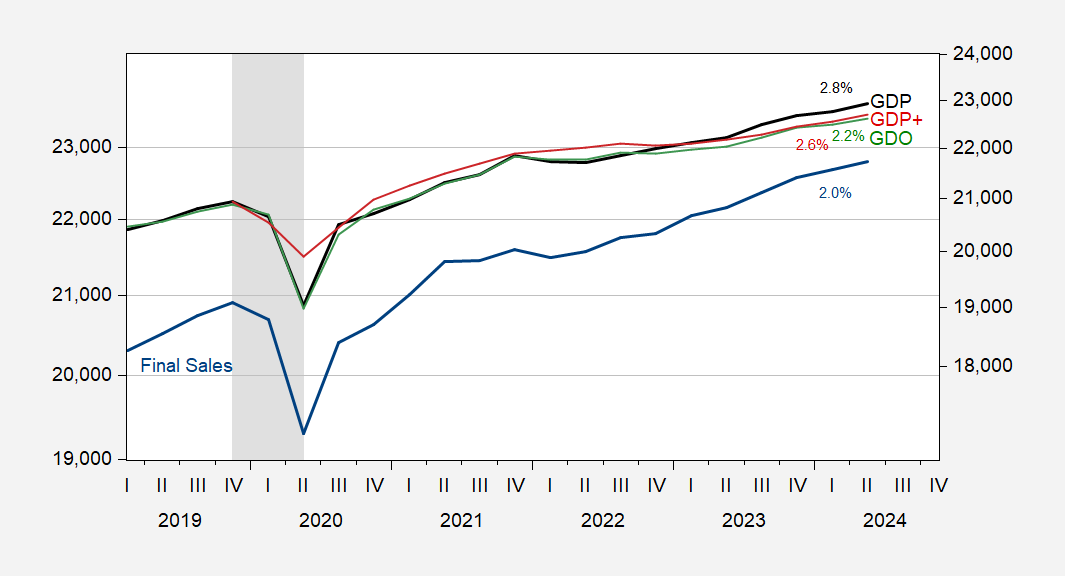

For a longer term perspective, across macro aggregates:

Figure 4: GDP (bold black, right scale), GDO (green, right scale), GDP+ (red, right scale), final sales (blue, left scale), all in bn.Ch.2017$ SAAR. GDP+ iterated on 2019Q4 GDP. GDI used in GDO estimated by author. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Philadelphia Fed, NBER, and author’s calculations.

As of today, GDPNow nowcast for Q3 stands at 2.9% SAAR.

Source link