I was contemplating hamburger cookout over the Labor Day holiday. Prospects?

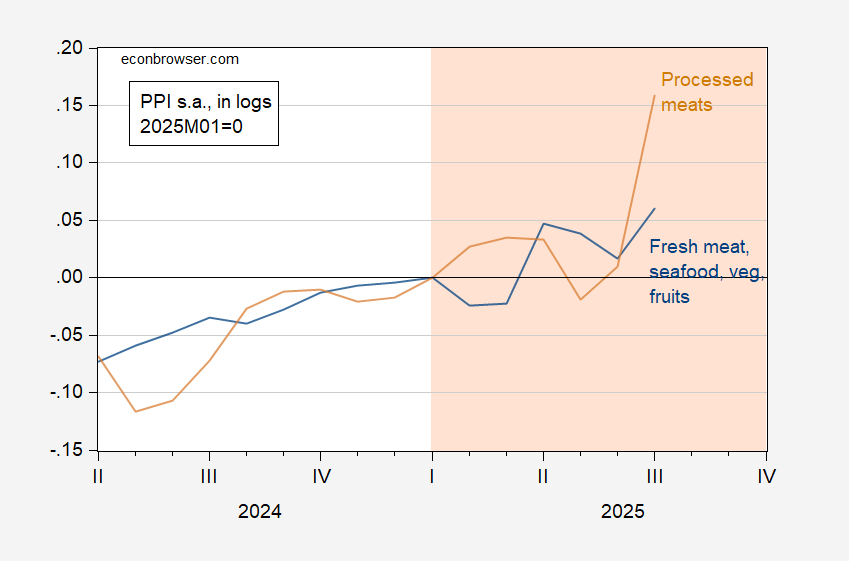

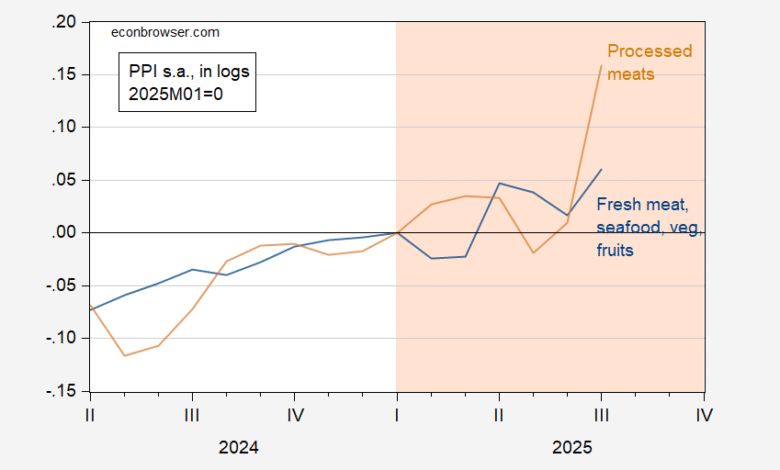

Figure 1: PPI Wholesaling of Fresh Meat, Seafood, Dairy, and Fruits and Vegetables (blue), PPI Frozen Ground Meat Patties and Other Processed, Frozen, or Cooked Meats, Made from Purchased Carcasses (tan), all seasonally adjusted by author using geometric moving average, all in logs 2025M01=0. Source: BLS via FRED, author’s calculations.

For fresh vegetable and fruits, tariffs are now in place for Mexican goods, and we have anecdotal evidence on difficulty in obtaining labor in the fields, so the jump in PPI for fresh fruit and vegetables, meat and seafood is not surprising. For processed meat, smaller herds are part of the issue, but tariffs on Brazilian imports have added — Brazilian beef accounts for about a quarter of US beef imports.

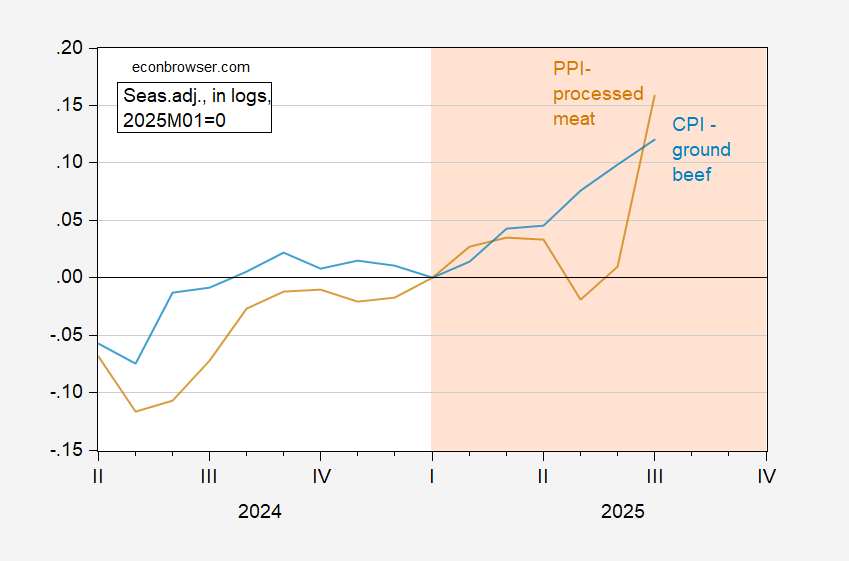

That’s at the wholesale level. What about at the impact at the retail level? There’s nothing exactly corresponding to fresh meats…, but I can check PPI processed meats and CPI for hamburger.

Figure 2: PPI Frozen Ground Meat Patties and Other Processed, Frozen, or Cooked Meats, Made from Purchased Carcasses (tan), seasonally adjusted by author using geometric moving average, and CPI for hamburger, (light blue), both in logs 2025M01=0. Source: BLS via FRED, author’s calculations.

Over the 2000M01-2025M07 period, the Granger causality test rejects the null at the 1% msl that PPI for this category does not cause the CPI for hamburger. The reverse causality relation fails to reject at the 50% level.

So…expect higher prices for hamburger… and lettuce and tomatoes and…

Thanks, Trump!

Source link