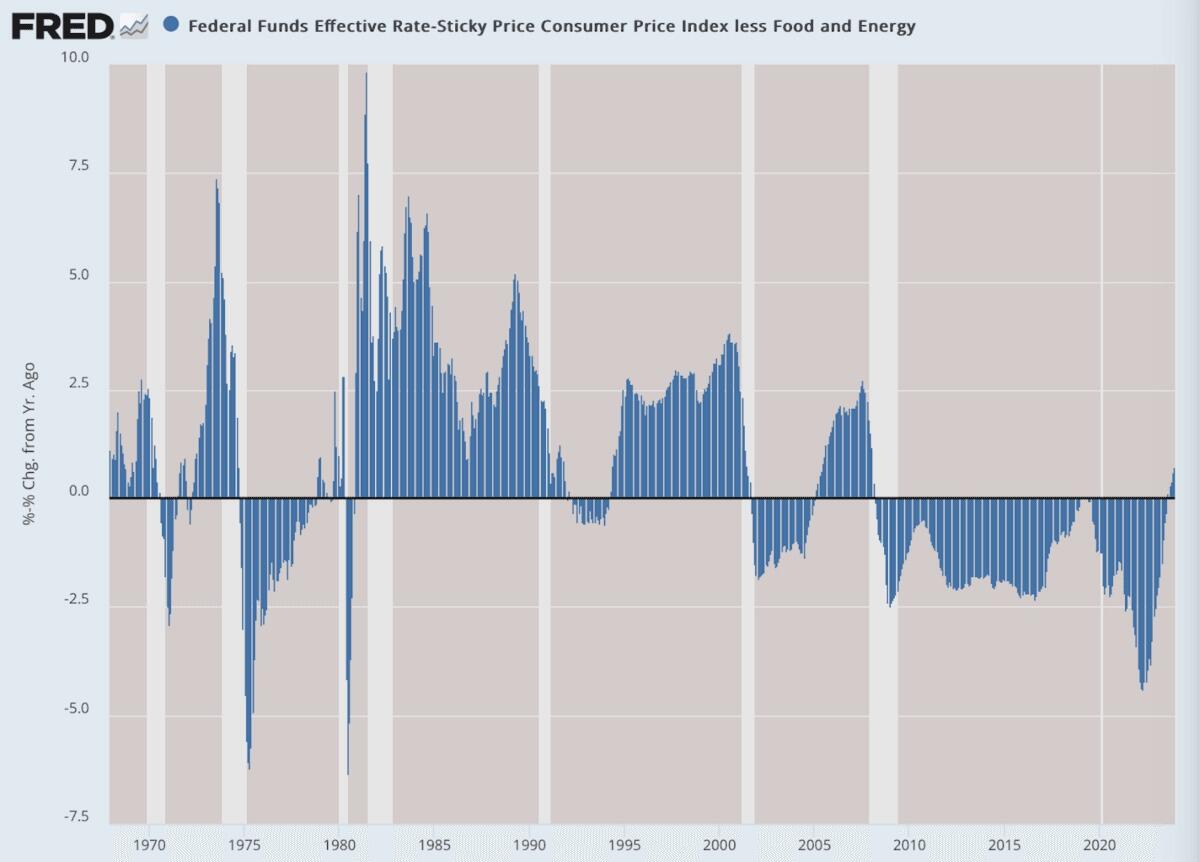

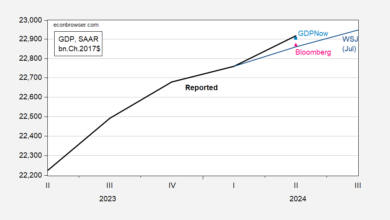

Imagine my surprise when I see a statement “rates are now barely positive according to all official inflation and rate data” in an article titled “Will the Fed Elect Biden?” and the accompanying graph:

Source: ZeroHedge. Notes: (Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

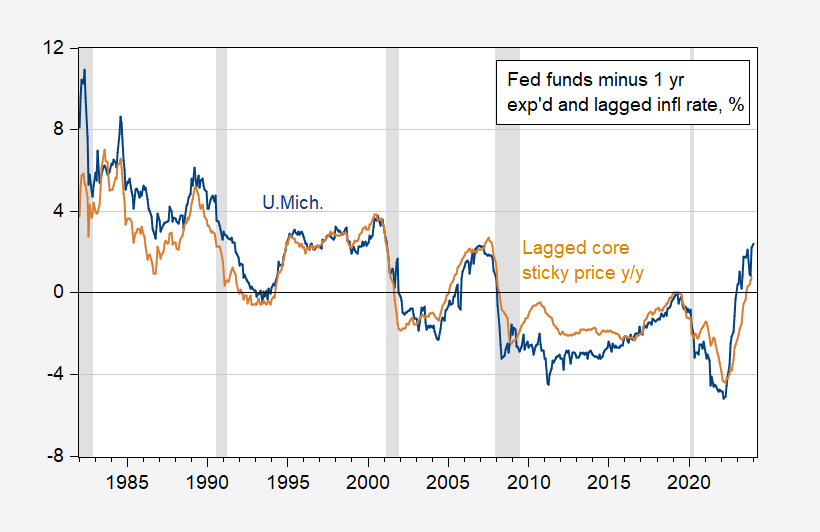

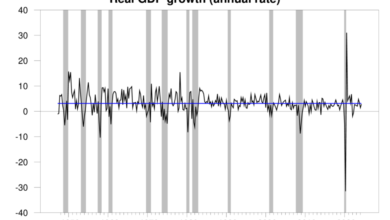

Well, the graph looks this way because it uses lagged ex post core sticky-price CPI inflation (y/y). To see how this graph would look like if one uses instead the University of Michigan’s 1 year ahead CPI inflation expectations:

