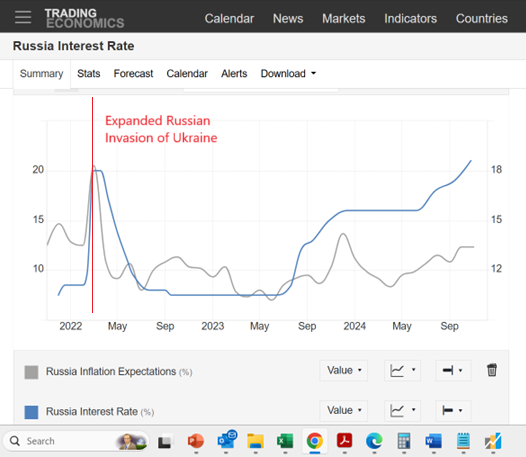

Locking up the butter in Russia (CNN). Official inflation in October was 0.8% m/m (annualize that and it’s about 10%. That’s the official inflation rate. The ex post rate is around 11% then.

Taking the CBR’s expected inflation rate of 13.4% at face value, this implies a 7.6% ex ante real rate. With the policy rate expected to rise to 23% at December’s meeting, this would imply 9.6% ex ante real rates assuming expected inflation remains constant.

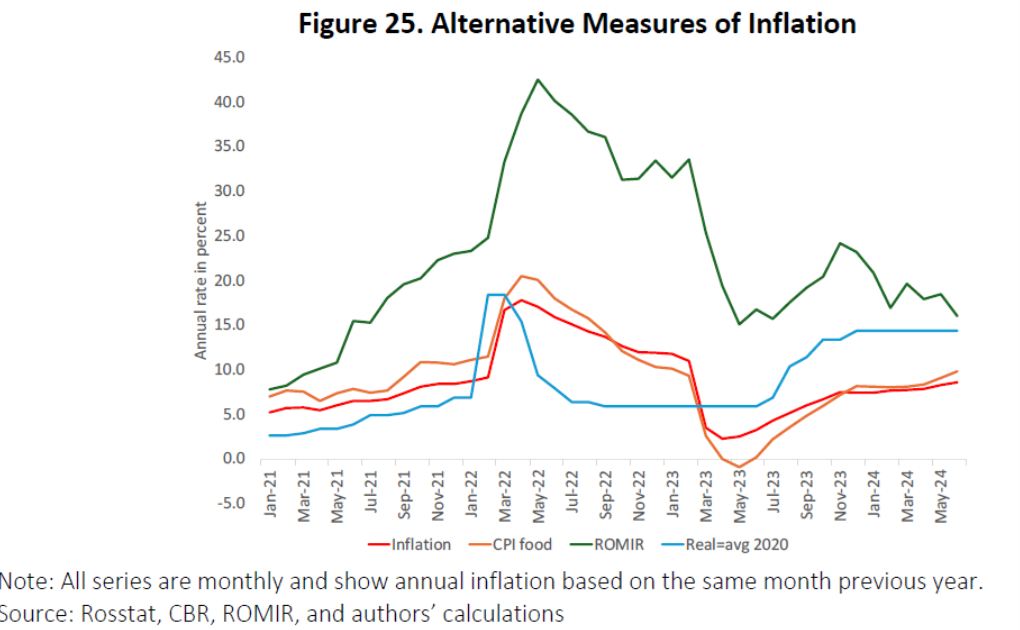

There is an interesting question of whether we can take the CPI numbers coming out of the Rosstat at face value. A recent report by the Stockholm Institute of Transition Economics observes:

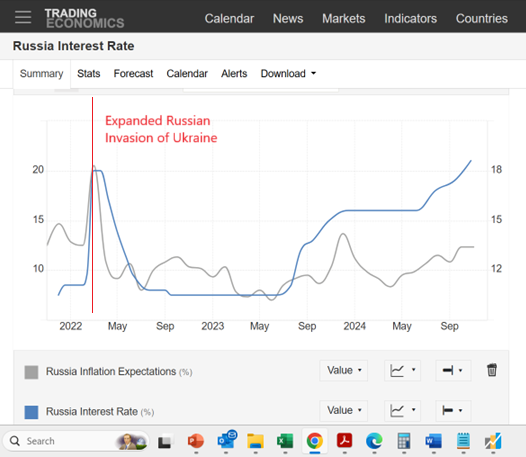

…the credibility of the official inflation numbers put out by Rosstat. Figure 25 shows some alternative measures of inflation that suggest that the official numbers may seriously understate the inflation households face. The first alternative measure is the fastmoving consumer goods (FMCG) index produced by the independent Russian public opinion monitoring service ROMIR.25 The FMCG mostly includes food and cosmetics and ROMIR estimates that the share of FMCG in total household expenditures is around 50 percent. Their index produces consistently higher inflation rates than both total CPI and the food CPI index produced by Rosstat. In May of 2022 their inflation measure peaked at over 40 percent at an annual rate. It has since come down significantly but has remained at around twice the rates published by Rosstat. In June 2024, which is the latest month currently available, the ROMIR inflation rate is at 16 percent versus 8-10 percent for the CPI and food CPI inflation by Rosstat. In contrast to ROMIR, Rosstat traditionally considers the share of food in the Russian CPI basket to be 38 percent, which Milov (2022) argues is too low and leads to an underestimation of inflation. Secondly, Rosstat observes prices for goods which consumers do in fact buy. It is likely that many Russian households have started to buy cheaper substitute goods due to the sanctions and budget constraints and that such substitution effects will not be reflected in CPI.

Here’s Figure 25 from that study.

Source: Stockholm Institute for Transition Economics.

Figure 25 also provides an implied inflation rate if CBR was trying to hold the real policy rate at 2020 levels. Using that logic to construct an alternative expected inflation series makes sense if the natural rate (r*) doesn’t change. However, my guess is that given the large fiscal stimulus and loss of labor stock, r* probably has changed, so the blue line is particularly questionable in my mind.

In any case, a 21% policy rate combined with either 13.4% or 16% (10% official CPI plus 6 percentage points for mismeasurement) still yields a 5-7.6% real rate — pretty high.

Source link