Economy

-

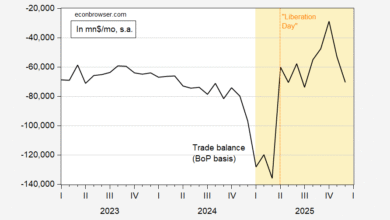

2025 Trade Deficit at 2024 Levels

Total seasonally adjusted trade deficit averaged $75.1 mn, vs. 2024 $75.3 mn. The real goods trade deficit averaged $99.8 mn…

Read More » -

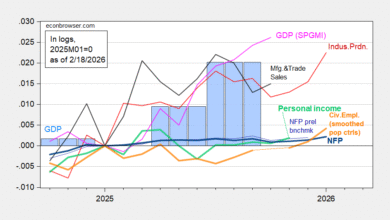

Business Cycle Indicators: Output Surges ahead of Employment

Industrial and manufacturing production rise, surprising on the upside: Figure 1: Implied NFP preliminary benchmark revision (thin blue), post-benchmark NFP (bold…

Read More » -

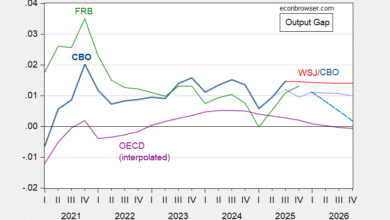

Output Gaps, Again | Econbrowser

Primarily from the production function approach (discussion here). Figure 1: CBO output gap, calculated using latest BEA data and February…

Read More » -

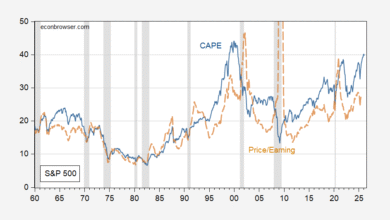

SP500 CAPE at 40 | Econbrowser

September P/E ratio at 28. Figure 1: CAPE (blue), P/E ratio (light brown). NBER defined peak-to-trough recession dates shaded gray.…

Read More » -

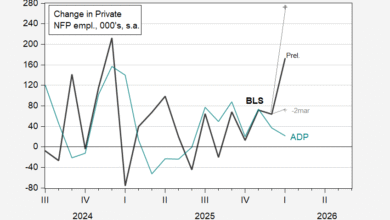

Two Measures of Private NFP Compared

Post-benchmark revision, here are changes in the BLS and ADP series: Figure 1: Change in BLS private nonfarm payroll employment…

Read More » -

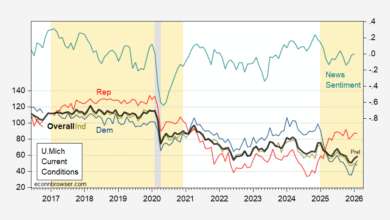

Quantifying Partisanship in Perceptions of Current Economic Conditions

Democrats/Lean Democratic current conditions assessment is relative insensitive to Trump being president, and statistically significantly related to news sentiment. Republican/Lean…

Read More » -

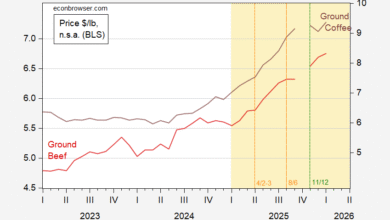

The Recent Evolution of Ground Beef and Ground Coffee Prices and Tariff Rates in the U.S.

From BLS: Figure 1: Price of Ground Beef (red, left scale), of Ground Coffee (brown, right scale), in $/lb., n.s.a.…

Read More » -

CPI Inflation at 0.69% Year-on-Year, Mid-Month February(?)

According to Truflation, today: The current Cleveland CPI inflation nowcast for February is 2.38%. Source link

Read More » -

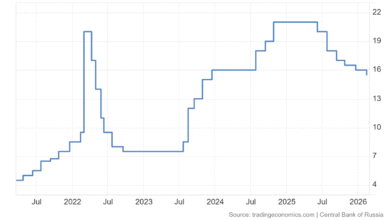

CBR Reduces Rates as Measured GDP Growth Declines

As of yesterday (discussion in WSJ): CBR estimates 0.9% growth for 2025 y/y. It also estimates y/y December inflation…

Read More » -

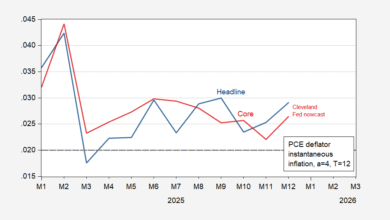

Nowcasted PCE Instantaneous Inflation Moving Away from 2% Target

Using Cleveland Fed nowcasts post-CPI release: Figure 1: Instantaneous inflation (T=12,a=4) for PCE (blue), core PCE deflator (red), all in…

Read More »