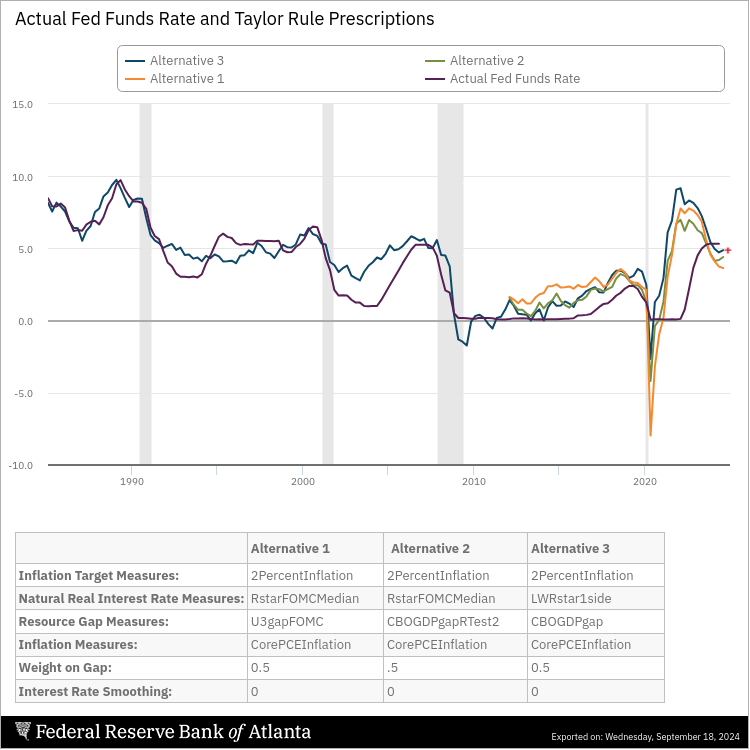

At the press conference for today’s FOMC meeting, there was a lot of talk about how the 50bps drop was dramatic. That focused on the change, rather than the level…Consider what some measures of the Taylor rule (which refers to the level of the Fed funds rate) indicate.

Source: Atlanta Fed, accessed 18 Sep 2024. Red + by author, indicating current Fed funds rate at 4.83%. No smoothing included, so think of this as a “static” Taylor rule.

I think Alternative 1 as a FAIT-like Taylor rule (with no smoothing), Alternative 2 as a more traditional Taylor rule using an output gap, while Alternative 3 uses a estimated r*.

By this measure, we’re “catching up” with where we should be. One can play around with the measures (in the Atlanta Fed’s great Taylor rule utility) to get a slightly different picture (e.g., assume the r* is 2%). Still, I think Alternative 3 is pretty reasonable.

Source link