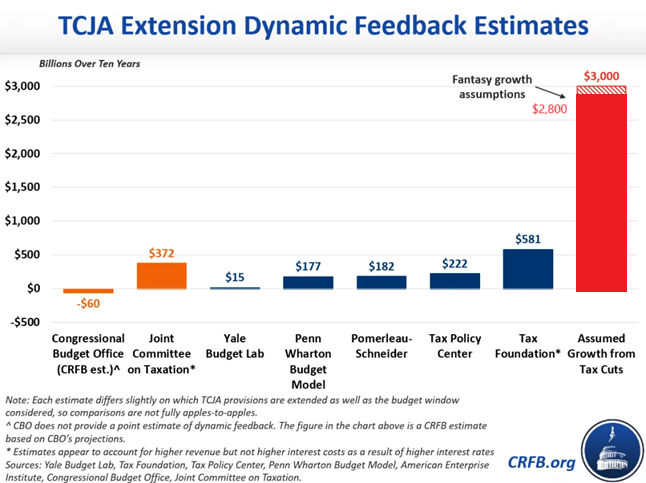

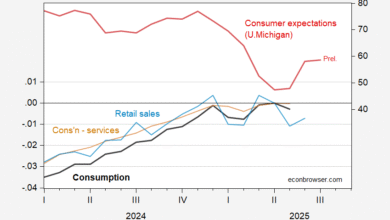

The House Budget, as expected, is not a serious document — see the tables. I’ll skip the fantasy spending cuts, and focus on revenue plans. From CRFB:

The budget resolution assumes $2.6 trillion of macroeconomic feedback, which press reports have indicated is a result of boosting average annual growth to 2.8 percent from a projected 1.8 percent. If one were to assume the House budget’s $2.6 trillion of economic feedback from 2.8 percent average annual growth and $3.3 trillion of net deficit increases, debt would reach 105 percent of GDP by 2034 and the deficit would total 5.6 percent of GDP in 2034.

Here’s a comparison of various estimates compared to the House plan’s estimate.

Notes: Modified by author to match current estimates of dynamic response. Source: CRFB.

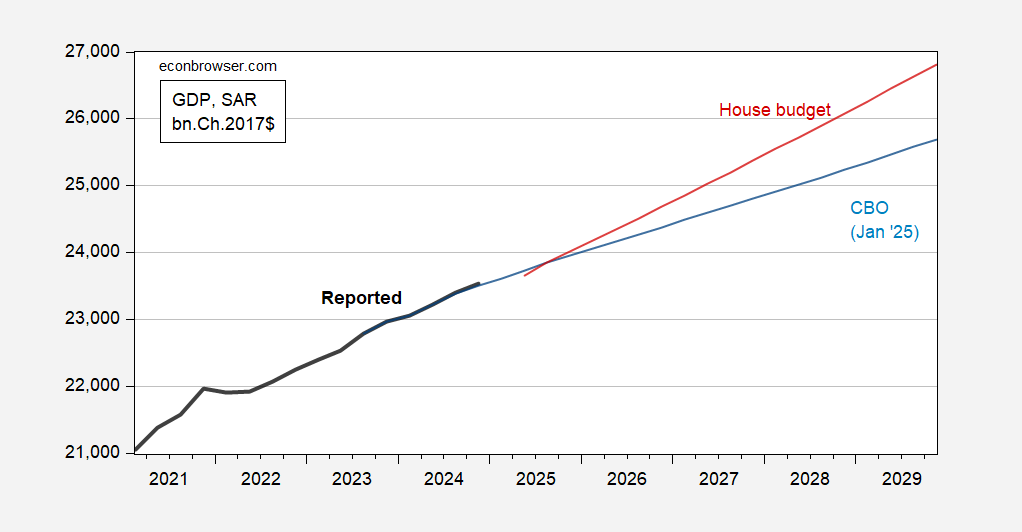

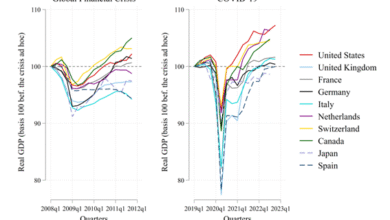

The assumed dynamic feedback requires a tremendous supply side response. To see how this alternative worldview compares to CBO current law projection, see Figure 1.

Figure 1: GDP (bold black), CBO projection (light blue), House budget assumed growth (red), all in bn.Ch.2017$ SAAR. Source: BEA advance, CBO January 2025, and author’s calculations.

It’s not surprising that the plan is so crazy. Clearly, it’s a linear descendent of the RSG document.

Source link