Oral arguments before the appellate court take place this week. Suppose the tariffs invoked under IEEPA are struck down, then that decision would likely be appealed to the Supreme Court (eventually). From CNBC:

The case, known as V.O.S. Selections v. Trump, is the furthest along of more than half a dozen federal lawsuits challenging Trump’s use of the emergency-powers law.

It’s set for oral argument before the Federal Circuit on Thursday morning.

“I think the tariffs are at risk,” said Ted Murphy, partner and head of global trade practice at law firm Sidley Austin, in an interview with CNBC.

The law has “never been used for this purpose,” and it’s “being used quite broadly,” Murphy said. “So I think there are legitimate questions.”

What about at the Supreme Court? The article continues:

“Trump will probably continue to lose in the lower courts, and we believe the Supreme Court is highly unlikely to rule in his favor,” U.S. policy analysts from Piper Sandler wrote in a research note Friday morning.

The analysts wrote that such a loss would effectively mean the collapse of almost every trade development that Trump has held up as an accomplishment during his first six months in office.

“If the Supreme Court rules against Trump, all of the trade deals Trump has reached in recent weeks — and those he will reach in the coming days — are illegal,” the analysts wrote.

“So are his letters informing countries of their new tariffs, the current 10% minimum, and the reciprocal tariffs he has proposed or threatened,” they added.

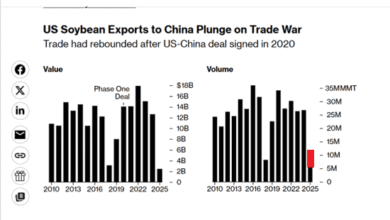

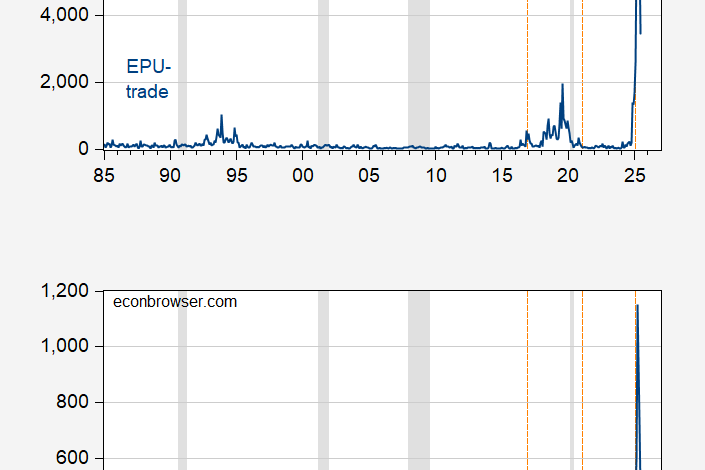

If the analyst is correct, then the question would be whether Mr. Trump complies. Abolishing the tariffs would then mean a massive hit on the US and global economy would have been for naught, while elevating policy uncertainty to capital investment-reducing levels. (Of course, better to get rid of the tariffs than to keep them.)

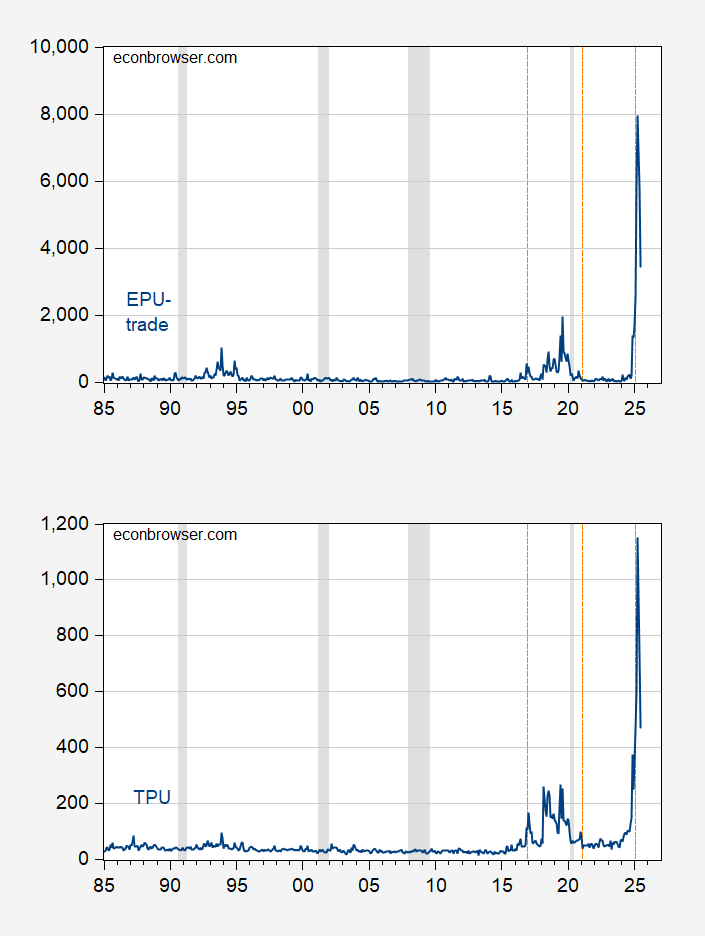

Figure 1: Top Panel: EPU-Trade, Bottom Panel: EPU. NBER defined peak-to-trough recession dates shaded gray. Source: policyuncertainty.com, Iacoviello, NBER.

More on the cases from the CRS.

By the way, I’m not certain what “national emergency” we’re in. GDP, core GDP are growing, inflation is for the moment below 3% (albeit accelerating), unemployment is at 4.1%.

Source link