From Heritage Chief Economist EJ Antoni on X:

N.B.: this is an INDIRECT indicator of tariffs not being passed on b/c import prices have fallen relative to their domestic counterparts; that’s the result of a substitution effect and foreign producers’ attempt to retain market share by reducing their prices relatively speaking:

·

Jul 17

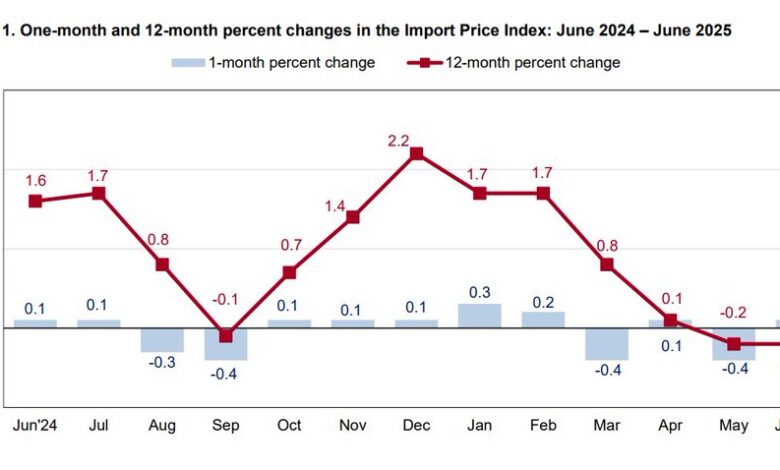

Import prices just came in WAAAY below expectations: June was up just 0.1% M/M, -0.2% Y/Y, while May saw a huge downward revision from flat to -0.4% M/M; still waiting for tariffs to be passed on by foreign producers…

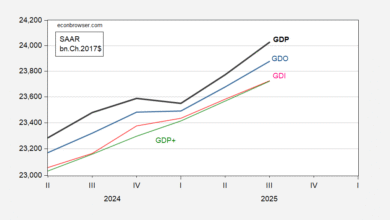

Note that Dr. Antoni is apparently using the all commodity imports price index. I think that, since no tariffs have been applied to oil, it would be more appropriate to use the import price index ex-petroleum.

Using this index, and Instead of plotting rates of change, I show price indices relative to 2025M04, given that the 10% tariffs were effective in early April.

Figure 1: Import price index for all commodities (blue), for commodities ex-petroleum (tan), all in logs 2025M04=0. Source: BLS via FRED, and author’s calculations.

Using this more appropriate series, I do not see the price decrease the Dr. Antoni refers to.

As an aside, I am still waiting for Dr. Antoni to declare the end of the recession he claimed started in 2022.

Source link