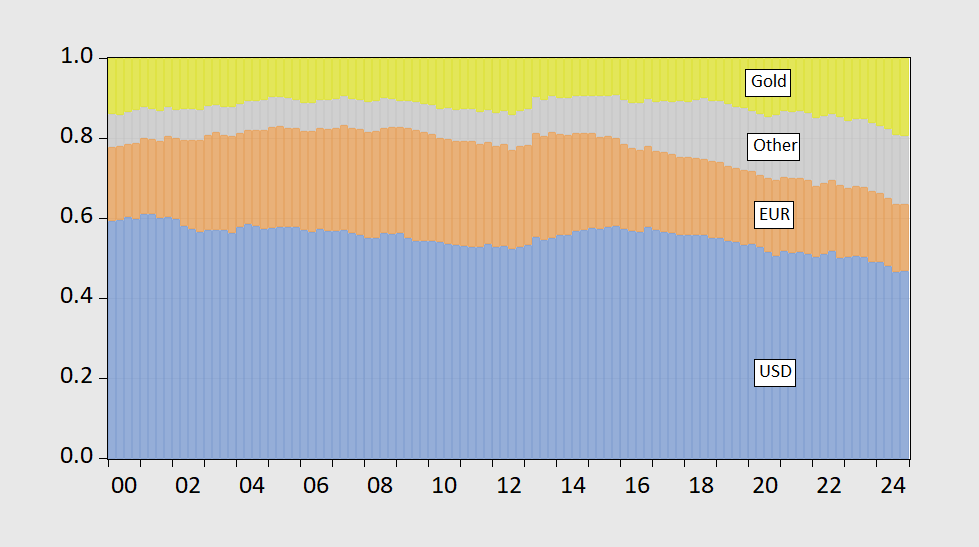

There’s not much data on individual central bank holdings of the dollar through 2023, but COFER goes through 2024Q4, and gold holdings through 2025Q1.

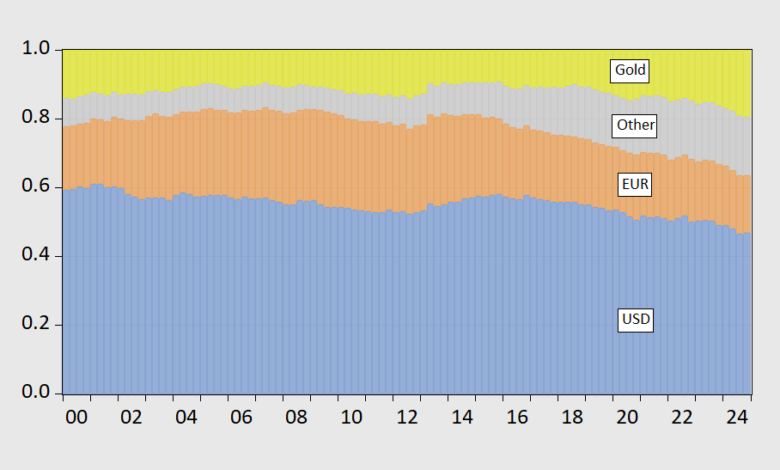

While there’s been some gain in EUR and other currencies in recent years, the biggest gainer in total reserves (fx reserves and gold) is … gold.

Figure 1: USD shares of fx and gold reserves (blue bar), EUR (tan), all other (gray), and gold (yellow). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Source: IMF COFER, World Gold Council, and author’s calculations.

The question is what happens to USD reserves in Q1, with bellicosity of US international economic policy and associated policy uncertainty.

