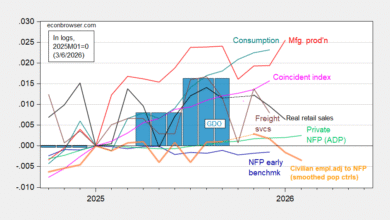

Residential or nonresidential?

This is a question brought to my attention in my discussion with Joe Schulz. Without hard numbers broken down to Wisconsin level (that I know of), it’s hard to say.

What does the surge in construction coincide with? It’s not so much with housing starts as with the CHIPS Act and Inflation Reduction Act.

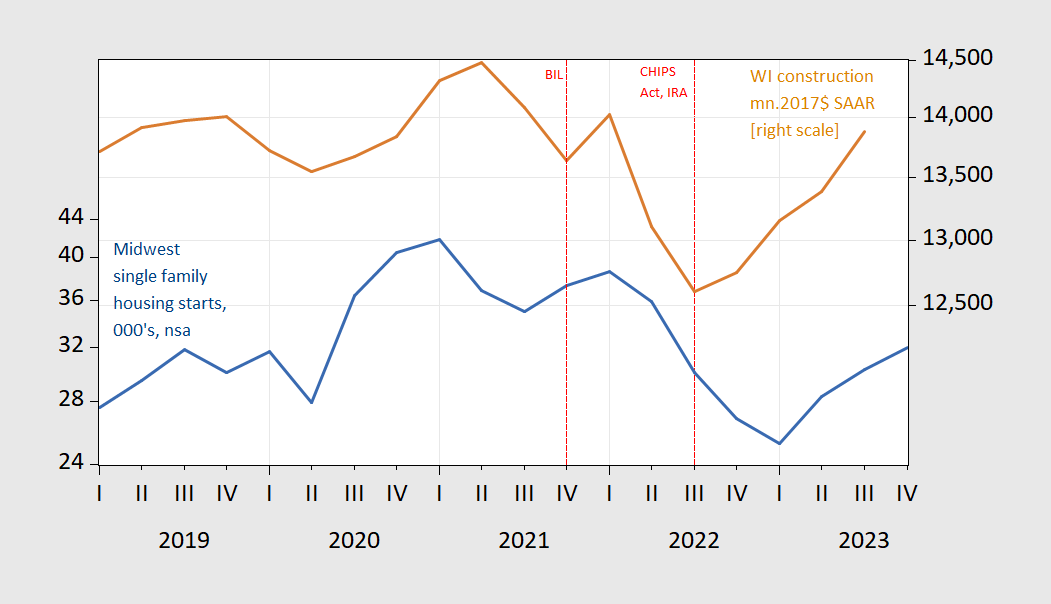

Figure 1: Midwest housing starts single family units, 000’s, n.s.a. (blue, left scale), Wisconsin construction, mn 2017$, SAAR (tan, right scale). Source: Census, BEA.

Wisconsin real construction value added jumped right after the passage of these two pieces of legislation, while housing starts don’t start rising until 2023Q2.

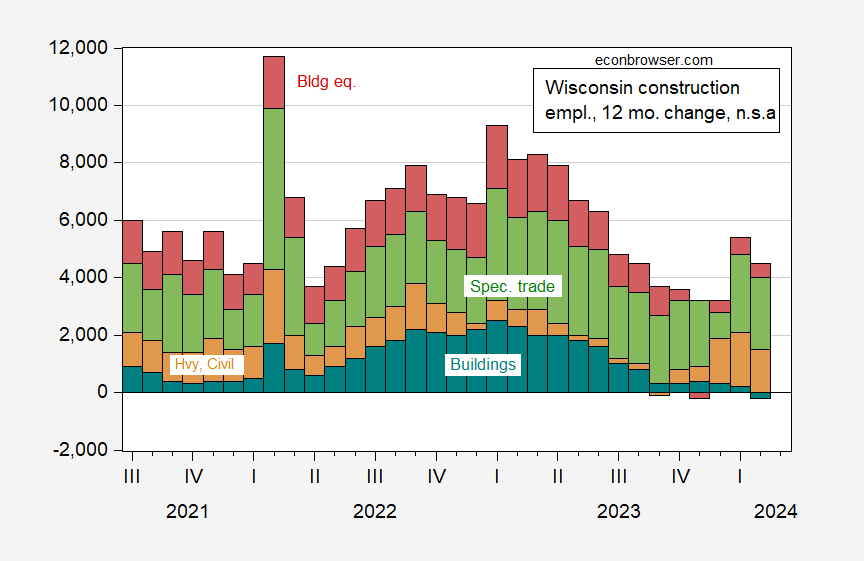

Inspection of the types of construction employment further suggests that nonresidential investment of some type is pushing employment.

Figure 2: Wisconsin 12 month employment change in building construction (teal), in heavy and civil engineering (tan), in specialty trade contractors (green), and building equipment contractors (red), not seasonally adjusted. Source: DWD, and author’s calculations.

I’d imagine heavy and civil engineering more associated with building factories and putting in infrastructure (linked with manufacturing, and with alternative energy) than residential.

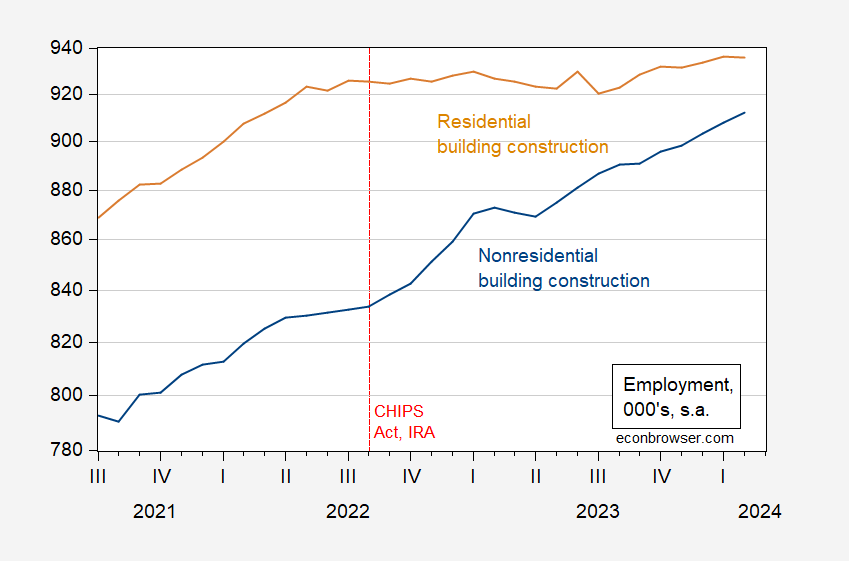

We do have a breakdown of construction workers between residential and nonresidential employment at the national level.

Figure 3: Nonresidential building construction employment (blue), residential building construction employment (tan), both in 000’s, s.a. Source: BLS via FRED.

Clearly, nonresidential construction employment is growing rapidly, while residential has only picked up since recently (4% vs. 1% y/y).

Source link