From reputable studies, that is. CEA concludes in its report on the OBBB:

$1.3 to $3.7 trillion in additional offsetting deficit reduction from higher growth unleashed by enhanced deregulation and energy policies

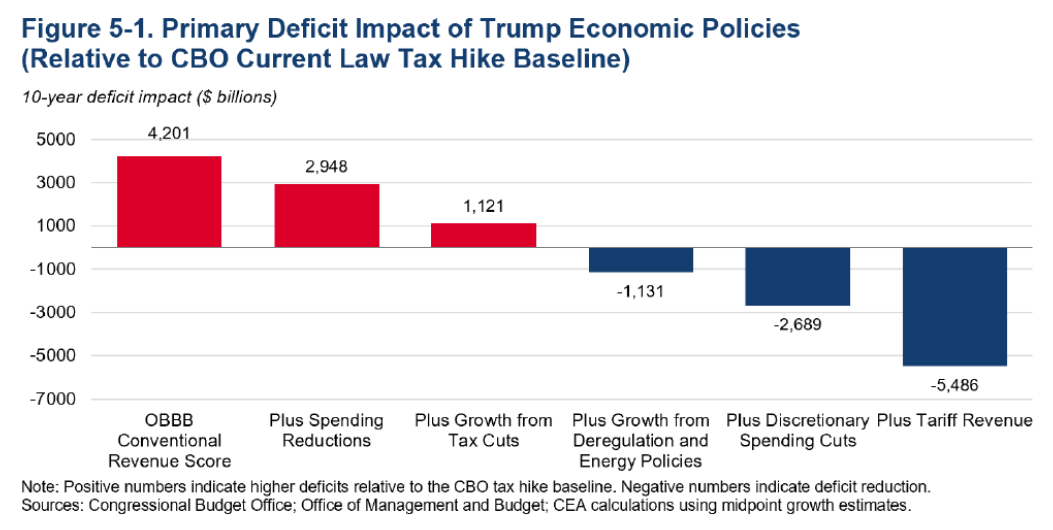

Here’s the impact over ten years of deregulatory efforts/energy initiatives which somehow CEA relates to the OBBB.

Note the cumulative impact is $2.251 trillion deficit reduction (this is relative to current law baseline, not current policy baseline, shown in CEA (2025) figure 2).

Now, where do these deregulatory benefits come from? Here’s the related CEA document on the benefits of deregulation.

To get a better sense of the potential long-run benefits of deregulation, it is instructive to look at rulemaking under the previous administration. Based on estimates from Federal agencies themselves as reported by the American Action Forum, the Biden Administration imposed a record $1.8 trillion in present value in new regulatory costs on the economy. If the potential cost savings from rolling back these rules is annualized over a 20-year period, it is equivalent to a 0.29 percentage point increase in annual economic growth, assuming that every dollar of regulatory cost reduces gross domestic product (GDP) by a dollar and that these regulations have no market benefits.5

However, even those effects come in far below University of Chicago Professor Casey Mulligan’s estimate of $5 trillion in present value regulatory costs in Biden Administration rulemaking, when properly accounting for resource and opportunity costs that, in his assessment, were not captured in the official estimates.6 If Professor Mulligan’s estimate is used, the potential long-run cost savings from rolling back these rules increase to 0.78 percentage points annually.

The $5 trillion estimate comes from a Committee to Unleash Prosperity document, written by Casey Mulligan. (The Committee to Unleash Prosperity was cofounded by Arthur Laffer and Steve Moore; those two are associated with ALEC’s publication, Rich States, Poor States. As discussed here, there is no empirical content to their economic outlook index).

Casey Mulligan earlier declared no recession (10 months after its start), as recounted in this post.

Barring a nuclear war or other violent national disaster, employment will not drop below 134,000,000 and real GDP will not drop below $11 trillion. The many economists who predict a severe recession clearly disagree with me, because 134 million is only 2.4% below September’s employment and only 2.0% below employment during the housing crash. Time will tell.

He later asserted that his incorrect prediction was due to his failure to understand that unemployment benefits would be so generous(!):

As of October 2008, I had not anticipated that the public policy response would be to pay the unemployed so generously, to the point that millions could make more unemployed than employed. Whatever ultimately depressed the labor market, it was apparently unanticipated by the chief White House Economic advisers, despite the fact that they had at least 3 months more data than I did.]

Other “Mulligans” here: [1] [2] [3] [4] [5] [6] [7] [8]

Source link