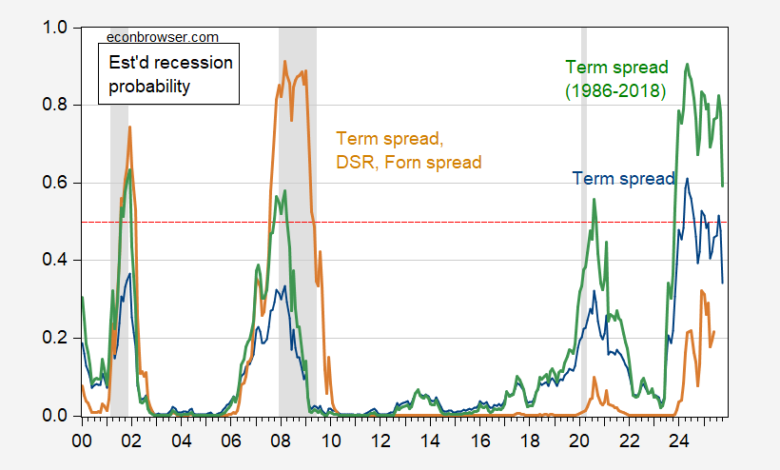

As I have observed before, the explanation for why we have not yet seen a recession’s onset in the data yet could be one of the following: (1) the model based on historical correlations is no longer applicable (DGP has changed), (2) we were using the wrong model, (3) the recession is yet to come, but has not yet shown up in the data. In addition, it could be the model was right, and in a probabilistic world, there’s never a sure thing.

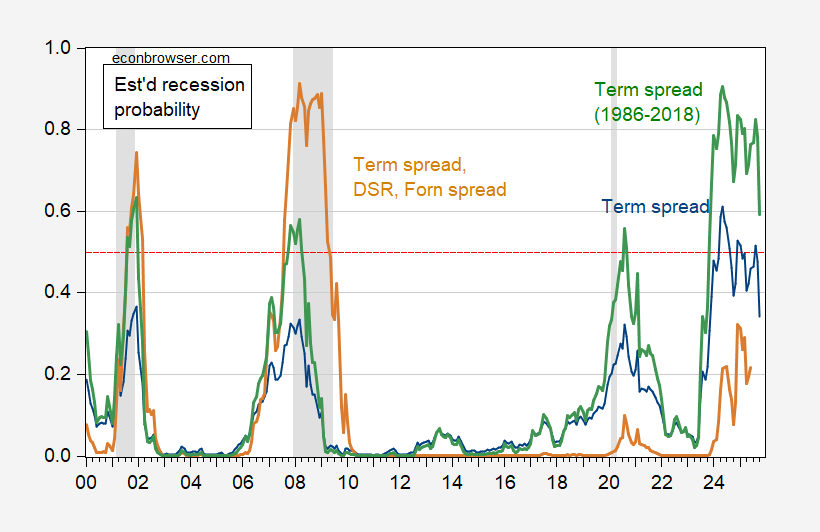

Just a recap on what a simple term spread model predicts, vs. one that includes the debt-service ratio and the foreign term spread:

Figure 1: Probit 12 month ahead recession probability prediction from simple term spread model estimated 1986-2023M06 (blue), from model estimated 1986-2018 (green), and from model with term spread, debt-service ratio, foreign term spread estimated 1986-2023M06 (tan). Assumes no recession as of November 2024. NBER defined peak-to-trough recession dates shaded gray. Red dashed line at 50% threshold. Source: NBER and author’s calculations.

It’s interesting that the term spread model estimated over the entire sample — including the pandemic period — indicates a greater than 50% probability this month (December) as well as a few times in 2025.

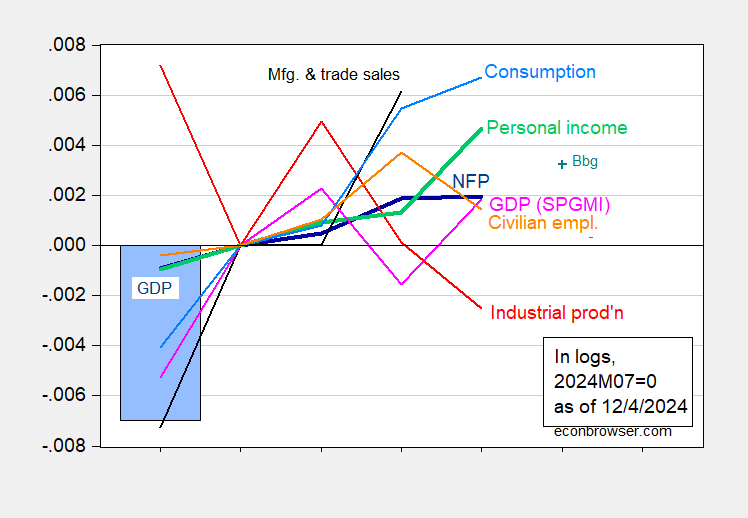

It could be the recession is here in December 2024. Unfortunately, we don’t have any data for December, and don’t even have employment data for November yet. Still, as documented here, the indications of recession are not strong for October, keeping in mind all we have is preliminary data. (That being said, I don’t think a recession started in July 2024).

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), Bloomberg consensus as of 12/4 (blue +), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 2nd release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 release), and author’s calculations.

On the other hand, it could be a model like that in Chinn and Ferrara (2024), using a foreign term spread as in Ahmed and Chinn (JMCB, 2024) could be the right model. Then there’s little to worry about…

Source link