Guest Contribution: “The Federal Funds Rate: FOMC Projections, Policy Rule Prescriptions, and Futures Market Probabilities from the June 2024 Meeting”

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its June 2024 meeting and, in the Summary of Economic Projections (SEP), projected one ¼ percent rate cut with a range for the FFR between 5.0 and 5.25 percent by the end of 2024. Futures markets summarized by the CME FedWatch Tool after the meeting predicted two rate cuts with a range for the FFR between 4.75 – 5.0 percent by the end of 2024. Comparing prescriptions of inertial policy rules where the FOMC smooths rate increases when inflation rises to projections from the SEP, the FOMC went from “on track” in March to “higher for longer” in June.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. In this post, we analyze four policy rules that are relevant for the future path of the FFR, update the policy rule prescriptions through the June 2024 SEP, and include futures market predictions.

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

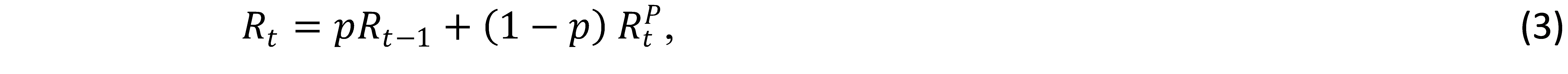

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

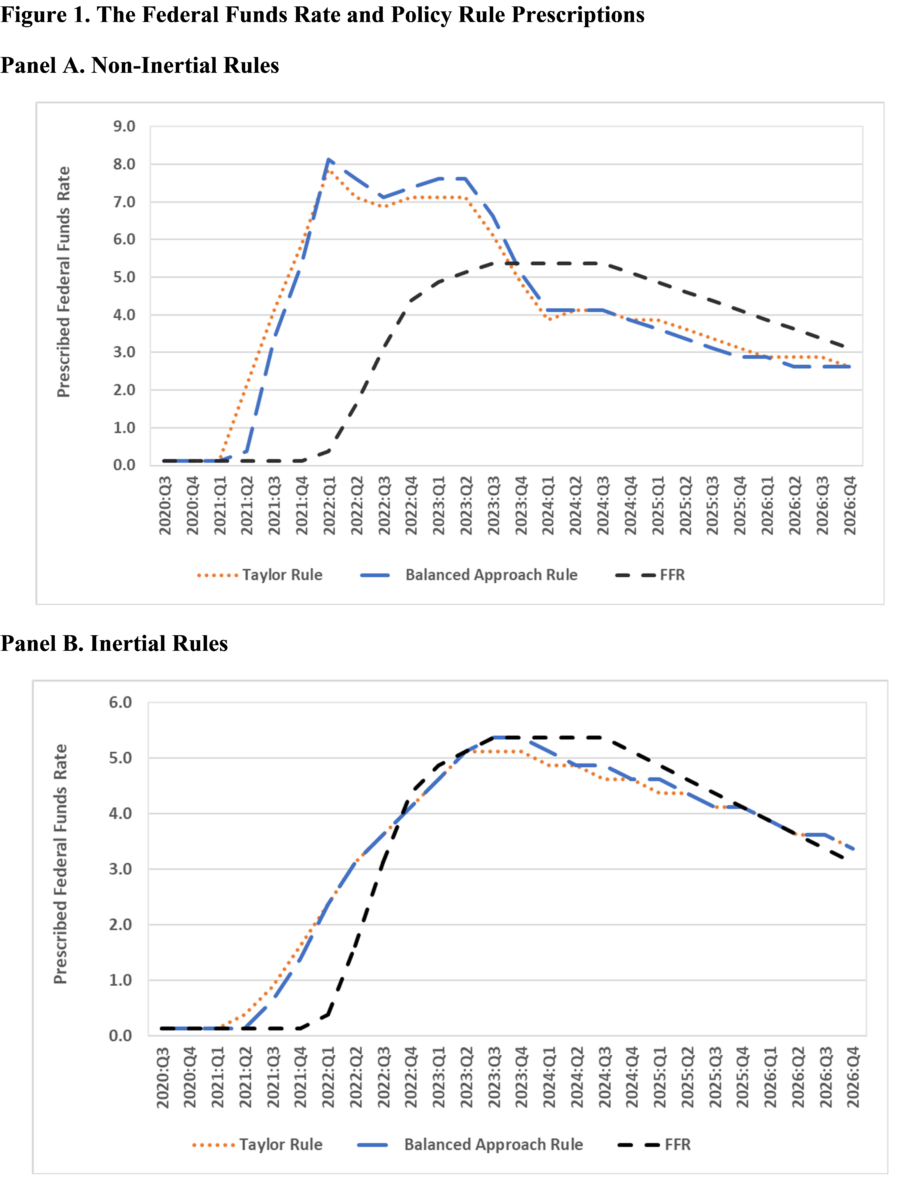

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to June 2024 and the projected FFR for September 2024 to December 2026 from the June 2024 SEP. Figure 1 also depicts policy rule prescriptions. Between September 2020 and June 2024, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between September 2024 and December 2026, we use inflation and unemployment projections from the June 2024 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are much higher than the FFR in 2022 and 2023 and are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. In contrast, the policy rule prescriptions for 2024 through 2026 from the June 2024 SEP are consistently lower than the FFR projections. The inertial rules in Panel B prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022.

