That’s a title of a Bloomberg article, coming right after the Trump (temporary?) retreat on Greenland related tariffs. Economic Policy Uncertainty is likely to stay elevated for a while.

President Donald Trump threatened Canada with 100% tariffs against all its exports to the US if it makes a trade deal with China, escalating tensions between the US and its northern neighbor.

…

Carney said he expects China to cut tariffs on Canadian rapeseed, also known as canola, after meeting Chinese leader Xi Jinping on Jan. 16. It was the first visit by a Canadian leader to Beijing in eight years.

In return, Canada will allow 49,000 Chinese electric vehicles into its market at a tariff rate of about 6%, removing a 100% surtax. Canada had put the large tariff on Chinese EVs in 2024 to align with US policy.

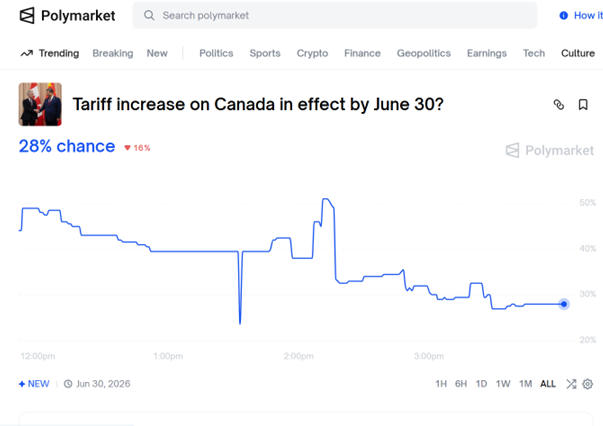

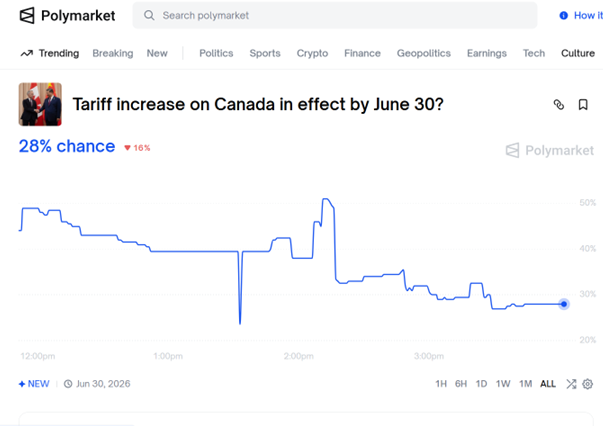

Polymarket is placing some 28% probability on a general tariff rate increase on Canadian imports as of 4pm CT, although there is no calculated probability of a 100% tariff rate being implemented.

Figure 1: Polymarket odds, as of 4pm 1/24/2026.

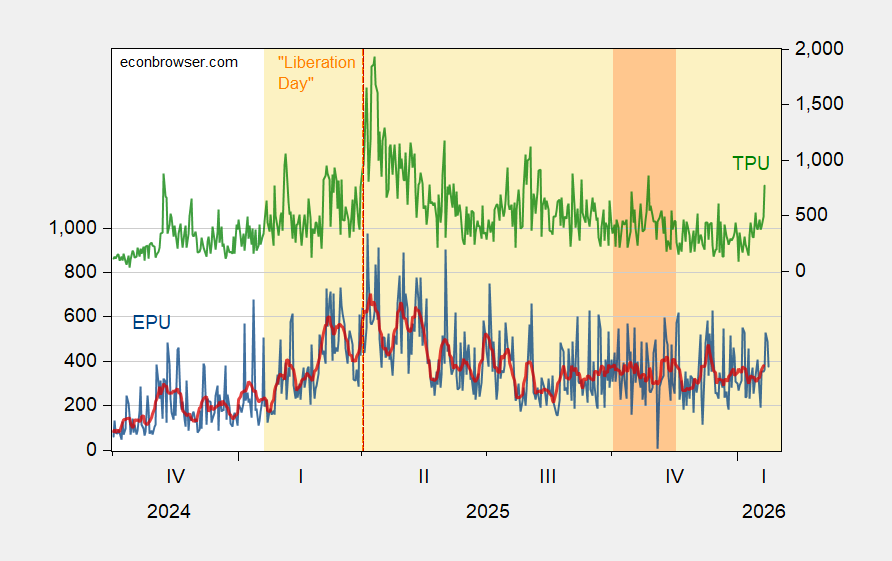

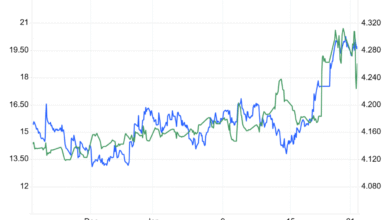

Policy uncertainty was already elevated, on the heels of the Greenland fiasco, and is likely to show up in indices going forward. Here are the ones available as of today, 4pm CT:

Figure 1: EPU (blue, left scale), 7 day centered moving average (bold red, left scale), and Trade Policy Uncertainty (green, right scale). Orange shading denotes Trump 2.0 administration, dark orange the Federal government shutdown. Source: policyuncertainty.com and TPU, and author’s calculations.

Trump’s threat is enabled by the Supreme Court’s refusal to strike down the IEEPA tariffs. Each day the court delays is another day Trump injures the US and global economies.

Source link