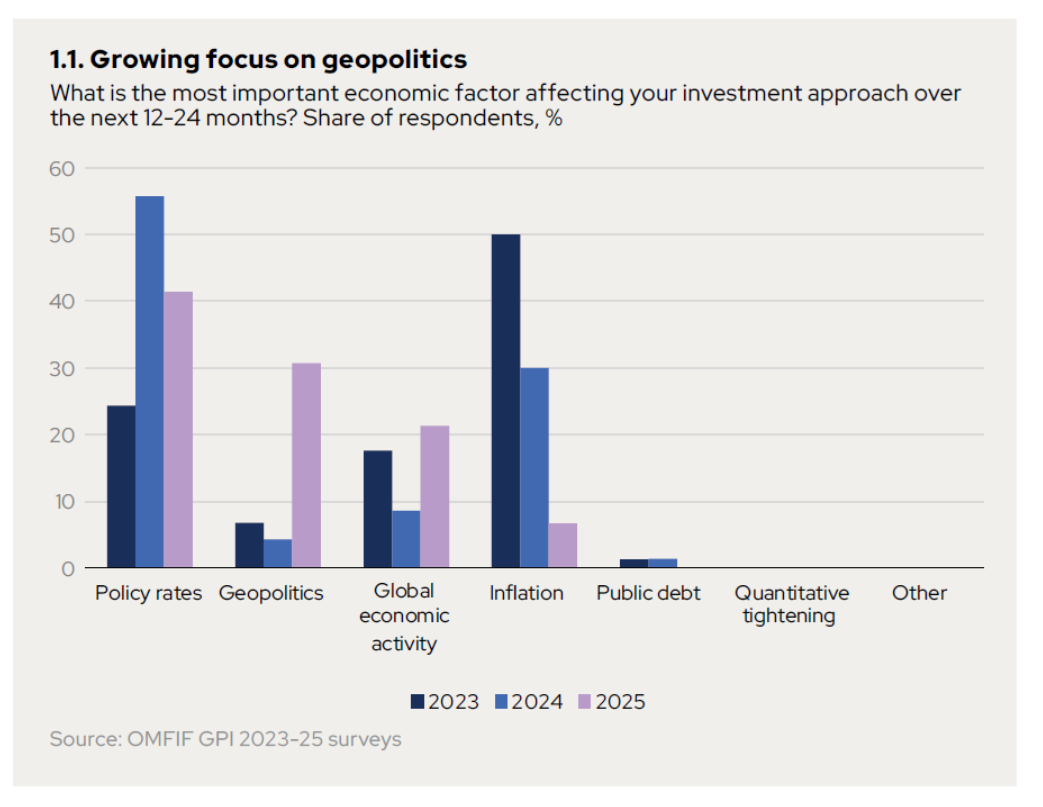

OMFIF’s Global Public Investor 2025 notes the rise in geopolitical concerns:

Source: OMFIF.