Looking forward, the policy rule prescriptions from the June 2024 SEP are below the FFR projections through September 2025 and are close to the FFR projections through December 2026. While the current and projected FFR is generally in accord with prescriptions from inertial policy rules, the gaps are larger for 2024 than in the March SEP because the FOMC projected three ¼ percent rate cuts in March and one ¼ percent rate cut in June. The results for the March 2024 SEP in this and the following two paragraphs are shown in our Econbrowser post.

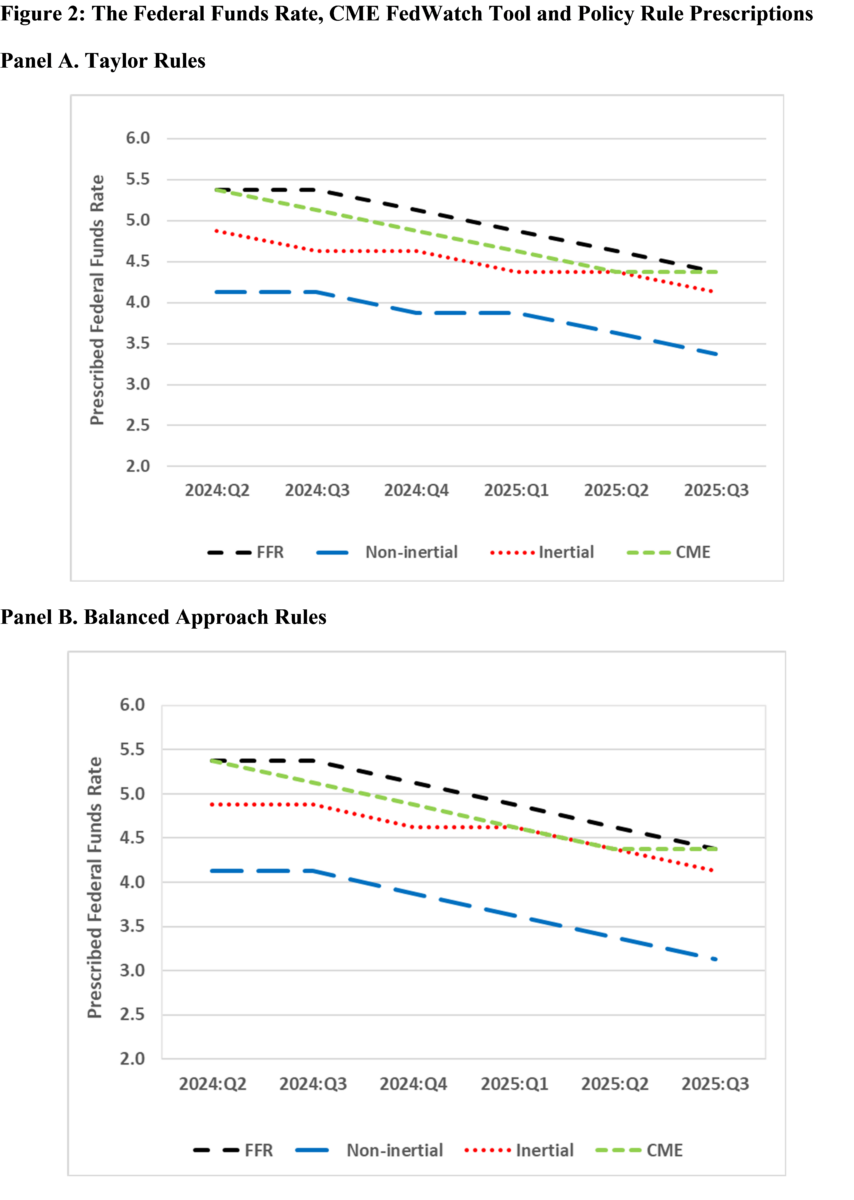

Figure 2 depicts the median predictions from futures markets described in the CME FedWatch Tool following the June 2024 FOMC Meeting through the end of the CME prediction horizon in September 2025. The futures market predictions are ¼ percent below the FOMC projections before converging at the end because futures markets predict two rate cuts while the FOMC projects one rate cut in 2014. The pattern of lower futures market predictions than FOMC projections is consistent with December 2023 but not with March 2024, where the predictions and projections were identical.

We add to this discussion by including prescriptions from policy rules. Figure 2 shows that, for both the Taylor and balanced approach rules, the prescriptions from the inertial policy rules for June 2024 through December 2025 are generally below both the CME predictions and the FOMC projections but are closer to the CME predictions than the FOMC projections. In addition, the gap between the inertial policy rule prescriptions and the CME predictions widens between March and June of 2024. The prescriptions from both non-inertial policy rules are considerably below the FOMC projections and CME predictions for the same period. Comparison between futures market predictions and policy rule prescriptions depends more on the choice between inertial and non-inertial rules than on the choice between Taylor and balanced approach rules.

This post written by David Papell and Ruxandra Prodan-Boul.

Source link