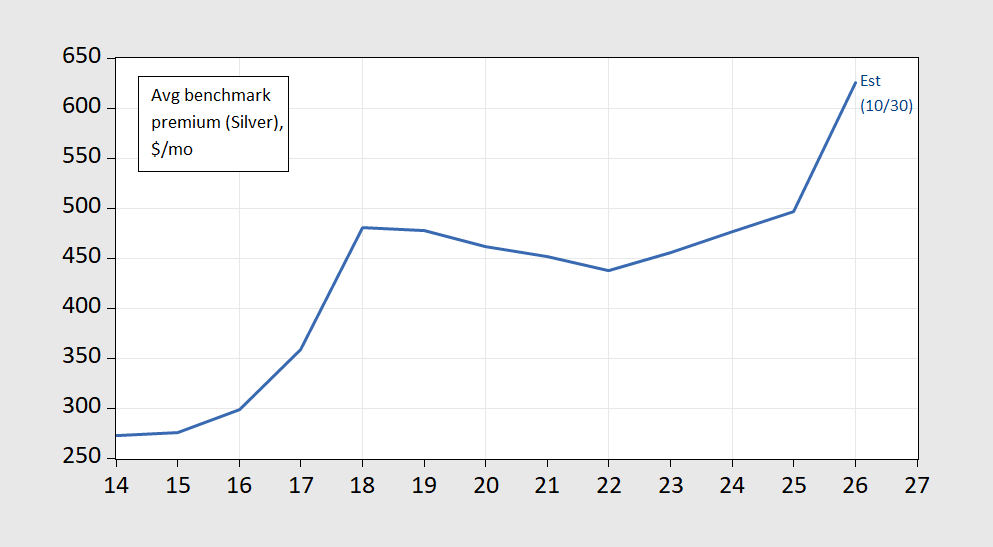

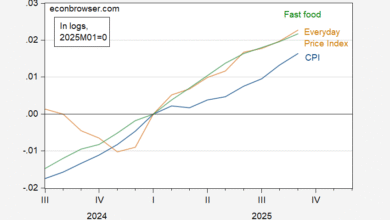

Data from Pew, for average marketplace benchmark plans, per month:

Figure 1: Average benchmark ACA premium (Silver plan, 40yr old), $/mo (blue). Note there is wide dispersion in plan premia given different states, demographics, income. Source: KFF, accessed 10/30/2025.

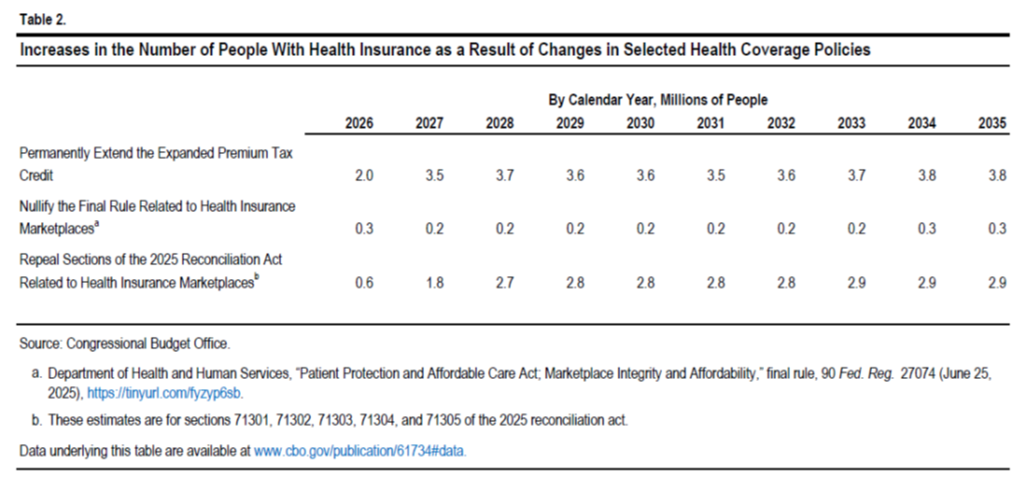

As noted in the CBO letter, in 2026 (2027), 2 (3.5) million more people would be covered by permanently extending the expanded premium tax credit, relative to not.

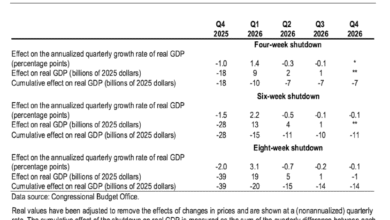

Source: CBO, 18 Sep 2025.

The cost of making the expanded tax credit permanent would cost about $300 bn over ten years. For comparison, making permanent the provisions of the TCJA cost about $4.6 trn over ten years.

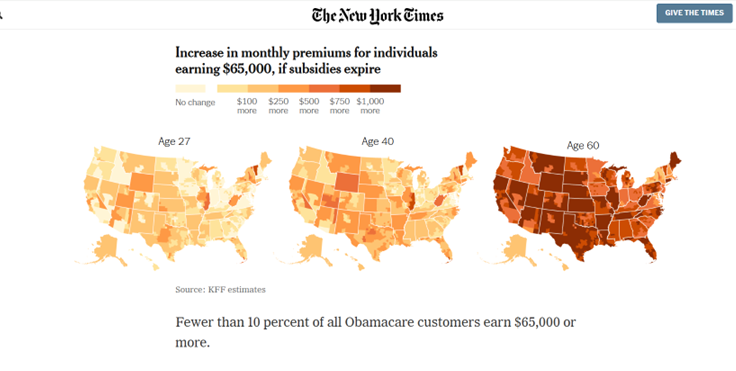

Heterogeneity of impacts is illustrated by this graphic from NYT based on Pew data:

Source: NYT, 30 Oct 25.

Source link