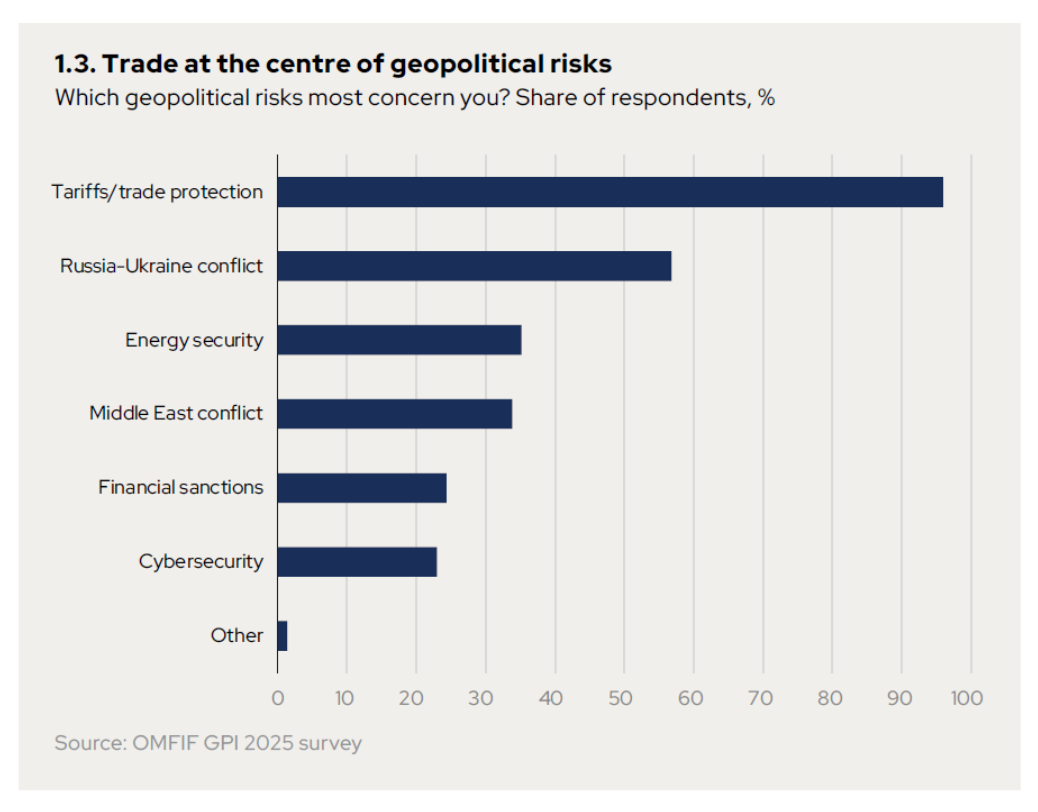

Of geopolitical concerns, tariffs and the trade war at the forefront:

Source: OMFIF.

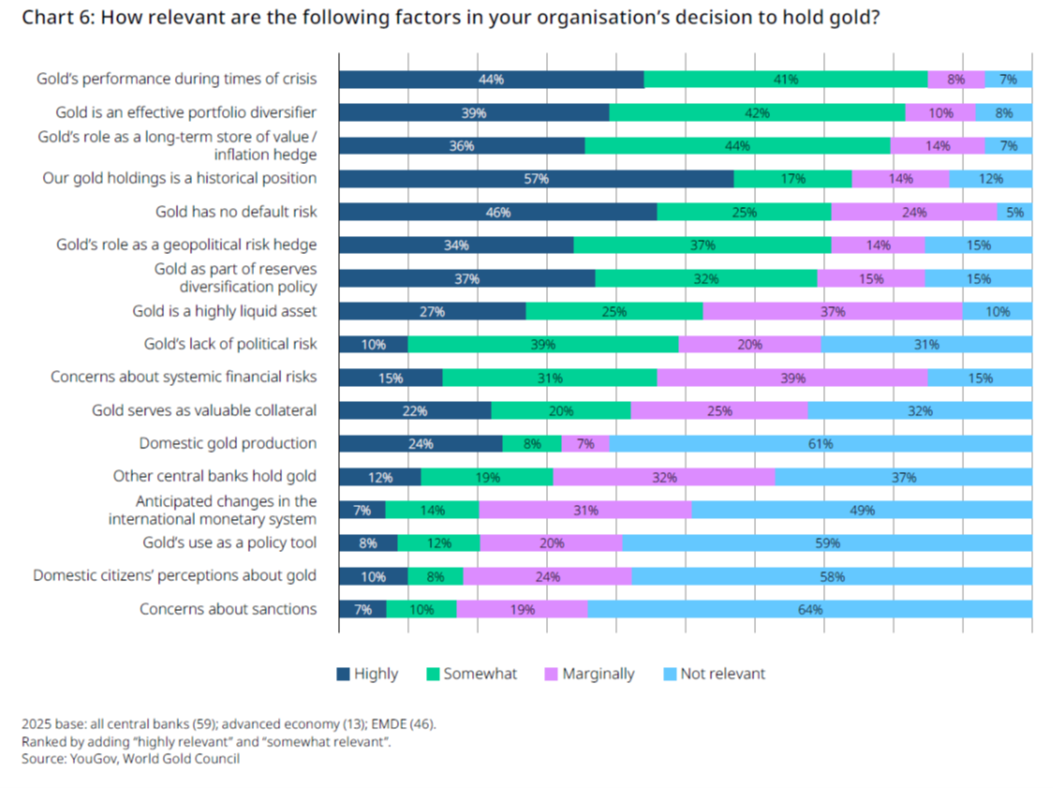

It’s also of interest to consider the central bank motivations for holding gold. From the World Gold Council’s Central Bank Gold Reserves Survey 2025:

Source: World Gold Council.

I find it interesting that the lack of default risk is highlighted as an important motivation for holding gold. While default risk on US Treasurys has come down recently, it is still high by historical standards.

Source: World of Government Bonds, accessed 6/28/2025.

COFER data through Q1 coming out in a few days.

Source link