Figure 1: Fed funds rate adjusted by U.Michigan one year ahead expected CPI inflation, y/y (blue), and by lagged core sticky price CPI inflation, y/y (tan), both %. NBER defined peak-to-trough recession dates shaded gray. Source: Fed, U.Mich., Atlanta Fed via FRED, NBER, and author’s calculations.

The ex ante real Fed funds rate is considerably higher, for longer period, than the oddly defined real rate provided by ZeroHedge. In fact, the ex ante Fed funds rate is higher than peak just prior to the 2007 recession, much higher than the real rate under Donald Trump. In any case, theory suggests that economic decisions are based primarily on ex ante real rates, not current rates adjusted by lagged inflation. Unless one uses adaptive expectations. All I can conclude is that either ZeroHedge or Jeffrey A. Tucker has gone fully adaptive expectations with unit coefficient. To quote: “Not that there’s anything is wrong with that.” After all, this is consistent with the Friedman accelerationist hypothesis. It’s just a bit surprising. And I’m not sure why one would choose the core sticky price measure.

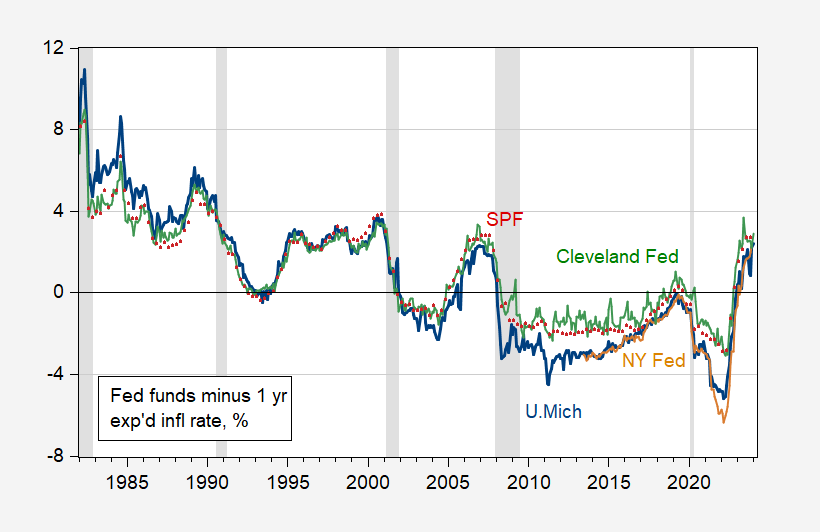

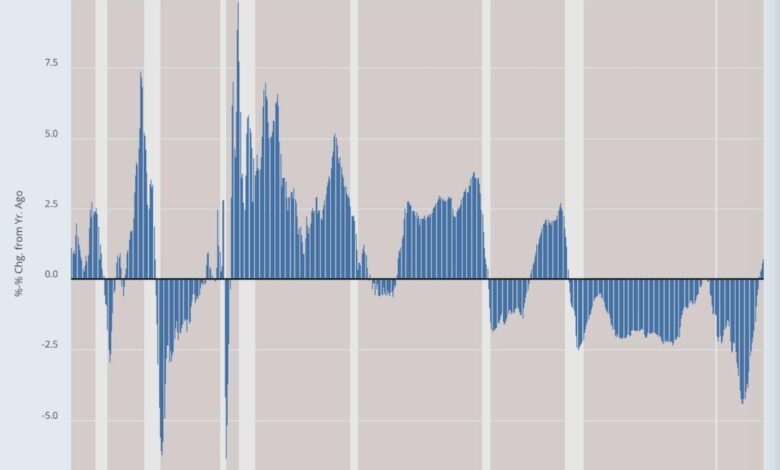

Here’s a picture of more conventional ex ante real Fed funds rates:

Figure 2: Fed funds rate adjusted by U.Michigan one year ahead expected CPI inflation, y/y (blue), by NY Fed (orange), by Cleveland Fed (green), and by Survey of Professional Forecasters (red), all %. NBER defined peak-to-trough recession dates shaded gray. Source: Fed, U.Mich via FRED,, NY Fed, Cleveland Fed, Philadelphia Fed SPF, NBER, and author’s calculations.

So, the other inflation expectations measures confirm that real ex ante Fed funds rates are well into the positive territory.

Source link